ASX Trader: Where to invest in the next 10 years? Hint: It’s in the quiet corner

Investors made jaw-dropping gains in big tech and Bitcoin in the past decade. But the secret is never look back. Real opportunities lie in areas no one is talking about yet, writes ASX Trader.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Over the past decade, Bitcoin captured headlines and imaginations with jaw-dropping gains. Last decade between 2010 and 2020, Bitcoin’s price skyrocketed from just a few cents to nearly $30,000, making early believers incredibly wealthy.

Many call Bitcoin the best-performing asset of the last decade. And they’re absolutely right. But there’s something important most people miss:

History shows that yesterday’s winners rarely stay on top.

If you’re thinking about piling into Bitcoin (or any popular investment) just because it did well before — pause. Let’s look at what history can teach us:

Decade by Decade: Winners Don’t Stay Winners

• 1960s: U.S. Stocks Reigned Supreme

Blue-chip U.S. stocks, led by a group called the “Nifty Fifty” companies like IBM, Coca-Cola, and McDonald’s were considered unbeatable. Investors believed these growth giants could do no wrong.

But what happened next?

The 1970s brought high inflation and a brutal recession. Many of these stocks lost half their value and underperformed that decade.

• 1970s: Gold Sparkled

Amid economic uncertainty and soaring inflation, gold prices surged over 1,400%. It was the safe haven everyone wanted.

And then?

In the 1980s, as inflation cooled and economies stabilized, gold prices fell nearly 50 per cent and gold underperformed.

• 1980s: Japan’s moment

Japanese stocks soared, making Japan the second-largest economy in the world. Real estate and stock prices seemed unstoppable.

But by the early 1990s, the bubble burst, leading to decades of economic stagnation now known as Japan’s “Lost Decades.”

• 1990s: The Tech Boom

Technology stocks, especially on the Nasdaq, exploded higher thanks to the internet revolution.

Until 2000, when the dot-com bubble popped, wiping out trillions in market value. Technology then underperformed that decade.

• 2000s: Emerging markets and commodities

China’s rise and a commodities supercycle made emerging markets and raw materials the big winners.

However, they underperformed for much of the 2010s as Big Tech took over.

• 2010s: Bitcoin and Big Tech

Bitcoin grew over 9 million percent from its early days. Stocks like Amazon, Apple, and Microsoft also delivered spectacular returns.

But today, these giants face regulatory pressures, slower growth, and increasing competition.

Don’t chase yesterday’s winners

If history is any guide, the best place to invest over the next 10 years probably isn’t where the last boom happened.

Why?

Because by the time something becomes “obvious,” it’s often already fully priced into the market. Growth slows, risks rise, and the easy gains vanish.

Think about it:

If you bought tech stocks at the peak in 2000, it took 15 years just to break even.

Why don’t winners repeat? It’s all about the macro environment

You might wonder: Why don’t the best assets stay on top?

The answer is simple: The macro environment always changes.

Each decade brings a new mix of:

• Inflation (rising or falling prices)

• Interest rates (low or high)

• Business cycles (booms and recessions)

And different assets perform better or worse depending on these conditions.

For example:

• When interest rates are low and growth is strong like in the 2010s the Nasdaq and growth stocks thrive. Cheap money fuels innovation and expansion.

• But in a world of higher inflation and rising interest rates, the game changes. Growth stocks struggle because borrowing costs rise and future profits are worth less today.

In those tougher environments, energy stocks tend to shine.

• Rising inflation boosts the price of oil, gas, and other resources.

• Higher rates and slower growth make hard assets like energy and commodities more valuable.

So there’s often a simple rule of thumb:

When Nasdaq does well, energy often lags.

When energy outperforms, growth stocks usually struggle.

Where are the hidden opportunities now?

Real opportunities often lie in the quiet corners, the sectors or regions no one is talking about yet.

While the media spotlight shines on tech and crypto, energy has been left behind and that’s exactly why I believe it could be one of the biggest outperformers of the next decade.

Since the 2008 Global Financial Crisis, the energy sector has been one of the worst places to invest:

- The S&P 500 Energy Index has lost over 40 per cent from its 2008 highs.

