Boss of collapsed builder Willoughby Homes to sell all seven of his properties to pay company’s $5.7m debt

The director of a collapsed building company has broken his silence and offered to sell up all seven of his properties, some of which he has owned for more than a decade.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

EXCLUSIVE

The director of a collapsed building firm will likely have to sell all seven of his properties to recoup funds to pay back the company’s debts.

But even then, most creditors are only expected to receive between 1.7 cents and 5.7 cents for every dollar they are owed.

NSW-based residential builder Willoughby Homes went into voluntary administration earlier this month but was spared from being placed into liquidation at a court case on Wednesday afternoon.

Gyprocking company Regno Trades began winding up proceedings against Willoughby Homes in early July over an unpaid debt of $184,000 and three supporting creditors also joined the case – H & R Interiors, owed $73,925, an ex-employee owed $53,000 in unpaid wages and Finese Electrical and Air Conditioning, owed $4531.

That means under the proposal, in a worst-case scenario, Regno Trades will receive around $3200 — which is 1.7c in the dollar.

Two business days before the initial winding-up hearing, Willoughby Homes appointed David Mansfield and Jason Tracy of Deloitte’s turnaround and restructuring department as voluntary administrators. They successfully argued for the case to be adjourned until August 31. It was then adjourned again on Wednesday to give creditors the chance to vote on what to do next.

Willoughby Homes’ collapse comes after news.com.au conducted an extensive investigation and found the company has been non-functional for some time, with build sites stalling for as long as a year, the company’s home building insurance not being reinstated, staff not being paid and finally, all its offices being cleared out and phone lines going straight to voicemail.

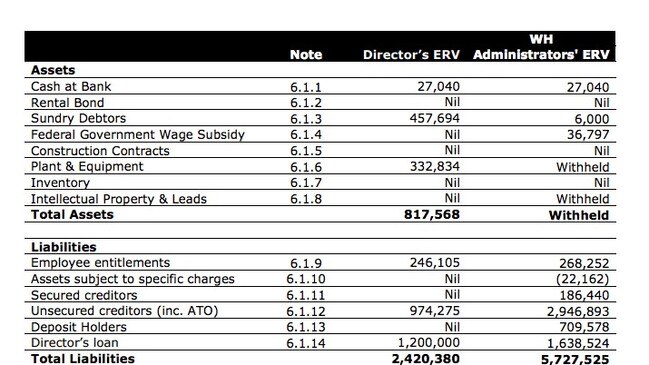

The construction company’s demise has impacted 57 customers with homes at varying stages of completion as well as other creditors who are cumulatively owed $5.7 million, according to the administrators’ report.

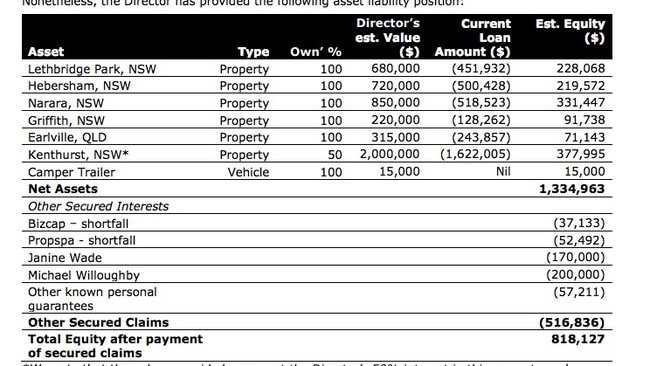

The director of Willoughby Homes, the eponymous Steve Willoughby, has put forward a Deed Of Company Arrangement (DOCA) proposing to sell seven of his properties and one camper trailer.

This would give the company $1.3 million in assets to distribute among creditors.

In an earlier statement to news.com.au, Mr Willoughby said: “Whilst I do not have an obligation to do so, I am proposing to creditors to sell properties that I have owned for 10 plus years.

“The economic climate has not been good for anyone.”

Without putting forward the director’s personal properties, Willoughby Homes would have only had $14,000 in the bank to disperse among all its creditors.

Mr Willoughby’s seven properties were from Lethbridge Park, Narara, Earlville, Griffith, Hebersham, Kenthurst and Harden, ranging from $220,000 to $2 million in value.

The Kenthurst property is the most valuable but half of it is owned by Mr Willoughby’s wife Rochelle and a large portion of it was bought through a loan.

However, once secured creditor claims are taken out of those funds, that leaves unsecured creditors with just $818,000. The administrators have also already racked up $250,000 in fees.

They estimated that creditors were left with between $409,063 and $654,501 from those assets.

In the Wednesday afternoon court hearing, QC Hugh Smith, representing the administrators, acknowledged that 1.7 cents and 5.7 cents to the dollar is “a small amount” but added that it was “better than nothing”.

The proposal is going to a vote next week, on September 5.

Administrators also found that Willoughby Homes had been trading insolvent for 18 months and had taken deposits from 41 customers even though they didn’t have the insurance to do so.

“It appears that Willoughby Homes may have been insolvent from at least 21 April 2021,” the administrator’s report stated.

April 21 was the day that state insurer iCare refused to renew the insurance for Willoughby Homes, which meant the builder was not able to start construction projects costing more than $20,000 as it would not be insured.

“Our investigations to date have identified 41 creditors totalling $709,578 who have paid deposits to the companies to construct their properties,” the report added.

“We are not aware of any of these deposits being covered under the HBCF (Home Building Compensation Fund).”

An earlier court case deemed that Willoughby Homes had been “hopelessly insolvent” and that the company had “failed so miserably”.

Mr Willoughby blamed the failure to obtain insurance as one of the main reasons for his company’s collapse, as well as Covid-prompted lockdowns, tough market conditions and increasing costs of materials and labour.

In a turn of good news, some customers are set to receive most of their money back for the deposits they paid.

The administrators said they would try to give the 41 deposit holders — those customers who paid a deposit but are not insured — “a priority” and that they would be “paid back 100 cents in the dollar”.

However, lawyer Rodney Kent, who represented another creditor, Kamaljit Pawar, said it was unfair for everyone else owed money.

“My client is as vulnerable as anybody else, all of their businesses are at risk of going under as well if they’re not paid,” Mr Kent said earlier this month.

Peter Fary, acting for Regno Trades and three supporting creditors, agreed.

“The priority here is quite extraordinary, on the one hand you’ve got 100c in the dollar”, and the other hand is 1.7c to the dollar, Mr Fary said.

Originally published as Boss of collapsed builder Willoughby Homes to sell all seven of his properties to pay company’s $5.7m debt