Smaller suburban centres could be in Big W firing line as discounter announces first of 30 store closures

Big W is tight-lipped about the next batch of stores to get the axe. But could a map of the three closures announced yesterday provide a big hint?

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Big W’s announcement of the first three of 30 stores it will shutter was no big surprise — analysts have for some time been expecting the Woolworths-owned discount retailer to slim its store numbers.

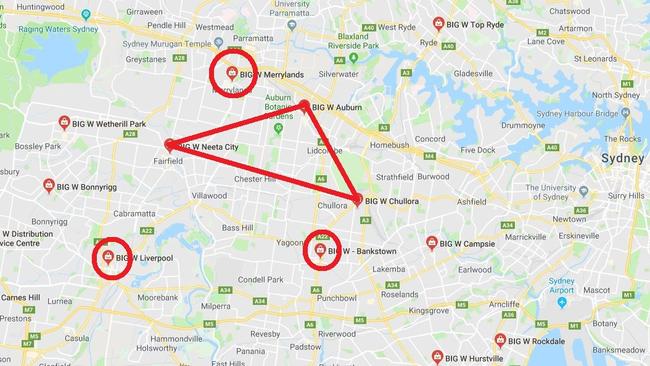

But what was a surprise was where those three stores were. And a quick look at a map of the doomed shops could give a huge hint as to the next Big W stores on the chopping block.

In April, Woolworths CEO Brad Banducci said 30 of Big W’s 180 stores were at risk. In recent years, the discounter has become the problem child of the group continuing to lose millions, $110 million last year, as customers froth over Kmart or head to fast-fashion powerhouses H&M and Zara.

Yesterday Big W announced loss-making stores in Auburn, Fairfield and Chullora in Sydney’s west would close for good in January.

Other Big Ws have quietly shut up shop, such as the Broken Hill branch that closed last year after 32 years in the desert town.

Big W is remaining tight-lipped about the locations of the 27 further dead shops trading and has said “each store is being reviewed individually”.

However, yesterday’s announcement has dropped a possible heavy hint, says QUT retail watcher, Associate Professor Gary Mortimer.

He should know; before he was an academic, Dr Mortimer was the sales manager at Big W Chullora, which is on the hit list.

“When I was with Big W in the 1990s they had 89 stores, and now they have more than 180.

“The initial talk around these closures was it would be many of the regional stores. But yesterday’s announcement means you can’t discount suburban stores also being in that mix.”

MAPPING THE AXED STORES

Charting the stores to be closed on a map, and bringing up other Big W stores, reveals some of the potential reasons behind the closure.

Firstly, all three stores are in proximity of one another. It was likely they were competing for some of the same customers, cannibalising sales. Their loss will create a kind of Bermuda triangle of lost Big W stores in Sydney’s middle western ring.

They share other similarities, too. Fairfield, Chullora and Auburn are relatively minor residential, retail and transport hubs. Their shopping centres are modest, and Chullora doesn’t even have a railway station.

Indeed, look further, and you’ll see they are surrounded by much busier suburbs, many of them with large shopping centres that contain, yup, a Big W.

Bankstown’s Big W is just to the south of Chullora, Liverpool’s Big W to the south of Fairfield and Merrylands’ store to the west of Auburn.

THE DEPARTMENT STORE DANGER ZONE

“The closing stores are sitting between major centres that have profitable Big Ws,” said Dr Mortimer.

“When you have big Westfield complexes close by, there is a pull towards those centres and away from smaller centres.

“In Underwood, in Brisbane, there is a Big W but the pull is to Westfield Garden City which is much bigger and where there is also a Big W.”

Underwood and Garden City are 10km apart, around the same distance as between Fairfield and Liverpool.

A look at where Big W stores are cited across the major cities shows a number dangerously close to another bigger store. These could be vulnerable.

In Sydney, Rockdale’s Big W is just 5km from the Big W at Westfield Hurstville. Big W Winston Hills, a suburb with no train station, is a short hop to Big W Blacktown, one of the busiest hubs in Sydney’s rail network.

The Top Ryde City shopping centre in Sydney’s north has already lost its Myer, which did nothing like the trade of its store at the Macquarie Centre 5km away. Could Big W leave too?

In Newcastle, the Big W in Mt Hutton is minutes away from the Big W in the huge Charlestown Square.

Melbourne is less blessed with Big Ws, nonetheless the Box Hill branch is well within the orbit of the store within Westfield Doncaster.

Dr Mortimer said Myer had started down the same path. In Brisbane, Myer axed stores in Brookside and Loganholme, both in neighbourhood centres far smaller than mega malls or CBDs nearby.

Big mall companies like Scentre (Westfield Australia’s owner), Vicinity and GPT are spending big on transforming their major centres into destinations, with not just shops but cinemas, gyms, childcare facilities, even fine-dining precincts.

“People might be like, why would I go to a smaller centre and buy a shirt when I have a better experience at a bigger centre?” said Dr Mortimer.

Big W would be betting, he said, that most customers wouldn’t begrudge the extra few minutes in the car to a store down the road.

‘TOO BIG TO BE SMALL, TOO SMALL TO BE BIG’

Brian Walker, who runs the Retail Doctor Group consultancy, told news.com.au he had been predicting the downsizing for some time.

As Australia’s cities grew ever bigger, the race was to have more and more outlets. But changes in shopping habits, such as the growth of online and external factors such as stagnant wage growth, had put the brakes on retail.

“There were centres built in every suburb. Now retail doesn’t rely on physical shop.

“It’s a pincer effect. Large centres like Bondi, Chadstone and Parramatta will get bigger. At the other end we will see a resurgence of community hubs with butchers, bakers and candlestick makers.

“It’s in the middle ground that’s in the firing line. These are centres that are too big to be small and too small to be big.”

The downsize was no surprise, he said. Compared with other countries, Australia has simply too many shops.

“Australia has the third highest per capita intensity of stores, so we need an adjustment,” Mr Walker said.

A similar contraction has been happening in the UK where big high street names like Debenhams, Marks & Spencer and Boots are closing down stores.

Boots, a pharmacy, said it would shutter stores when there was another nearby. Debenhams is closing a slew of department stores in UK towns and the suburbs of cities, opting instead for the larger CBDs and big mall branches.

A Big W spokesman told news.com.au the majority of stores would remain open. The firm would not confirm the location of any other stores to close as they were continuing to talk to landlords.

“Each store is being reviewed individually based on a number of criteria which includes lease obligations and performance,” he said.

“Discussions with landlords are ongoing as part of this review.

“If or when we reach an agreement with a landlord, we will aim to give at least three months’ notice to our store teams and the community if a closure is announced.”

Big W managing director David Walker said yesterday supporting employees who lose jobs was a priority. The company was committed to “doing the right thing” and would “explore redeployment opportunities” with staff.

But if Myer and Big W are just the first in a cavalcade of retailers reaching for the mall exit door, what will become of these smaller suburban shopping centres?

Mr Walker said the departures could be an opportunity.

“As department stores contract this is a chance for landlords to ask themselves what they should do with the space. Star landlords can repurpose the gap with perhaps commercial spaces or gyms.

“This is merely a symptom of the transformation in retail here and overseas.”

Originally published as Smaller suburban centres could be in Big W firing line as discounter announces first of 30 store closures