‘There is a risk’: Fears tanking Aussie dollar will ‘raise costs’

The Australian dollar has plummeted to a near five-year low recently – and experts have warned of dire consequences ahead.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

The falling value of the Australian dollar relative to the US dollar has been making waves in recent weeks, with our currency nearing its post-pandemic lows.

It’s prompted headlines noting the risks of inflationary pressures stemming from a weaker currency, as well as some raising the possibility of the Reserve Bank of Australia attempting to intervene in currency markets to cushion the fall of the Australian dollar should it become warranted.

But what does a weaker Australian dollar actually mean for the nation’s economy, government coffers and the average person in the street?

Cost of living and interest rates

The biggest impact from a weaker Australian dollar is arguably the value Aussie travellers get for their money when they go overseas.

Despite the weakness of the Aussie against the US dollar, when compared with other major currencies such as the Japanese Yen and the Euro, it’s more of a mixed bag.

By taking the last trading day of 2019 as our base, an Australian dollar this week buys 22.6 per cent more Japanese Yen than it did previously, 3.9 per cent fewer Euros and 12.6 per cent fewer US dollars.

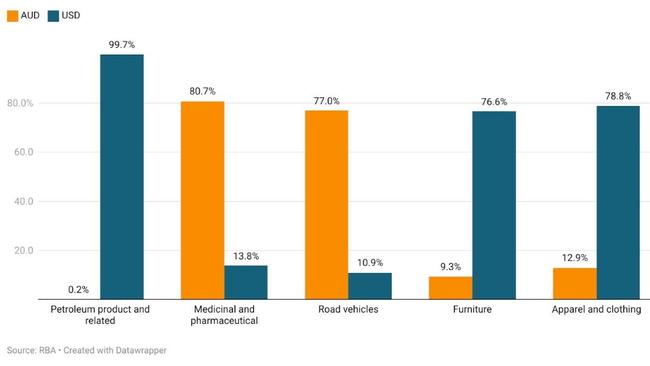

According to figures from a 2016 RBA report, 56.8 per cent of Australia’s goods imports are priced in US dollars, 29 per cent are priced in Australian dollars and the remaining 14 per cent are spread between the Euro, Japanese Yen and other currencies. This leaves Australia exposed to potential inflationary pressures stemming from a weaker currency.

But not all imports are created equal.

In terms of goods we use every day, 99.7 per cent of fuel and oil imports are priced in US dollars, along with 78.8 per cent of apparel, 76.6 per cent of furniture and 54.4 per cent of electrical appliances.

There is a risk is that a weaker currency could raise the cost of imports and potentially see higher costs passed on to consumers. This could also contribute to greater inflationary pressures and in a vacuum, place upward pressure on interest rates.

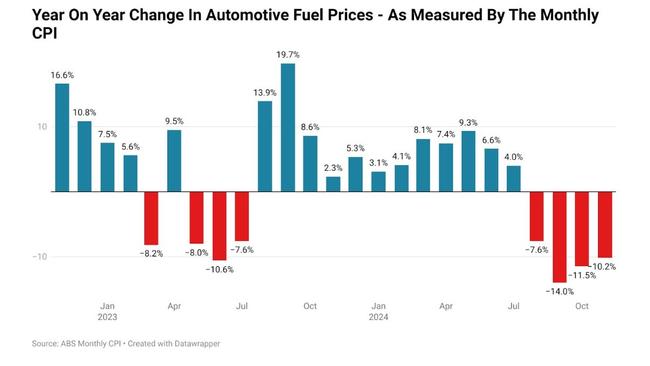

Recently, year-on-year falls in the cost of automotive fuel have played a major role in driving down headline inflation. If prices were to stabilise in year-on-year terms, or worse, still rise significantly, that could complicate the RBA’s fight against inflation.

To what degree a weaker currency could impact interest rates over time depends a great deal on the broader circumstances. Given the current environment of still uncomfortably high underlying inflation and rising uncertainty surrounding global trade and geopolitics, there are risks that a weaker currency could potentially contribute to keeping interest rates higher than they may have been otherwise.

The silver lining

A weaker Australian dollar relative to its US counterpart is not an unprecedented development. For example, during the period between April 2000 and March 2003, the Australian dollar spent the overwhelming majority of the time buying below 60 US cents, dropping in several instances below 50 US cents.

Despite the downsides of a weaker currency, there are benefits.

Australia becomes a significantly more attractive place to do business with. From the lower relative costs of filming a movie or television show in Australia to the exports of the nation’s manufacturers and tourism services providers, there are advantages to a weaker currency.

