All the changes coming next month

From tax to minimum wage, the financial landscape for Australians will change dramatically from July 1. Here’s what’s coming.

From tax to minimum wage, the financial landscape for Australians will change dramatically from July 1. Here’s what’s coming.

A massive net overseas migration number has pushed Australia’s population to 27 million in the latest population figures from the ABS.

A major Australian bank has issued a grim warning on where rates are heading, with the next cut not predicted until 2025.

Australia’s workplace umpire has revealed its reasons for increasing the minimum wage for 2.6m workers by another 3.75 per cent.

There are warnings that Australia’s “biggest cost of living crisis” remains unsolved – and it will create hardship and huge financial costs for families.

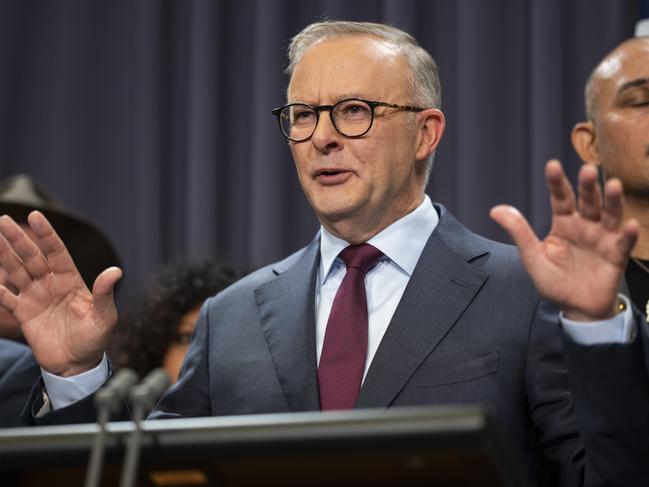

The budget has been delivered and while it’s good news for some, one group of Aussies are fuming at Anthony Albanese for leaving them high and dry.

An attractive fringe benefits tax exemption for green machines has helped drive sales of electric and plug-in hybrid cars – but that’s about to change. See how.

The government promised a budget that would build “stronger foundations for a better future”. Here are this year’s winners and losers.

The move, which has been described as a “tourism tax”, is expected to send prices soaring.

With just months to go until the Voice to Parliament referendum, the budget has revealed how much putting it on will cost.

A big change is looming for Australians, with already frustrated renters expected to be hit the hardest.

The government has unveiled cost of living relief in its budget but it has been slammed as a “betrayal of the people”.

Wealthy Australians are set to score a $9000 tax cut next year, but you wouldn’t know it if you read the budget papers.

Tradies could be counted among the biggest losers this budget after a super-sized tax break was axed.

Original URL: https://www.goldcoastbulletin.com.au/business/economy/federal-budget/page/45