Famous investor’s huge move sparks fears for the economy

A famous investor and multi-millionaire has made a huge move which has sparked dire fears for the economy, with all eyes on the US.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

A prominent investor and multi-millionaire has made a huge move amid growing concerns about the global economy.

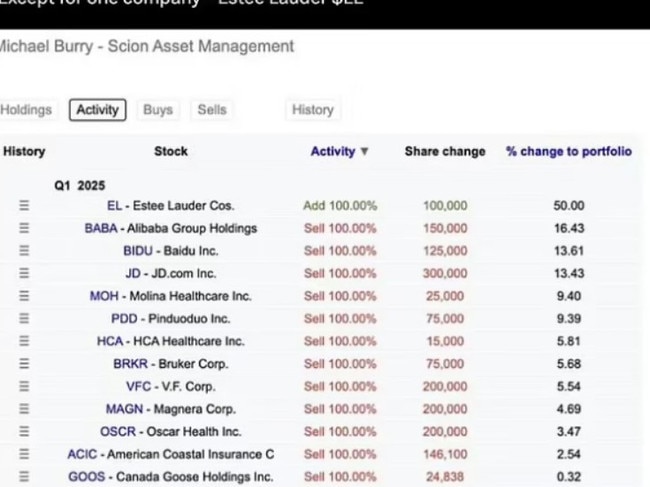

Michael Burry – one of the first investors to predict and profit from the subprime mortgage crisis that occurred between 2007 and 2010 – has turned sceptical on stocks, dramatically slashing the portfolio of his Scion Asset Management company.

As revealed by recent SEC filings, Burry’s Scion Asset Management has liquidated most of its equity holdings in a sign that the investor is bracing for a hard market crash.

The company cut the size of its portfolio to just seven stocks in the first quarter, according to a regulatory filing in May. This is down from 13 stocks in the previous quarter.

Shares sold by Scion include Alibaba (BABA), Baidu (BIDU), JD.com (JD), and PDD Holdings (PDD).

Meanwhile, the company’s position in beauty giant Estée Lauder doubled, to 200,000 shares.

Burry, who was portrayed by Christian Bale in the 2015 movie The Big Short is well known for spotting market bubbles, and has issued a string of warnings over recent years – some of which haven’t come true.

Burry has also slashed shares before – raising eyebrows in 2023 when he cut most of his holdings. Later, he discovered that it wasn’t the greatest move.

The investor’s move comes amid uncertainty on Wall Street over US President Donald Trump’s trade war and the Big Beautiful Bill, which could saddle America with a staggering $4 trillion in debt over the next decade.

Currently, America’s national debt stands at $USD36 ($AUD56) trillion, a figure that dwarfs defence spending as a proportion of the country’s GDP.

What's more, US Treasuries are on track for their first monthly loss this year due to Trump’s abrupt policy shifts, which have shaken the confidence of investors.

Those investors include Burry and JPMorgan chief Jamie Dimon, with Dimon declaring at an economic forum on Friday that a “crack” was about to appear in the bond market, which happens when investors no longer have confidence in the government and its ability to service its debt.

He also stated that government ‘mismanagement’ could potentially “kill us”.

“I just don’t know if it’s going to be a crisis in six months or six years, and I’m hoping that we change both the trajectory of the debt and the ability of market makers to make markets,” the JPMorgan Chase & Co. chief executive officer said Friday at the Reagan National Economic Forum.

“Unfortunately, it may be that we need that to wake us up.”

Dimon had a bleak prediction for most investors.

“I’m telling you it’s going to happen, and you’re going to panic. I’m not going to panic. We’ll be fine. We’ll probably make more money,” he said.

When it comes to Australia's economic future, Treasurer Jim Chalmers said in May that managing the risk from the global economic uncertainty is a priority.

He said the “spectrum of scenarios” posed by the global outlook was “much broader” following the impact of Donald Trump’s trade war.

The spotlight is well and truly on the increasingly volatile US and China relationship.

The Treasurer has also stated that boosting productivity will be the focus of the Albanese government’s second term, while still reining in inflation.

Originally published as Famous investor’s huge move sparks fears for the economy