Government plans to overhaul vocational students loans system

THEY’VE been accused of signing up students who will never complete their course — now the government wants to clean up private colleges.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

STUDENTS screwed over by shonky colleges providing questionable qualifications could be a thing of the past with the Federal Government unveiling plans to overhaul the vocational student loans system.

Education Minister Simon Birmingham says the new loans program will “hit the reset button” and return integrity to the sector.

It’s probably no coincidence it’ll also help Canberra’s coffers saving the budget bottom line billions.

“To actually get the shonks out of the scheme, the best thing to do is to close it down,” Mr Birmingham told ABC radio on Wednesday.

“I wish that we had shut it down sooner but I believe that we have now got the right approach in place ... that guarantees we’re only supporting students in courses with the likelihood of strong employment outcomes.”

Senator Birmingham said loans would now only support legitimate students to undertake worthwhile and value-for-money courses at quality training providers.

Around $7 billion of taxpayers’ money is spent on vocational education and training (VET) annually.

Once dominated by TAFEs, private colleges are now among the 5000 providers in the VET sector but there are accusations some of the government funding pumped into these for-profit providers has ended up benefiting shareholders more than students.

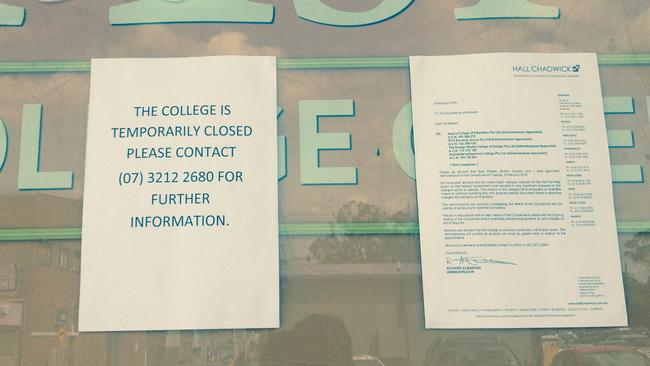

One of the chief concerns has been the conduct of some private colleges which have seemingly proved to be far more adept at sucking in government funding than churning out employable graduates.

Much of this has come from a kitty of $1.6 billion in funding from Canberra for student loans to pay for course fees. Called VET FEE-HELP, this cash ends up with the education provider but doesn’t have to be paid back by the student until they are earning more than $54,000.

As more students have enrolled in private colleges, so more VET FEE-HELP funds have come their way.

But despite attracting four times as much funding as TAFEs and other public providers, private colleges only produced 14,400 graduates in 2014, compared with 18,400 in the public system.

By some estimates, around 40 per cent of VET FEE-HELP loans will never be paid back, partly due to the fact people are being enrolled in courses they, arguably, will never complete or earn enough to pay back the funds.

Under the new system, courses will be sorted into bands with fees covered by the government capped at $5000, $10,000 or $15,000 depending on delivery costs.

Some trainers have been charging $30,000 or more for courses.

Senator Birmingham expects the new caps will lead to lower prices, AAP reported. Public VET providers, including TAFEs, will automatically be able to offer the revamped commonwealth loans but all private providers will have to reapply to be eligible.

The government’s plans also include bans on using recruitment brokers or cold-calling potential students; requirements for students to log in to an online student loans portal to ensure they are active and legitimate and a much higher bar for providers that want to offer government loans, including examining their relationships with industry.

Senator Birmingham wants the new system of VET student loans in place by the start of next year.

That means he’ll have to steer legislation through parliament quickly, with just five sitting weeks left before the end of the year.

But TAFE Directors Australia head Martin Riordan is worried there still won’t be enough transparency.

“We’re seeing really the rules change but still the same umpires,” he told ABC radio.

Mr Riordan is pleased public providers will not have to reapply for accreditation but noted all the new rules would still apply to them. However, the sort of consultation the sector expected ahead of such a major overhaul hadn’t happened.

“We’ve invited (Mr) Birmingham to TAFEs and there’s been no response; we’ve written to him asking for even in camera consultation, even in private colleges — no response. And now I think the best we received was at 35 minutes to midnight last night we were simply given by a junior staffer a copy of a media release,” he said.

“I just don’t think it’s quite the way to treat 1.8 million students.” The Australia Education Union said the government’s moves appeared to be a first step to “restoring sanity to the way we fund VET”.

Originally published as Government plans to overhaul vocational students loans system