MFS/OCTAVIAR: Gold Coast financial services company’s shocking collapse in 2008

A Gold Coast financial company’s $2bn collapse left investors devastated, including one retiree who went from a plush $100k a year lifestyle to surviving on welfare. HOW IT UNFOLDED.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The collapse of Gold Coast financial services company MFS 15 years ago was a devastating blow to the city’s economy.

The company, later known as Octaviar, imploded in 2008 owing more than $2bn, leaving investors out of pocket in a precursor to the economic devastation wrought just months later when the global financial crisis began, sparking a credit freeze.

The company, created by Gold Coast lawyers Michael King and Phil Adams in the late 1990s, was worth $4bn at its height.

The listed company was a corporate giant with interests in financial services, travel and leisure, and childcare before its collapse.

Things fell apart on January 17, 2008 when the value of MFS’s shares plummeted 70 per cent in one day, wiping more than $1bn off its value.

Charlie Green, from Institutional broker Hunter Green told Mr King that day on a call with investors “I think it’s all over, Michael”.

Wellington Capital took control of MFS/Octaviar in May 2008 and began working to try and recover investors’ funds.

Investor meetings were held in Brisbane and on the Gold Coast in July 2008 where the full scale of the company’s impact became clear.

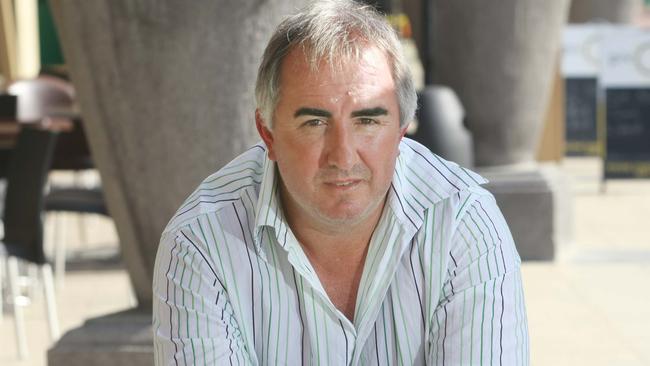

Former businessman Dennis Chapman was among those who spoke after losing more than $1.25m.

The once well-off retiree was living off $100,000 a year before investing heavily in the company, lured in by big treats and perks, but was left having to take welfare payments just to survive.

The then-62-year-old spoke of the company’s largesse before its collapse, offering him “free dinners, box seats at football games and invitations to lavish Christmas parties”.

Mr Chapman, who had emphysema, said the former management, including Mr King, drew him in by taking him to long lunches at high-end Gold Coast restaurant Omeros Brothers and corporate boxes at Suncorp Stadium and The Gabba.

“I would ring them and say we were coming to the Gold Coast,” he told media at the time.

“The MFS people would not take me for a burger – it would be a full seafood restaurant lunch.

“They took me to the corporate box at Suncorp Stadium. They took me to the AFL at the Gabba. We were taken to the footy, wined and dined. They could not do enough for me, it was always hugs and kisses. We were friends.”

Mr Chapman, who admitted regretting recommending the company as a sound investment to friends and family, said he had been “suckered” by company bosses and investing more of his retirement savings into it.

He told the Bulletin at the time he could no longer afford to fill up his car with petrol.

“You’ve got to be realistic about these things,’’ he said.

“(Our second investor meeting) was the same as the last one.

“It will be so long before we may see any money and by then I might not be here, many of us might not.

“If I died tomorrow, I don’t know how they would afford to bury me.’’

Mr Chapman revealed MFS bosses assured him the company had “no exposure” to the US subprime mortgage crisis a week before its collapse.

Administrators were finally appointed in September 2008 amid the height of the GFC, brought about by the collapse of US investment firm Lehman Bros.

The Queensland Supreme Court ordered MFS/Octaviar to be liquidated in mid-2009.

In 2017, Mr King and four other former executives were ordered to pay $615m in compensation to investors for breaches of the Corporations Act owing to MFS’s collapse.

Mr King was declared bankrupt in December 2021 owing more than $177m.