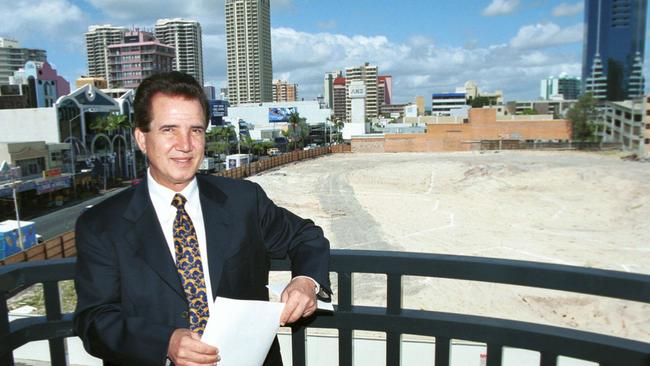

Developer Jim Raptis fighting QBCC to keep builder licence so $47 million in projects stay afloat

TWO major developments worth $47 million are at risk as Queensland’s building regulator fights to ban a comeback king developer from holding a building licence.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

TWO major developments worth $47 million are at risk as Queensland’s building regulator fights to ban comeback king developer Jim Raptis from holding a building licence.

Mr Raptis has engaged a top commercial lawyer and taken the Queensland Building and Construction Commission (QBCC), commissioner Brett Bassett and licence entitlement officer Mark Wilson to the Supreme Court in an effort to block the ban.

Despite several of his various development companies suffering spectacular collapses totalling more than $1 billion, Mr Raptis has never lost his licence, under which he can be a site supervisor or a nominee builder for a company.

He has been a registered nominee builder since 2016 for Garnet Constructions, part of ASX-listed Raptis Group, and for Ezra Constructions, which is also linked to his operations.

Documents lodged in the Supreme Court reveal the QBCC wrote to Mr Raptis and the Ezra and Garnet construction companies on April 5 with notices to cancel their current builder licences and also to exclude Mr Raptis permanently.

Ezra Constructions is currently developing a 140-unit tower in Raptis projects Waterpoint Residences at Biggera Waters and the 57-townhouse Panorama Residences at Carrara, entering two building contracts with a total value of $47 million.

GET A NEW SET OF HEADPHONES WITH YOUR DIGITAL SUBSCRIPTION

Court documents in the case reveal both projects are about 30 per cent complete, with subcontractors engaged and off-the-plan sales under way.

In his affidavit to the court, Mr Raptis said his group had 589 shareholders and that a loss of licence was “likely to have adverse consequences on the reputation of Raptis Group Ltd and in turn to its shareholders”.

Mr Raptis said the loss of his licence would be “devastating to me personally” and would affect the success of his current and future developments.

“I value my reputation as the person responsible for a substantial number of successful residential property developments and commercial property developments throughout Brisbane and the Gold Coast,” his affidavit said.

“I … have won many industry awards recognising the quality, unique design amenity and value for money developments.

“In the majority of the developments, it has been my building licence as the builder or as the nominee … that has stood behind these building developments.”

RAPTIS TURNS $30M TAX BILL INTO $6

The commission said it considered Mr Raptis an excluded individual on the basis of him being a former director of a company named RT No2, which was placed into external administration with debts of $3.54 million in September 2014.

The QBCC also issued Mr Raptis a permanent exclusion notice, citing his previous directorship of another company RT No3, which went into liquidation with debts of $7.49 million in November 2015.

The RT companies were used during the development of the three-tower, 162-unit Sapphire project at Labrador.

The QBCC in May sought to have the case dismissed on the basis that it would be better dealt with through the commission’s internal review process or by the Queensland Civil and Administrative Tribunal, rather than by the Supreme Court.

An internal review completed by the QBCC in June upheld its exclusion of Mr Raptis and the two companies, but found no grounds for permanently excluding the 72-year-old developer.

Mr Raptis’s legal team claims the commission had made “an unlawful assumption of power” and “jurisdictional error”.

It is pushing for the matter to go to trial and for no action to be taken on the licences.

Mr Raptis, Ezra Constructions and Garnet Constructions are asking the court to declare that RT No.2 was not a “construction company” as defined by the Act, and that its collapse was not relevant under the QBCC Act.

They say on that basis, Mr Raptis should not be considered an excluded person and thus Ezra and Garnet should also retain their licences.

The case is next listed for court on September 7.

The Raptis Group returned to the ASX in 2015 after an eight-year suspension in 2008, when the group was delisted after collapsing for the second time, owing creditors almost $1 billion.

Its first meltdown, in 1991, left investors owed $65 million but the company worked its way out of trouble after striking a deal in which creditors recovered 3.5¢ in the dollar.

In 2008 under the weight of almost $1 billion in debt it again survived, this time through a deed of company arrangement struck with creditors in 2009.

It posted a $466,283 interim profit in March after selling $25.5 million worth of units in a Brisbane housing development. Raptis Group made a $54,848 loss the same time last year.