‘News is grim’: Graph reveals more rates pain ahead for Aussie homeowners

The ASX futures market has predicted when interest rates will stop rising in Australia. And it’s more bad news for mortgage holders.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

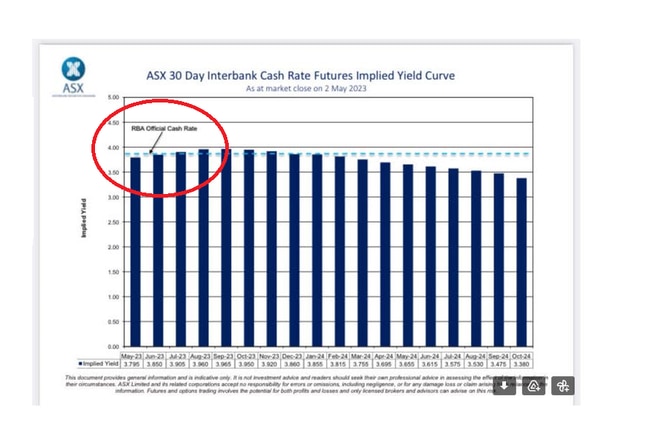

It’s the single graph that tells homeowners everything they need to know about what the future holds for interest rates and when they will start falling.

And the news is grim for the next year according to financial markets, with another rate rise a real possibility and the cash rate expected to remain higher for nearly a year.

Australians are set to endure more financial pain after the Reserve Bank of Australia decided to lift rates by 0.25 per cent to 3.85 per cent.

It means those with the average loan size of $586,000 will be forking out around $14,000 more annually compared to what they were paying this time last year.

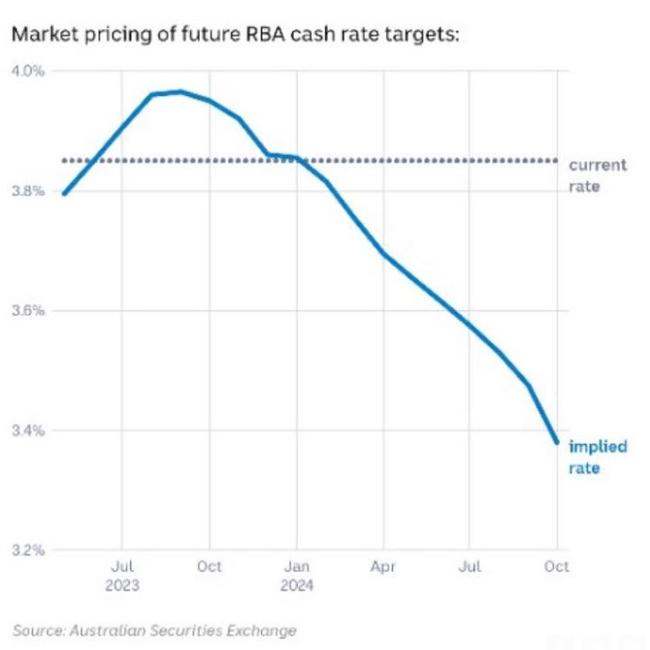

But according the Australian Securities Exchange futures market, interest rates in Australia are not set to peak until September with another rate hike a real possibility, and to remain high until early next year

ASX futures market predicts rates will peak in September 2023

The graph suggests that the official cash rate – now at 3.85 per cent – will peak at close to 4 per cent in September-October.

Because the RBA tends to increase in 25 basis point increments, that suggests another rate rise in spring.

Rates will not fall behind the current level until March 2024 as the RBA fights inflation. But by October 2024, the cash rate could fall to around 3.380 per cent – suggesting several rate reductions next year.

The ASX’s 30-day interbank cash rate futures is not foolproof. Just last month it had the Reserve Bank leaving rates on hold.

But after the RBA stunned the market by hiking rates again on Tuesday, the graph now suggests homeowners should brace themselves to expect more pain later this year.

ANZ predicts another rate rise in August

According to the ANZ’s Head of Australian Economics Adam Boyton, another rate hike should be budgeted for in August.