The coffers of federal and state Treasuries also benefit.

With commodity exports generally priced in US dollars and input costs for the resources sector overwhelmingly paid in Australian dollars, the level of profit per unit sold is significantly greater with a weaker currency.

This may help to cushion the potential downside from growth in the Chinese economy slowing and increased levels of global iron ore production that is expected to be seen later in 2025 and into 2026.

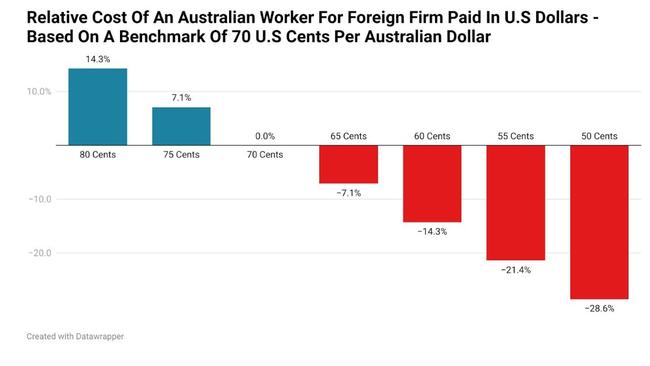

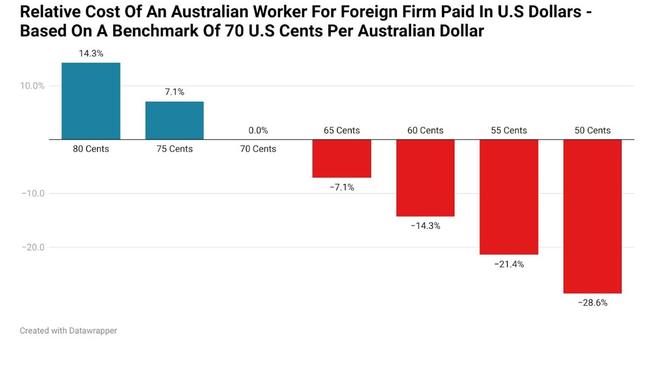

A weaker Australian dollar may also provide opportunities for Australian remote workers with skills in demand globally.

For example, at 60 cents to a US dollar, an Australian worker is 14.3 per cent cheaper than at 70 cents. At 55 cents, the rough range where the Aussie dollar spent much of the early 2000s, an Australian worker is 21.4 per cent cheaper.

On balance

To what degree the relative strength of the Australian dollar impacts the economy is highly dependent on the backdrop of broader conditions.

For example, while the Aussie sat at an average level of around 55 cents during the second quarter of 2002, the nation achieved annual GDP growth of 4.9 per cent – a level that has not been seen again outside of the years impacted by the pandemic and the resulting stimulus.

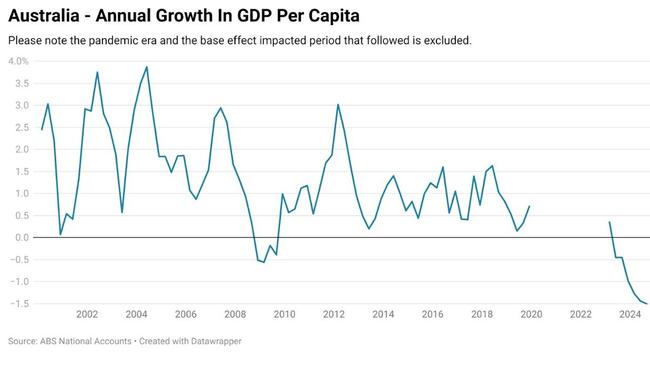

To put this into perspective, the current level of annual GDP growth is 0.8 per cent. In per capita terms, the comparison is even less favourable, with annual per capita GDP growth in Q2 2002 sitting at 3.7 per cent versus -1.5 per cent today.

But unlike 2002, the Australian economy and its currency are in a significantly more vulnerable place.

If the Chinese Yuan were to continue to fall in value against the US dollar, the Australian dollar’s at times strong links to the Yuan could see further downward pressure placed on the Aussie.

With inflationary pressures still simmering and a high degree of uncertainty across much of the board of indicators for the economy, the long term risk of upward pressure on inflation and interest rates is unfortunately quite real.

Yet ultimately, a weaker currency in a vacuum does have a silver lining for parts of the economy and a sizeable number of Australian businesses.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘There is a risk’: Fears tanking Aussie dollar will ‘raise costs’