‘Slugged no matter what’: Cruel Federal budget detail exposes ‘unfair’ truth

A key piece of information buried in the budget has revealed hardworking Aussies are getting a seriously raw deal.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

It all depends on us now.

We are the last big taxpayers, while companies slink quietly away.

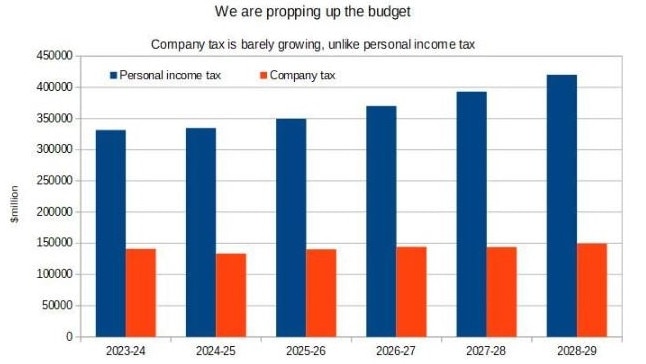

Australian families are set to fund more and more of the federal budget as personal income tax revenues continues to climb fast, while company tax stalls.

I don’t feel great about this.

I’d rather we all share the load and I don’t love the idea that my own pay cheque is the big target for the government.

But, as the next chart shows, that is where we are at.

I found these figures in the budget papers, and what they show is that personal income tax revenues will rise by 27 per cent over the next few years, while company tax is set to go up by just 6 per cent.

An additional $100 billion will go from families to the government each year, while companies give up only an extra $8 billion each year.

“Company tax receipts have been downgraded in 2027-28 and 2028-29, driven by a weaker outlook for non-mining profits,” say the Budget papers.

Far more from people, slightly more from companies.

This is despite the government giving out personal income tax cuts and not giving out company tax cuts.

What is going on?

Here’s the big difference: we pay tax on all our income, but companies pay tax only on their profits.

We get taxed on the raw amount of money that goes in our bank account, with no consideration of the cost of all the things we need to buy for our private lives.

Companies do not.

They get taxed only on what is left over after they do all their buying and selling, ie their profits.

A company that buys biscuits for $900 and sells them for $1000 has $100 in profit and they get taxed on that. If they have a bad year where biscuit supply costs go crazy and they make no profit, they pay no company tax.

It sounds unfair that people get slugged no matter what, and in some ways it is.

But remember, there are a couple of tweaks to the system that make it a bit fairer for people.

People don’t pay tax on every dollar they earn – if you earn less than $18,000 you pay no income tax.

Meanwhile, company tax is 30 per cent on every dollar of profit (small and medium businesses pay 25 per cent tax on profits).

We can see why they don’t tax companies on revenues. That would punish the ones with the lowest profit margins the most.

A hypothetical company that bought biscuits for $900 and sold them for $909 has $909 in revenue and if you tax them even one per cent of their revenue ($9.09), they make a loss. Different industries have different profit margins, so taxing profits makes sense.

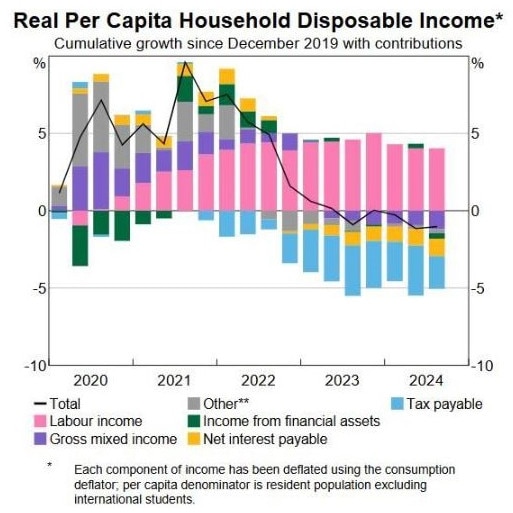

The challenge is that we keep taxing people so much.

In a time of high inflation and high employment, like now, the nation’s income goes up a lot.

And so the amount of tax taken off that income soars.

Tax rates, meanwhile, stay still until a Treasurer moves them.

That leads to a situation where people pay more and more tax, and it eats into their disposable income, which is exactly what we see in the next chart.

The light blue bars show extra income tax gobbling up so much of our income that our disposable income growth has turned negative.

We’re getting worse off, and higher tax bills is a big part of the reason why.

That’s why last night’s income tax cuts were welcome news in my eyes.

Individuals, households and families are bearing too much of the tax burden.

But the chart we looked at earlier shows that last night’s tax cuts are really only a start.

We need to find a way to spread out the burden of tax, take it off the shoulders of normal people with jobs.

Income tax is almost the only growing category.

Petrol taxes are growing slowly thanks to working from home and hybrid vehicles.

Diesel taxes are chugging along despite the fuel tax credit, meaning a lot is sold tax-free. Tobacco taxes have absolutely collapsed thanks to illegal cigarettes and vaping.

Superannuation taxes are the other growing category, and as Australia has more and more in superannuation, super will look more and more attractive as a source of tax.

If the generations of Australians with jobs need to fund the health care and retirements of the baby boomers, then super might be the right place to look for a bit of a tax top-up.

The alternative is a smaller and smaller share of people paying more income tax.

And that is not going to work in the long run.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

Originally published as ‘Slugged no matter what’: Cruel Federal budget detail exposes ‘unfair’ truth