More than 20,000 payments totalling $367m made under Fair Entitlements Guarantee in three years

Thousands of payments totalling more than $367 million have been paid out to employees of collapsed companies since the Covid-19 pandemic.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Taxpayers have spent $367.08m paying out employees of collapsed businesses since the onset of the Covid-19 pandemic.

Data from the Department of Employment and Workplace Relations reveals more than 20,000 payments have been made under the Fair Entitlements Guarantee Act between March 1, 2020 and May 31, 2023.

Under the FEGA, workers are able to claim up to 13 weeks of unpaid wages, unpaid annual leave and long service leave and some redundancy pay if they have lost their job due to the insolvency of their employer.

Of the payments made during the three year period, 2413 payments were related to the insolvency of large employers with more than 200 employees; 12,385 were related to medium size employers (15-199 employees) going bankrupt, and 5468 payments were made due to small businesses (less than 15 employees) collapsing.

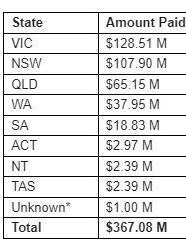

Victoria had the highest number of claims paid, with 6810 payments totalling $128.51m over the three years; followed by NSW, where $107.9m was paid out to 5715 claimants.

There were 3946 claims paid in Queensland, totalling $65.15m.

In the last year alone, amid skyrocketing inflation and a weakening economy, 6416 payments totalling $126.85m were made.

Last month’s budget suggested the government expects to fork out $283.46m in the year ahead to employees made redundant as a result of insolvencies, but that payments required to be made under the Act would lower from 2024 through to 2027.

The likes of construction giant Porter Davis, start-up Milkrun, and luxury fashion house Alice McCall have all gone under in the past year.

Jenny Craig was also forced to close its Australian and New Zealand operations after administrators failed to find a buyer for the company’s physical stores, with many of its employees set to receive entitlements – either through assets sold or through the Fair Entitlements Guarantee.

But as the data obtained from the Fair Entitlements Office reveals, it’s not just big businesses struggling.

In the March 2023 quarter alone, the Australian Financial Security Authority recorded 2494 new personal insolvencies – up 12.6 per cent compared to the same time the year prior. Of the insolvencies, 60.3 per cent were bankruptcies and 38.3 per cent were debt agreements.

In April alone, there were 769 new personal insolvencies – 437 of which were bankruptcies. In the one month, 90 healthcare and social assistance companies were put into insolvencies – defined by ASIC as the first time a business enters external administration.

In the same month, 88 construction companies were made insolvent.

The markets are widely expecting more companies to buckle under the pressure of a weakening economy, slow growth and sustained high inflation over the coming years.

Several lending indicators in the May 2023 CreditorWatch Business Risk Index released this week show external administrations, B2B trade payment defaults, court actions and credit inquiries are all trending sharply upward.

And, with economists predicting the RBA is unlikely to consider lowering interest rates until at least mid-2024 – when inflation is expected to return to the two to three per cent target – there are concerns more businesses will be forced into insolvency.

The CreditorWatch data suggests food and beverage services are the most likely to default over the next 12 months, with a 7.10 per cent chance.

CreditorWatch chief executive Patrick Coghlan this week said pressures were mounting on businesses across almost all industries.

“Our Business Risk Index data is showing a clear upward trend in the rate of external administrations across almost all sectors, with mining being one of the few exceptions,” he said.

“With economic conditions forecast to decline further, we encourage all businesses to perform proper due diligence on their trading partners and monitor them on an ongoing basis to ensure they don’t become an unfortunate statistic.”

The data shows parts of western Sydney – Merrylands-Guildford, and Canterbury – remain the worst performing regions in the country for default rates.

Meanwhile, Unley in South Australia has the lowest insolvency risk.

Chief economist Anneke Thompson said trading conditions for businesses were clearly becoming more challenging.

“Sentiment in the business community has shifted down now that it is clear that core inflation is proving hard to tame. It is now unlikely we will see any downward movement in the cash rate until mid 2024 at the earliest,” she said.

Treasurer Jim Chalmers in last month’s budget announced a $314m tax incentive to help small and medium businesses save on energy bills, which the government hopes will keep companies afloat amid rising cost-of-living.

Originally published as More than 20,000 payments totalling $367m made under Fair Entitlements Guarantee in three years