Aussie man wakes to ‘shock’ as $10,000 siphoned out of bank account on Brazil holiday

An Aussie man’s first holiday in years turned into the opposite of a relaxing time when a criminal wreaked havoc on his bank account.

Travel

Don't miss out on the headlines from Travel. Followed categories will be added to My News.

An Aussie man’s first holiday in three years turned into the opposite of a relaxing break when a criminal cloned his credit card and racked up $10,000 worth of debt in his name.

Adrian*, 49, from the Central Coast north of Sydney, had worked in NSW’s health department at the height of the pandemic, admitting his workload was pretty “insane”, resulting in him not taking a single day of leave.

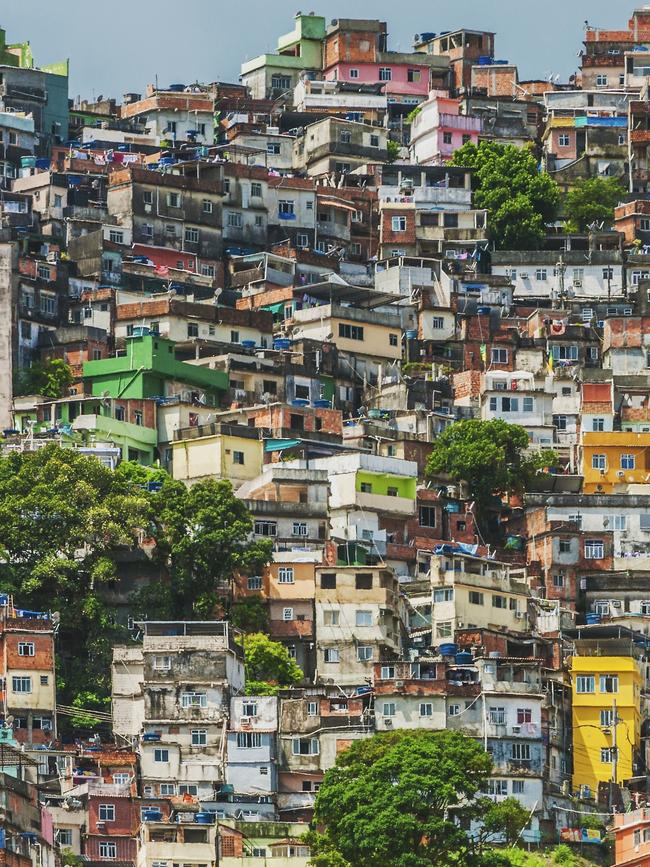

He was looking forward to a big break and booked a trip to Brazil several months ago.

But one day, waking up in the morning and checking his phone, the NSW resident did a double take when he realised thousands of dollars had been siphoned out.

“I woke one morning and checked my account as I regularly do and nearly AU$10,000 had been charged to my card over multiple transactions at the one merchant in a single day,” the holiday-goer told news.com.au.

“Oddly the nearly $10,000 was spent at a bakery in Rio.

“I never left São Paulo and $10,000 in Brazil goes a long way.”

Adrian has lived and worked in Brazil previously and can’t recall a moment where his card details could have been stolen.

“This was my first (trip) getting away from life,” Adrian lamented.

“Everyday I would log into my account to see what I’d spent the day before to monitor the currency exchange. I’d transferred $10000, to change flights, I don't normally have that much sitting in there.”

Three days before his holiday came to a conclusion, he continued this routine, but this time when he checked his bank account, something was different.

“There was probably a balance of $200,” he said.

“I thought ‘hang on, that’s not right’

“It was a shock.”

As soon as he realised his money was gone, he had to wait for several excruciating hours to speak to his bank, Greater Bank, because of the time difference between Australia and Brazil.

“I basically had to wait 12 hours until I could ring the bank, rang them that night. In Brazil time, it was 9pm, 10pm at night,” Adrian recalled.

His account was luckily locked straight away.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

What followed in the weeks and months since has been another ordeal for the Australian man.

Putting in his Australian SIM card into his phone, Adrian was concerned that he hadn’t received an SMS message from Greater Bank warning him about the larger transaction, nor had he received any kind of email alert.

For the rest of his trip, he had to keep calling the bank to lock and unlock his card accordingly.

He tried to make a report to local authorities but ended up giving up on this.

“In Brazil you can’t do anything without a national identity number, it was a bit of a brick wall,” he said, so he gave up.

But when he returned to Australia, Greater Bank said to open a fraud investigation, he needed to lodge an incident report.

It was only because Adrian had previously lived in Brazil and had friends there that he was able to file the report, which took several weeks.

By the time he contacted news.com.au, it had been three months since the theft, and he was still no closer to knowing if the bank would compensate his losses.

After news.com.au contacted Greater Bank earlier this month, Adrian was refunded within days.

Stuart Hall, NGM Group Chief Operating Officer, told news.com.au in a statement “The issues of fraud and cybercrime are of paramount importance to us, and in the unfortunate event a customer has been the victim of crime we work closely with them through the process of lodging a claim and taking actions to stop any further unauthorised activities, such as blocking their cards.

“The investigation period for these cases can take up to 45 days to complete once we have received all of the required information …

“I am pleased to confirm that the customer will be fully reimbursed. Our team has been in contact with the customer again … to ensure that we’ve addressed all his concerns.”

alex.turner-cohen@news.com.au

*Name withheld for privacy reasons

Originally published as Aussie man wakes to ‘shock’ as $10,000 siphoned out of bank account on Brazil holiday