‘Mean’ tax forcing people out of their homes and businesses

Soaring insurance costs continue to cripple businesses and homeowners, with agencies blaming an “unfair” hidden tax paid by only two Aussie states.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Elton Cummings is paying a staggering $3,000 per month on business insurance, more than double what it was three years ago, while Natasha and Brendon Garred were quoted roughly $270 per day to cover their generational fruit shop for floods.

They are just two of hundreds of Australians being taxed out of their businesses and their homes, with New South Wales one of only two states still charging an “antiquated” levy which can add at least $2,000 more to premiums.

More than 15 months after Premier Chris Minns vowed to review the Emergency Services Levy (ESL) – which slugs policy holders to help fund NSW emergency services organisations – business groups and community leaders argue further delays will only make matters worse for those affected.

Among those leading the call are businesses and households in the northern NSW city of Lismore, who are still struggling to recover after being hit by the worst flood on record three years ago.

READ: Aussie street where 50 people are living for free

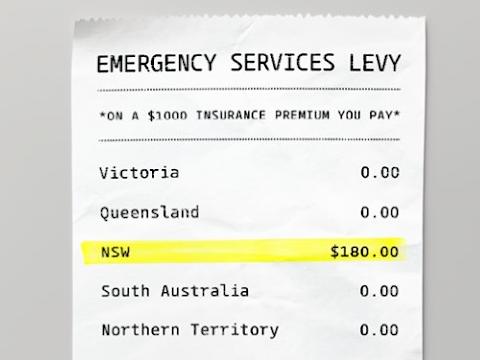

NSW and Tasmania are the only two states still charging the levy, which adds up to 18 per cent on residential premiums and 30 per cent on business policies. The NSW Government was projected to have collected $1.3 billion from the tax in 2024/25.

With the high premiums forcing many households and businesses to ditch insurance cover, Business NSW – which represents 50,000 members – argues the pool of those funding the levy is getting smaller and smaller.

It also puts the financial burden of the levy largely on the desperate few who have insurance, with calls being made to remodel the levy to apply to all landowners who benefit from the support of emergency services in a crisis.

“The ESL is applied to the base premium, followed by GST and then NSW stamp duty. This means that when premiums rise, the two taxes, ESL and stamp duty, add to the cumulative load and the total cost of insurance leaps,” Business NSW CEO Daniel Hunter told news.com.au.

“The ESL means people are less likely to take up insurance, reducing the amount of coverage of the scheme.

“This skews the insurance pool, meaning those who get the insurance are the ones who desperately need it. It makes the scheme more risky and therefore more expensive.

“The insurance crisis is not a problem that can wait for long-term solutions,” Mr Hunter said.

“While reforms to improve affordability and accessibility are underway, businesses need immediate support. Delays in addressing these issues will only deepen the economic risks to our state.”

A government spokesperson told news.com.au they “will not be rushing the process”.

“The Minns Government has committed to creating a fairer system for funding emergency services while helping to drive down insurance costs. This long overdue reform to make our tax system fairer and better adapted to the conditions we face is now well underway. It is important we get it right,” the spokesperson added.

Nowhere is it being felt more than in Lismore.

Having struggled through the Covid pandemic and shut downs, and then hit by record-breaking floods in 2022 - which saw the town besieged by 14.4m of water - several businesses told news.com.au they were still paying off staggering debts in the wake of these events without any insurance support.

A damning federal inquiry report handed down in October last year found insurance companies “failed too many people” following nationwide flood events in 2022, with more than 300,000 insurance claims made totalling almost $7.4 billion.

“Insurance companies treated their own policyholders in a disgraceful and disgusting way – it was ruthless, and it was appalling, and it must never happen again,” Independent MP for the central NSW seat of Calare Andrew Gee said in the report.

“The evidence taken by this inquiry amounts to a withering and damning indictment of the insurance industry.

“While some in the industry may be ashamed of it, I suspect many are not.”

