Expert reveals one simple step banks can take to stop scammers fleecing hard-earned savings from Aussies

After a Gold Coast couple’s dream home was lost to a cunning scam, an expert has revealed the simple step banks could take to stop scammers from fleecing the life savings from hardworking Aussies.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

It’s just a simple step that could save hundreds of thousands of dollars earned by working Australians from falling into the hands of cold-hearted scammers.

Just requiring payee confirmation would be enough to make sure the finances are going into the right account, and prevent interference from someone pretending to be who they’re not, Gerard Brody from the Consumer Action Law Centre says.

Mr Brody says the lack of protections in place in Australia are leaving people vulnerable to swindlers who are able to dupe people through their computers.

One Gold Coast couple were left devastated when they lost almost $40,000 to a “cunning” email scammer who posed as a real estate agent.

Mitch Wilson and Penny Davies believed they were just following their agent’s advice when they transferred their house deposit to a bank account.

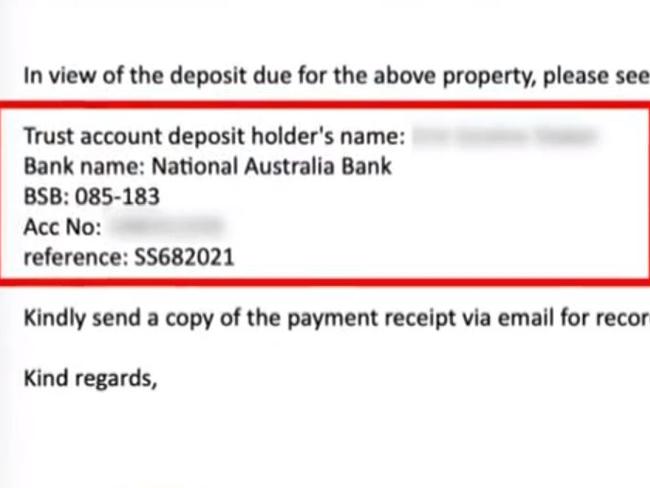

They had received an email from what appeared to be their real estate agent’s email address.

“It plays over and over in my head all of the time,” Davies said.

“We got an email from the real estate agent we had been dealing with, from their email account saying in light of the contract, please pay money to this account,” Wilson told 9 News.

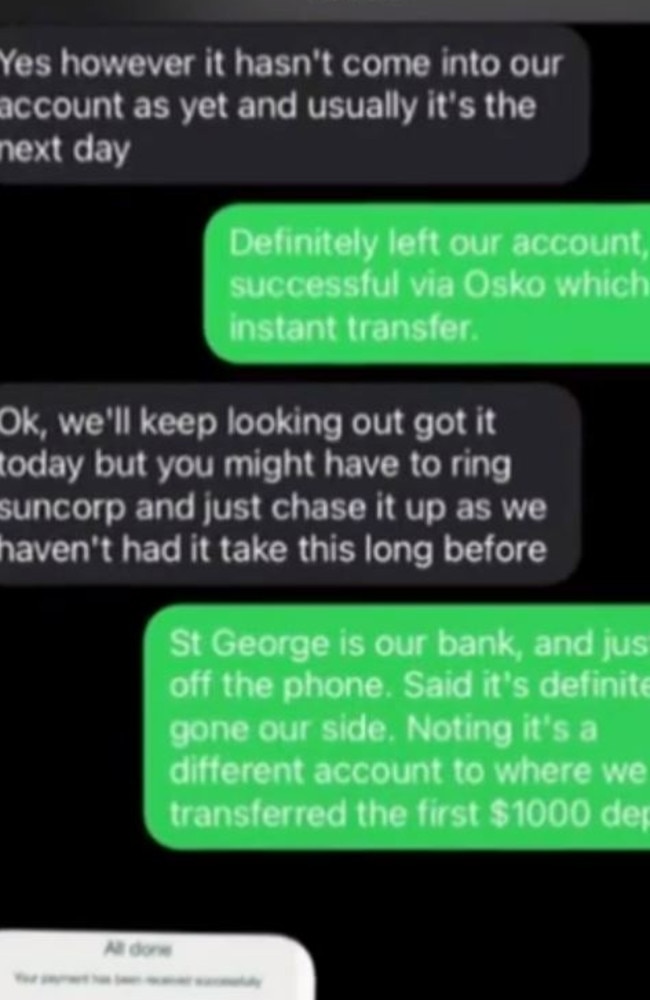

The couple transferred $39,000 to the bank account and didn’t think about it again until the agent contacted them a few days later inquiring about the payment.

“We went back and forth, we exchanged screenshots and emails from their side and ours, and what was obvious is the money didn’t go where it was supposed to go which was their account,” Wilson said.

“(It) ended up in some fraudster’s account and then offshore to a crypto account.”

Police are referring to it as an email compromise scam whereby scammers infiltrate an email account and send emails to victims – making it very difficult to discern that it is a scam.

“These people with these skills, they're very cunning, they’re very calculated,” Ian Wells from the Queensland Police Service Cyber Crime Group told 9 News.

When a business owner sends an invoice, the hackers change the bank account numbers for payments and then forward the invoice to the unsuspecting customer.

“Mummy blogger” Constance Hall has also fallen victim to the cruel scam.

She told news.com.au last month she felt “stupid” after losing thousands of dollars to the fraudsters.

Ms Hall believed she was paying a deposit on a rental property when she transferred money via a link sent from the real estate agency that managed the property.

When she contacted her bank she was told that as she had authorised the transaction, the chance of getting money back was minimal.

Her bank recovered just $7.57.

“To have it all stolen in an instant … felt unbelievably unfair,” she said.

Police urge home buyers to always contact the businesses first to verify bank account numbers when paying invoices online.

Gerard Brody from the Consumer Action Law Centre said the current system leaves Australian vulnerable to scams.

“The risk sits with you as the individual to get those numbers right and the bank doesn’t double check that the account name you put in is going to the right accounts,” he told DailyMail.

The consumer law expert said there is no bank mechanism to confirm the payee in Australia at the moment.

“Reforms in the UK and other countries now require banks to do confirmation of payee,” Mr Brody said.

“Here in Australia, there have been calls for banks to do the same but they are not and that raises big risks for scams.”

Under the current banking system, Australians can only get their money back if their details or cards are stolen.

If the transactions have been approved, as they were in the cases of Ms Davies, Mr Wilson and Ms Hall, then getting reimbursed from the bank is much harder.

“It can be very easy to get scammed, unfortunately, and they can be very sophisticated including these sort of impersonation scams,” Mr Brody said.

“It doesn’t seem fair that individuals bear the full losses associated with scams and so what we’re pushing for is there to be stronger measures in place to prevent fraudulent bank transactions from being processed.”

Police urge Australians to contact their bank as soon as possible to report a fraudulent transaction.

The Australian Cyber Security Centre advises impacted businesses to report the incident at cyber.gov.au/acsc/report/ and alert other employees and clients.

Businesses should also report the breach to their email service provider for example Gmail or Microsoft Outlook.

Originally published as Expert reveals one simple step banks can take to stop scammers fleecing hard-earned savings from Aussies