CreditorWatch finds 16.2 per cent of hospitality businesses are at a high or very high risk of failure

Almost one in six food and beverage businesses are rated at a high risk of failure due to problems created by the high cost of living, new CreditWatch data shows.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Almost one in six businesses are rated at a high risk of collapsing thanks to high interest rates, cost of living and the lingering effects of the Covid-19 pandemic which continues to put pressure on the food and beverage services sector.

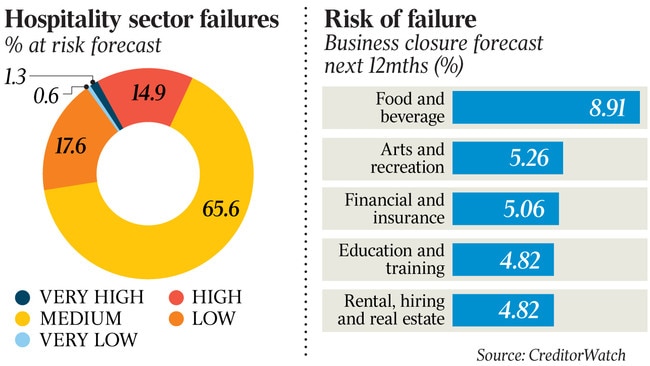

Credit reporting bureau CreditorWatch’s latest industry risk ratings confirm hospitality is the most under pressure with 16.2 per cent of businesses rated at a high or very high risk of failure.

Administrative and support services are next at 7.2 per cent, and arts and recreation services are at a 7 per cent high or very high risk of collapse.

CreditorWatch said the current higher interest rate regime, increased input costs, energy price rises, reduced visitation in CBD locations, and lower consumer demand were negatively affecting discretionary spending.

Chief executive Patrick Coghlan said businesses in sectors such as hospitality and the arts were unlikely to see an improvement in conditions until the Reserve Bank cuts interest rates.

“These industries that are heavily reliant on discretionary spending will, unfortunately, continue to find it tough until consumers feel a reduction in cost-of-living pressures, which won’t happen until we see a couple of rate cuts,” he said.

“Discretionary spending is one of the few ways that consumers can actively cut costs – whether that’s eating out less, buying fewer coffees at cafes or not seeing so many concerts or theatre shows.”

At the other end of the scale, the wholesale trade sector has the highest proportion of businesses rated at low and very low risk at 58.6 per cent, followed by manufacturing (57.8 per cent) and agriculture, forestry and fishing (51.3 per cent).

Just 18.2 per cent of food and beverage businesses are rated low or very low risk. In fact, just 0.6 per cent are rated very low risk.

CreditorWatch chief economist Ivan Colhoun said that on the lower risk ratings side, unsurprisingly, there was a predominance of government or effectively government-funded business categories.

“It will be interesting to see to what extent there is movement in risk ratings in the education and training sector over the next year, given the well-publicised changes to federal government policy in respect of higher education and immigration caps,” he said.

The Australian Securities and Investments Commission reported 1225 companies entered insolvency in September 2024, slightly more in seasonally adjusted terms to the same time last year.

However, CreditorWatch said that while the number of insolvencies was higher than the previous peaks during and after the global financial crisis, and in the slow period for economic growth that followed the end of the mining boom, it should be recognised there were 3.4 million registered companies – twice as many than at the beginning of 2009.

CreditorWatch’s models predict increased business failures in four industry sectors – food and beverage services, financial and insurance services, rental, hiring and real estate services as well as agriculture, forestry and fishing.

The first three reflect the lagged impact of tighter monetary policy on what are relatively interest-sensitive and/or discretionary spending sectors of the economy.

Although the food and beverage services has a range of challenges, neither financial and insurance services (rated 5.8 per cent) rental, hiring and real estate services (5.9 per cent) were not currently showing a significant rise in companies in the very high or high risk categories.

However, CreditorWatch said it was not “unreasonable” to expect some increased pressure in these areas given the current restrictive setting of monetary policy and the likelihood that interest rates will not be reduced before early 2025 in light of slow progress reducing inflation and continuing strength in the labour market.

The bureau said although higher interest rates were likely to be part of the story in the agricultural, forestry and fishing sector (3.3 per cent), lower commodity prices, especially for beef in the face of escalated costs, would more likely be a major driver.

Mr Colhoun said, overall, restrictive monetary policy and several Covid-19 after-effects – such as Australian Taxation Office enforcement actions, migration and foreign student policy changes – were combining to increase the risk of business failure, with interest sensitive/consumer discretionary sectors most at risk.

“The rate of insolvencies is not yet especially high and the enforcement actions of the ATO are currently obscuring the underlying trend,” he said.

“CreditorWatch modelling expects a further lift in insolvency rates, though expected interest rate cuts in the first half of 2025 and the beneficial aspects of recent tax cuts should prove a support.”

More Coverage

Originally published as CreditorWatch finds 16.2 per cent of hospitality businesses are at a high or very high risk of failure