Insurance Council CEO Andrew Hall backed calls to abolish the “antiquated” ESL, confirming to news.com.au costs would be brought down to reflect the scrapping of the levy, which makes up around 10 per cent of premiums.

“Queensland and Victoria have abolished their ESL levies and it has the effect in New South Wales of making premiums in this state the most taxed in the country, during a cost of living crisis,” Mr Hall said.

“And for regions where there’s high peril risk and therefore high premiums, people are just paying an extraordinary amount of tax and quite often they don’t realise it.”

However, Mr Hall noted relief wouldn’t be immediate.

“What happens is when things like this are adjusted, your premium renews annually, your insurance contract renews annually. So when your annual renewal will come up, it will come up less,” he said.

“The ESL in the background, that’s where the complexity is because insurers will have collected ESL, and so they need to calculate at what point it ends, at what point they stop giving that money to the government and at what point they can normalise those premiums.

“Whenever those situations happen, we fully expect there’ll be a price monitor in place and we’ll be reporting that data and information to the government as the tax has rolled off.”

Businesses lost millions without insurance

Lismore-based husband-and-wife business owners Natasha and Brendon Garred are second generation business owners, having bought local institution PJs Country Fruit & Veg from Brendon’s parents 16 years ago. They weren’t insured when the 2022 floods hit.

It cost them “half a million dollars” to rebuild their completely gutted store, which only managed to reopen to its former glory in September 2023. This, all while they’re still paying off loans from their rebuild following the 2017 floods.

“We couldn’t afford flood insurance. It was six figures, more than $100,000, after the 2017 flood for us to purchase,” Ms Garred, 39, told news.com.au. “We don’t even make that.”

“It was already high, but when 2017 happened, it skyrocketed. We’ve never had it, because we’ve never been able to afford it,” she added.

In the Lismore CBD, Elton Cummings owns electrical goods and furniture businesses Retravision and Bi-Rite, which are located side-by-side on a levee, adjacent to Wilsons River.

His late father Thomas Cummings formed the family business after World War Two, later expanding to several locations across the Northern Rivers.

Mr Cummings said insurance fees across his whole portfolio had skyrocketed in the wake of the 2022 floods. None of his policies include flood cover.

“In this particular location [Glasgow Lane, Lismore], it never included flooding. That was not an option,” he said.

“We were paying around $14,000 to $15,000 annually [before 2022] to insure this building. Now it’s around $35,000 annually.

“Plus, I found it hard to even get an offer on the table. Although this building sits on top of the levee, it’s riverside, and that seems to be a barrier.

“It’s one of my major costs. You’ve got wages as number one, then rent, and now fuel has become a major one too. But now, in this location, insurance is a big one.”

The 2022 floods marked the first time the Retravision and B-Rite shops had been impacted by a flood. The business didn’t receive any rebates from its insurance company.

“We lost, including the stock, the purchase of new stock, and the repairs of all the shops and buildings, about $2 million to $2.4 million worth of capital to get us back to buying stock and fixing the buildings,” Mr Cummings said.

“It was stressful when I started to do the figures and thought, ‘Oh my goodness, this has really cost the family a depth of wealth.’

“That was more stressful … Trying to make sure that we secured out future, not only business wise, but personally. That probably still stresses me a bit today.”

‘Sickens you to the stomach’: Lismore businesses not eligible for flood insurance

Lismore Mayor Steve Krieg is a business owner himself with his La Baracca coffee shop and bar in town.

He can’t wrap his head around why residents and businesses aren’t able to insure themselves against their greatest risk.

“What you need insurance for is your greatest risk factor. So I can insure my building for bush fire and theft and all of those sorts of things, but I can’t insure for flood, the one thing I want to be able to insure for,” he said.

“South and Western Australia, can insure for flood. They get the least rainfall of anywhere in the country, but they can’t get bush fire insurance. It just seems to be an anomaly that an industry built around protecting people from risk are not prepared to risk their own business.

