Harvey Norman annual sales, profit down, but rebounded in the second half and saw a boost from its property holdings

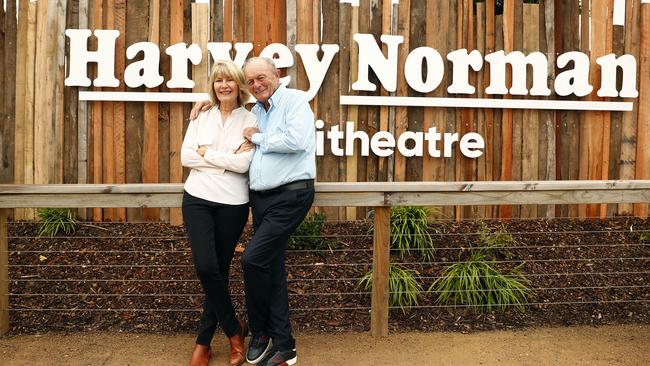

Harvey Norman chairman Gerry Harvey says he does not expect a housing-market crash at the scale forecast by some economists, outlining an optimistic view of the economy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Harvey Norman chairman Gerry Harvey says he does not expect a housing-market crash at the scale forecast by some economists, outlining an optimistic view of the economy as one with a “lot of money” flowing through it.

The retailer’s flagship Harvey Norman stores in Australia were concentrated around rural areas, where he expected property prices to remain strong while good growing conditions for farmers should also fill his customer’s pockets with money to spend.

“I think there is a lot of money out there being thrown around the community in the last few years and wages have gone up,” Mr Harvey said after Harvey Norman posted a 3.6 per cent fall in full-year net profit to $811.53m as total sales for the furniture, consumer electronics and home appliances giant fell 1.7 per cent to $9.558bn.

“All house prices in regional Australia have gone up,” he said. “They talk about house prices going down; that might happen in the capital cities, but it won’t happen in country towns.

“One of the banks came out and said there would be an 18 per cent drop in housing prices; well, I’d like to venture that won’t be happening in country towns all across Australia.”

Mr Harvey said global supply chains were showing some improvements and key costs such as freight was starting to ease back from record highs seen through the initial years of the pandemic that put a rocket under containers, freight and logistics charges.

Meanwhile, Harvey Norman’s Australian arm suffered a sharp retreat in first half sales due to store closures and Covid-19 restrictions, but a strong rebound in the second half as restrictions eased and a property boom that helped raise the value of its billion-dollar property portfolio minimised the damage to its profit. Those improved trading conditions looked to have spilt into the new financial year, as Harvey Norman reported sales for its Australian retail business rose 10.7 per cent between July 1 and the end of August, and like-for-like sales were up by 10.3 per cent.

Mr Harvey’s penchant for property looks to have buffeted some of the retail pain caused by Covid, with its freehold property portfolio valued at $3.74bn as at June 30, up 10.9 per cent, and the retailer’s net assets surpassing $7bn for the first time in the second half. The property segment remains strong with real, tangible property assets exceeding $3.7bn and achieving a property segment profit result of $366.48m for 2022, up 25.7 per cent.

The retailer also benefited from strong conditions at its growing offshore retail operation, with Harvey Norman’s company-operated overseas retail stores now comprising 25 per cent of total pre-tax profit. On Wednesday, Harvey Norman reported earnings before interest, tax, depreciation and amortisation of $1.437bn, down by 1.4 per cent against 2021 and up 52.1 per cent from in 2020.

Harvey Norman said total sales for the first half of the year decreased by 6.3 per cent as its Australian franchisees were negatively affected by nearly four months of government-mandated lockdowns because of the Delta variant. There was also protracted mandatory closures in two of its largest overseas regions.

However, the second half saw an acceleration of consumer and business confidence as Covid restrictions eased, resulting in an increase in total sales revenue by 3.2 per cent. In Australia, total sales for the year ended down 2.9 per cent, while like-for-like sales were down 2.7 per cent. Australian like-for-like sales turned positive in the second half, up 3.9 per cent.

Harvey Norman declared the payment of a fully-franked final dividend of 17.5c a share, up from 15c, to be paid in November.

Shares fell 2.31 per cent, or 10c, to close Wednesday at $4.23.

More Coverage

Originally published as Harvey Norman annual sales, profit down, but rebounded in the second half and saw a boost from its property holdings