“The RBA has surprised us and the market by tightening 25bp to 3.85 per cent,’’ he said.

“Looking further ahead, some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve.

“The reference to inflation in that sentence, the importance of the quarterly inflation data in providing a more comprehensive read on services price pressures and the importance of the inflation forecast profile all suggest (in the absence of an upside surprise on the activity data) that August is the most likely window for any additional move from the Bank.

“At 3.85 per cent is the Bank done? We don’t see a case for easing this year, given our views on the economy.”

AMP’s chief economist Shane Oliver thinks the RBA has “done enough”, but fears another rate rise is possible.

“We think that the RBA has done more than enough and we have reached the peak in rates. Continuing to raise rates from here adds to the rising risk of plunging the economy into a recession,’’ he said.

“However, given high inflation, the still tight labour market and the RBA’s still hawkish guidance, the risks are still skewed to the upside for interest rates. However, by year end or early next year we continue to see the RBA starting to cut rates.”

But Barclays predicts Tuesday’s hike is the last, with rates to fall next year.

“We now think the hiking cycle of the bank is over and the next move will most likely be a cut in Q1 next year,’’ it said.

“We think the RBA hiked even after a softer inflation print because the window for higher rates is fast closing, especially with global central banks nearing the end of their own tightening cycles.

“The bank’s forecasts suggest that no further hikes are likely needed.”

Treasurer Jim Chalmers urged to intervene

Treasurer Jim Chalmers has been urged to overturn the RBA’s shock decision to hike rates – but there’s little prospect of that happening.

Amid fears the latest hike could result in a recession, the government has been urged to take the unprecedented step of direct intervention.

“The RBA’s decision to raise interest rates again beggars belief and will smash renters and mortgage holders even harder than they were being smashed already,” Greens Senator Nick McKim said.

“The RBA is out of control. Jim Chalmers needs to use his powers and step in and overrule this terrible decision.”

Senator McKim said by the RBA’s own admission, interest rate rises are the wrong response to an inflation spike driven by corporate profiteering and supply side issues.

“If Dr Chalmers refuses to act, it will be a tacit endorsement of the RBA’s decision and will mean that he supports the rate rises,” he said.

Earlier, the Treasurer sidestepped questions over whether the Reserve Bank‘s “brutal” interest rate rise could plunge Australia into recession.

Rates ‘brutal reminder’ of inflation challenge

The Treasurer conceded the RBA’s shock move was a “brutal reminder” of the inflation challenge, but stopped short of reassuring homeowners that a recession was off the cards.

“I think that the rate rise is really a pretty stark, pretty brutal reminder of the difficult economic conditions,” Dr Chalmers said.

“And I think people are broadly aware that we‘ve got an inflation challenge in our economy, people feel it every day.”

“Are you worried that the RBA is tightening rates so much that [it] could drive the country into recession?” the Treasurer was asked.

In response, the Treasurer said he wasn‘t about to “second guess the decisions taken independently by the Reserve Bank”.

“As you know, my job is different. It‘s to hand down a budget, which is carefully calibrated to these economic conditions that we confront right now,’’ he said.

“The Reserve Bank, the Treasury, I think almost everybody expects the Australian economy to slow substantially later this year.

“That is the inevitable consequence, in my view, of higher interest rates combined with the global slowdown. And so the Reserve Bank’s forecasts reflect that the Treasury’s forecasts reflect that too.

“And inflation is moderating off the peak around Christmas time, but it’s still higher than we’d like for longer than we’d like and the forecast will reflect that as well.

“Our job is to provide responsible cost of living relief, to do what we can without adding substantially to this inflation challenge that we have in our economy.

“And the best way to do that is to prioritise the most vulnerable and the best way to do that is through ways like the energy bill assistance, which I’ll detail in the budget, which is all about getting electricity prices not rising as much as what they were anticipated to do last budget.”

Originally published as ‘News is grim’: Graph reveals more rates pain ahead for Aussie homeowners