- For the past 17 years, energy stocks have either fallen or gone nowhere, even as tech boomed.

But this underperformance has set the stage for a powerful comeback.

Today, the energy sector offers:

- Lower valuations than tech stocks.

- High dividend yields, rewarding patient investors.

- Tight supply, after years of underinvestment in new oil and gas projects.

- Rising global demand, not just from emerging economies but from something new: AI.

AI needs energy and a lot of it

Right now, Artificial Intelligence (AI) is the hottest story in the investment world.

AI is changing industries, creating new opportunities, and driving massive infrastructure builds.

But here’s the part many people miss:

AI needs enormous amounts of energy to run.

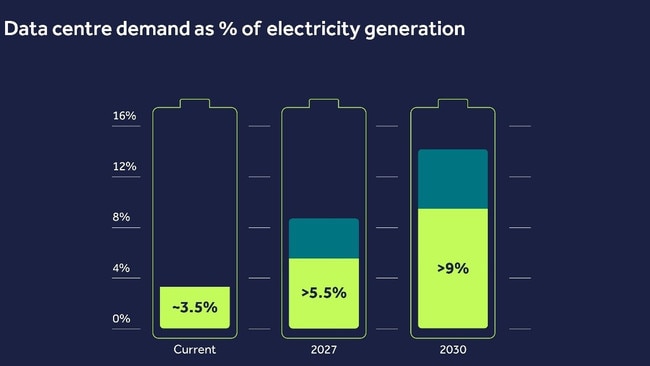

• Data centres that power AI models are energy-hungry beasts.

• Training a single large AI model can consume as much energy as 100 homes use in a year.

• Demand for electricity to fuel AI and cloud computing could triple by the early 2030s.

Where will all that energy come from?

That’s the looming problem.

We’re heading toward a global energy supply crunch, as fossil fuel production lags, renewable projects can’t scale fast enough, and demand keeps rising.

In short: AI is the future. But energy is the foundation.

Without affordable, abundant energy, the AI revolution could stall and that’s why I believe energy investments could be the biggest surprise winners of the next decade.

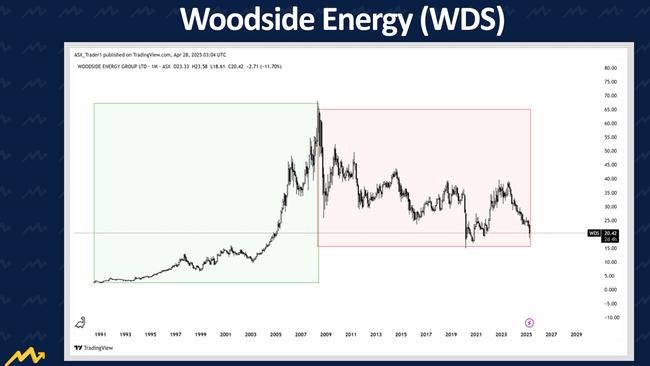

Woodside Energy: A real-world reminder about cycles

Here’s a powerful example close to home:

Imagine standing outside Woodside Energy’s headquarters in 2008, when oil was booming, and the energy sector had enjoyed a 20-year bull run.

Woodside, Australia’s largest listed energy company, was one of the stars of the ASX.

Now imagine telling someone back then:

“This stock is about to enter a 17-year bear market.”

You would have been laughed out of the room.

And yet, that’s exactly what happened.

Woodside’s stock spent the next decade and a half mostly going sideways or down, even while companies like Afterpay, Atlassian, and other tech darlings soared.

Why?

Because the cycle had changed.

The macro backdrop moved from a commodity-driven boom to a low-interest-rate, tech-fuelled environment.

It’s not about the company, it’s about the cycle you’re operating in.

The bigger picture: Think forward, not backward

If history teaches us anything, it’s this:

Chasing yesterday’s winners often leads to disappointment.

The greatest opportunities often come from the most ignored, unloved sectors right before the world realises it needs them again.

Before diving into the hottest assets of the last decade, consider Wayne Gretzky’s advice: “Skate to where the puck is going, not where it’s been.”

Originally published as ASX Trader: Where to invest in the next 10 years? Hint: It’s in the quiet corner