‘What sane person is buying this?’: Sign Aussie fast food icon Domino’s is in serious trouble

One of the country’s most popular fast food chains is now in crisis mode thanks to a series of truly astonishing fails and blunders.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

ANALYSIS

Wow. Pizza is not looking like such a good investment all of a sudden.

Domino’s just made its first loss in 20 years and its stock price has turned into a dumpster fire.

On Tuesday, the company fronted up to the ASX and made its confessions.

“Our recent decision to close 205 loss-making stores, including 172 in Japan, should demonstrate we will take the steps we need to provide the venture capital to reinvest in sustainable, long-term growth,” said CEO Mark van Dyck.

The market punished it. Savagely.

The stock fell 12 per cent on Tuesday alone.

But that’s just the latest in a long series of falls for the Australia-listed outpost of the global pizza brand.

The difference between its peak stock price and its current price is astonishing.

Domino’s Pizza Australia owns the license to run and franchise the Domino’s brand in this country, parts of Europe and much of Asia.

As the next chart shows, the market thought it was a winner back in 2021.

At that point, the stock had risen to over $160.

But now, the vibes have well and truly turned. Domino’s is turning into a real disaster. The stock price is now under $28.

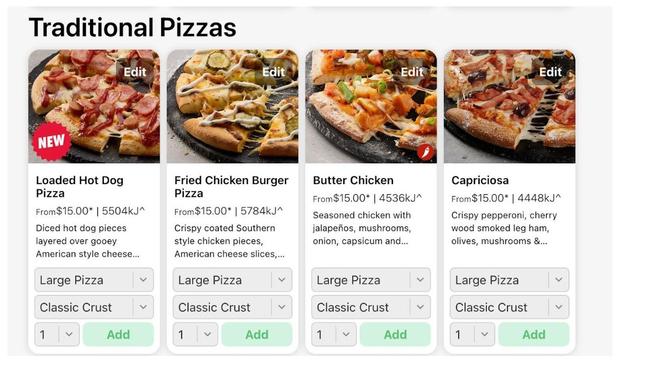

If you invested $100 in Domino’s Pizza stock at its peak in 2022, it would be worth $16.83 today. Barely enough to buy one of their traditional …. Fried Chicken Burger pizzas?

Looking at the picture below raises serious questions about why anyone ever thought this stock was a winner.

Who wants to eat a chicken burger pizza?

Don’t get me wrong. I was young once. I made use of those $5 Domino’s deals when I first moved out of home – I would buy two and freeze one for dinner later that week. But those were pizzas, not abominations.

Domino’s Australia is now closing stores around the world, across Europe and Asia. Sales are falling in both places.

And it’s not the fault of fast food generally.

People still want unhealthy food. The owner of KFC, a company called Yum Brands, is making huge bucks. In the time that Domino’s Australia’s stock price has fallen 80 per cent, Yum Brands’ has risen 50 per cent.

Interestingly, Australia is a massive part of the success of Yum Brands.

We account for 7 per cent of KFC system sales worldwide, which is crazy when you consider our population.

America is 10 times the size of Australia, but accounts for only twice as many Zingers and chicken buckets. We buy more KFC than the UK too, even though they have 40 million more people than us. (Actually, this fact is probably exactly why Domino’s is trying to sell a chicken burger pizza in Australia …)

McDonald’s, too, seems pretty stable.

So is pizza to blame?

If it was, the US branch of Domino’s would be in trouble too. But instead, it seems robust.

It opened 364 new stores in the last three months alone, including 280 outside America.

Nope, the real problem seems to be specific to Domino’s Australia.

What it did wrong was its aggressive expansion into Japan – not a region famous for pizza. Apparently the Japanese enjoyed a few pizzas during Covid lockdowns, and Domino’s got overexcited.

The company opened loads of stores. But it turned out the locals were just after delivery – they didn’t like the actual product much.

The company’s desperation to please the customer in Japan can be seen in the fact it has pivoted to rice bowls. But what sane person is buying this?

Another Covid-era problem for Domino’s is its stock price probably got a bit crazy back there. At one point, it seemed to convince the market it was a tech stock destined for world domination, just because it had an app.

That story is thinner than a thin crust pizza.

A pizza chain is in the pizza business, and it needs offerings that are pizza.

Not rice bowls, not burgers.

I remember the pizzas I used to defrost – they were pretty good even after I took them out of the freezer.

A pizza is an inherently good thing – you have to try pretty hard to stuff it up.

Domino’s should be able to turn its fortunes around if it keeps that in mind.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

Originally published as ‘What sane person is buying this?’: Sign Aussie fast food icon Domino’s is in serious trouble