GCB Constructions and GDI Group in court over Drift Main Beach development, sites still shut down

A multimillion-dollar fallout between a builder under siege and key developer has emerged amid a crisis halting construction of 500-plus apartments. Read the saga’s latest court action.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A multimillion-dollar fallout between major builder GCB Constructions and a key developer has emerged amid a crisis halting construction of 500 apartments that’s left subcontractors and suppliers out of pocket.

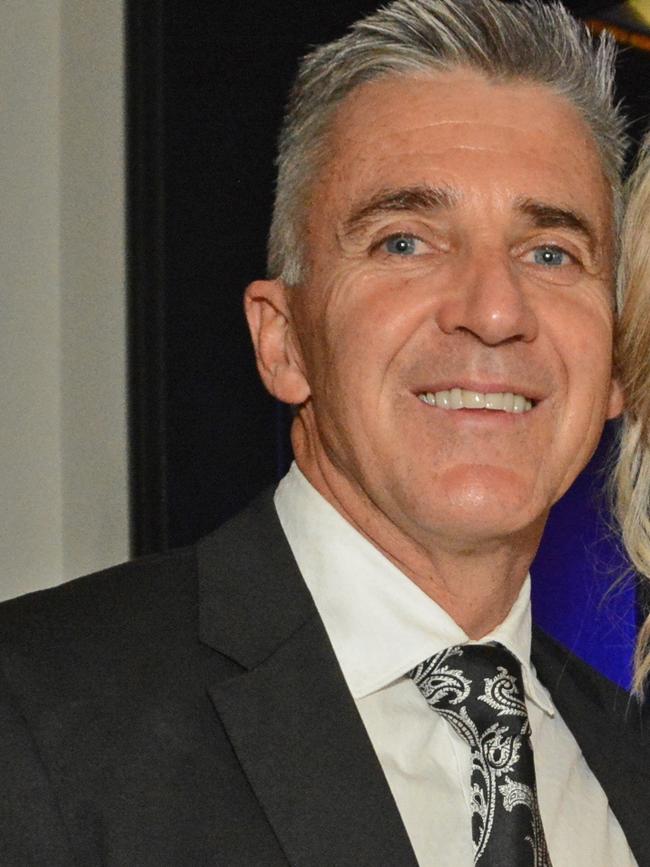

Court action was lodged against GCB Constructions last week by four companies related to Dean Gallagher’s GDI Group, developer of the 27-storey Drift tower at Main Beach.

GDI claims the building company failed to lodge security bonds worth more than $3.7m and then locked the developer out of the site when they tried to take possession of it.

Meanwhile GCB alleges the developer owes them $3.8m in progress payments – more than the security required under the contract.

Concerns have simmered about the stability of GCB Constructions since subcontractors downed tools and exited sites on May 8, claiming they hadn’t been paid.

Despite off-the-plan buyers of more than 500 apartments being in limbo across six residential towers, GCB boss Trent Clark has maintained his company is viable.

Workers in GCB shirts and trucks were seen removing equipment from the Drift site on May 12 and 13, a few days after police were called to a heated argument between a GCB staffer and a subcontractor at the site.

An affadivit from Mr Gallagher said GCB was contracted to complete early works on the Drift site for $152,759 and to design and build the apartment tower on the Hughes Ave site for a further $74.85m.

Mr Gallagher said his financier for the project, Qualitas Agency Services, asked the developer to obtain additional security from GCB, due to concerns about its financial position and “ability to complete the contract”.

The affidavit said Mr Clark agreed to provide insurance bonds worth five per cent of the value of the tower build, around $3.7m, to be paid by November 30 last year.

When the bonds went unpaid by December, Mr Gallagher’s affidavit said Mr Clark had told him they would be approved and paid by the end of January.

According to the affidavit, the security bonds were still outstanding at the end of February, with Mr Clark partly blaming “media hype on the construction industry” for a delay in getting them approved.

The Bulletin had earlier reported on GCB’s court battles against developers on two of its other projects, including Marine Quarter Southport and Ascot Aurora in Brisbane.

“The recent Gold Coast Bulletin articles hasn’t (sic) helped the situation by slowing down the review process”, said a letter from Mr Clark to Mr Gallagher which was submitted to the court.

By April 14, the affidavit said, the security had still not been provided and, on May 8, the developer gave GCB notice it had taken the remainder of the contract out of its hands. It also suspended payment to the builder, the affidavit said.

GCB responded via its lawyers, saying the developer had breached the contract by not making the progress payments and that GDI’s representatives “should immediately leave the site”.

According to Mr Gallagher’s affidavit, GCB had removed its gear from the Drift site but had not removed the fencing and gate, which was locked when the affidavit was lodged.

The GDI court action sought to take the contracted works out of the hands of GCB, for GCB to give the developer possession of the site and for the builder to pay the costs of the action.

On Monday the site was ringed by temporary fencing, which was secured with a heavy chain and padlock.

The affadavit said Mr Gallagher’s companies had been unable to draw down on finance from Qualitas because of the lack of security bonds and had borrowed from another lender in the meantime.

This interim loan was incurring “holding costs” for the developer, which would continue to grow until it was able to obtain security from GCB Constructions and draw down on the Qualitas finance or find a new contractor.

Mr Gallagher’s affidavit said the “negative media coverage” that resulted from GCB removing its equipment from the site was “impacting sales for the project”.

Before the court action was lodged, Qualitas said it was not financier for the project.

Head of marketing and communications Kate Stokes told the Bulletin “Qualitas has never been the financier to the GDI Group, GCB Constructions or the Drift Main Beach project”.

Qualitas has not been named as a party to the case and GCB had yet to lodge any response to GDI’s claim.

Drift was the second site GCB departed in a week, after developers of the $160m Amaya tower at Broadbeach said they would step in and take over construction.

GDI managing director Dean Gallagher last week said there was “no funding dispute in respect of the Drift project as far as we are concerned”.

“We do not believe that any payment is due to GCB. We remain committed to the project.”