Seven reasons this budget is awful

YOU’VE heard the good news. Now for the bad. These are just a few of the reasons why this Budget actually sucks, big time.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

OPINION

YOU’VE heard the good news. Now for the bad.

Higher taxes, higher spending, and not one mention of the word “agile” anywhere.

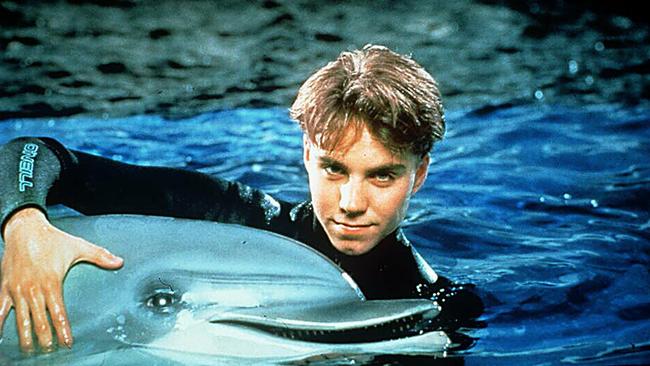

Scott Morrison’s “path to surplus” Budget may actually be the most disappointing thing since the episode of SeaQuest DSV where the talking dolphin revealed the location of the centre of the universe.

Here are just a few reasons why:

• A GREAT BIG NEW TAX

Congratulations, everyone who actually works and pays tax and doesn’t ask for handouts from the government. For your trouble, you’re getting a massive tax hike! The 0.5 per cent increase in the Medicare “levy” to 2.5 per cent, which conveniently doesn’t kick in until around the next election, will supposedly raise $8.2 billion over the next four years to pay for the white elephant/black hole that is Labor’s National Disability Insurance Scheme. For a worker on an annual income of $80,000, that works out to an extra $400 a year.

• BRACKET CREEP BACKDOWN

While they’re taxing you to your face, they’re also happily collecting the “stealth tax” of bracket creep, whereby workers are inexorably pushed into higher tax brackets through inflation despite not actually getting any richer in real terms. The government made a “modest down payment” on bracket creep in last year’s budget by tinkering with the 32.5 per cent tax threshold, but the issue was conspicuously absent in this year’s Budget. Personal income tax makes up nearly half of all government revenue, accounting for $209.6 billion this year, so it’s not hard to see why.

• BASHING BANKS WILL BACKFIRE

CommBank, NAB, ANZ, Westpac and Macquarie will be stung with a new tax for being too successful. As the Russian proverb goes, “The naked don’t fear robbery.” Set to raise $6.2 billion over the next four years, it’s being described as another “budget repair levy”, but in technical terms it’s known as a “you have too much money and we don’t have enough” tax. The ABA claims it will simply be passed on to consumers, but Malcolm Turnbull has warned that would be “very unwise”. We’ll see — but our money is on the banks.

• SMOKERS TAKE ANOTHER HIT

Whether it’s nanny state overreach or simply a treasurer desperate for his fix, smokers can’t catch a break. Not content with annual tobacco tax hikes of 12.5 per cent, the government is going after roll-your-own tobacco and cigars to bring their taxation into line with pre-made cigarettes. The average cost of a 50g pack of roll-your-own loose-leaf tobacco is about $62. The change, which will bring in $360 million in extra tax over the forward estimates, will be phased in over four years from 2017 to 2020, coinciding with the annual tobacco tax hike on September 1. On the plus side, it gives Baby Boomers and hipsters something in common to complain about.

• SCRAPING UNDER THE SOFA

The government has a serious obsession with your cash. It wants to know where it is at all times, who it’s been texting, and what time it will be home. More importantly, can it please have some? By describing it as the “black economy” and launching a “taskforce”, it makes it sound like cash is some evil force that must be stopped — but really it’s all about control, man. The cash economy is thought to account for around $21 billion, or 1.5 per cent of GDP, according to the Australian Bureau of Statistics. Workers who are part of the so-called black economy say they rely on illegal cash payments just to scrape by. The government is giving the ATO an extra $32 million to fund its cash jihad for another year, which is expected to bring in an extra $589 million in revenue over the forward estimates. Just how the government knows this, given how “black” all this cash is, is anyone’s guess.

• TRAIN LINE TO NOWHERE

Trains, planes, submarines — a billion here, a billion there, pretty soon you’re talking real money. You know what they say: give an MP a travel allowance, they’ll fly their kids business class to Uluru. Build them an airport, they’ll keep their seat. Last year Christopher Pyne got his subs-for-the-dole program, this year Malcolm Turnbull gets a $5.3 billion Western Sydney Airport and Barnaby Joyce gets an $8.4 billion inland rail link from Brisbane to Melbourne. There’s also a $10 billion infrastructure trough set aside just in case any other MPs are feeling peckish before the next election.

• THE BUDGET HOUSE OF LIES

The worst part, though, is that the whole thing is based on lies. The Budget is promising a “credible path” from a $29.4 billion deficit this financial year to a modest $7.4 billion surplus in 2020-21. But the projected surplus is based on Treasury’s almost impossibly rosy assumptions — which it gets wrong every year like clockwork — about economic conditions going forward. If you want to see for yourself, look at page 32 of the Budget Overview, “Detailed economic forecasts”, or the section in Budget Paper No. 1 titled “Statement 2: Economic Outlook”. Growth in tax receipts alone is forecast to leap from 4.2 per cent in 2016-17 to 7.2 per cent in 2017-18, thanks to “growth in wages, profits and consumption”. Really, Scott Morrison should have started his speech with, “The four years of paths to budget surpluses I announce tonight ...”

There’s probably a world’s best treasurer award on the way.

Originally published as Seven reasons this budget is awful