“It almost sickens you to the stomach when all the financials are getting released, and you see the CBA making $10.7 billion in profits, and GIO making $5 billion in profits, or whatever they make, yet their core business should be around looking after the people.”

Mr Hall, however, argued it was up to the federal and state governments to invest further in mitigation to future proof the city and ultimately make insurance accessible for locals, saying flood cover was “our most expensive and biggest challenge in this country”.

The federal government dedicates 97 per cent of disaster money on clean-up, with only three per cent going to infrastructure prevention.

“There’s a 41 per cent chance in the next 10 years [high risk] properties will be destroyed by a flood. It makes it very expensive when you do the actuarial work on it to price an insurance policy for a building that has at least 50 per cent chance of being destroyed in the next 10 years,” he said.

“In the short term. We can do things like the tax reform, but we need a long-term plan to reduce the risk on those properties and normalise the flood risk.

“Look around the world at other schemes that have tried to do this. The mistake they make is creating some sort of subsidy pool without linking it to mitigation, and if it’s not linked to mitigation, the cost of it grows out of control.

“In the US, their scheme now is up to $US40 billion in debt, which will never get recovered through premiums. We want to avoid those mistakes. What we want to do is have a sensible timeline with government about when flood levies can be built, buybacks completed, and then work on a plan to be able to normalise the premiums in those areas.”

Former NSW police commissioner Mick Fuller, who co-led the 2022 flood inquiry, said there was “lots of high ground” in the area that would not only entice new residents to Lismore, but make it more feasible for people to insure their properties.

“I would love to see some other investment that brings new people into Lismore. It’s a beautiful town. It is a safe town. Perhaps the state government or the federal government could look at acquiring some land that is reasonably priced, rather than try to put everyone back in flood prone areas,” Mr Fuller said.

“If we agree on the science that Lismore was, I think the second or third most flooded location in Australia, then something has to happen.”

Infrastructure investment ‘critical’ to driving down costs

While scrapping the ESL would provide relief for policyholders, Business NSW’s regional director Jane Laverty agreed mitigation would make the biggest difference to premiums long-term.

“Right now, we’re waiting for the reports to come through from the CSIRO to provide an understanding of what level of mitigation would be required,” Ms Laverty said.

“But I think we need to be looking at government’s willingness to invest in that mitigation. We know there’s going to be some suggestions and recommendations, so we want to show up to the investment early so there’s not a big period of time from knowing what’s needed, and then enacting on what’s needed.”

She continued, “We’ve got to actually think for the big picture in the future of the Northern Rivers, where Lismore is at the heart of it. We need to protect it and we need to be serious about putting that mitigation in place if we want to ensure that insurance is affordable.

“We’ve talked about business, but we’ve got a lot of older people that live in Lismore and they currently cannot afford the insurance premiums that have been offered to them. That’s not right.

“And if you can’t get the insurance coverage to even then do rebuilds or any renovations to protect yourself, you can’t go to the bank to get that loan if you don’t have access to insurance. So it becomes critical.”

As for healthy profits recorded among insurance companies in mid-February, including Suncorp and QBE, Mr Hall argued the windfall would actually benefit policyholders.

“We’ve had a period of time in the last couple of years following some really major events that have incurred huge losses, particularly in home and contents,” he said.

“What we’re seeing in the profit recovery at the moment, only a small amount of that is coming from home and contents. Most of it is coming from other classes of insurance and the investment pools. So we’ve had six months of benign weather except for the floods obviously in North Queensland over the last couple of weeks.

“The claims numbers have dropped off enormously. It’s given a reprieve to the insurance cycle. And what we’re seeing is the reserves that insurers build for natural disasters in a high interest rate environment is returning a lot more money. So a lot of the money is coming back off investment pools and other sources.

“And the good news about that is that we will see insurers become more competitive and start offering more deals. They look to get more market share. I think we’ll see probably an easing of the increases that have been happening in premiums, and I think there’ll be a lot more activity trying to grow market share.”

Originally published as ‘Mean’ tax forcing people out of their homes and businesses