Business failures push more Australians into insolvency as cost of living and inflation hit

Cost of living and a crackdown on ATO tax debt are leading to a rapidly rising number of Australians filing personal insolvency claims as experts warn of a looming Christmas crisis.

Record business failures combined with mortgage and cost of living pressures are pushing a rapidly growing number of Australians to the brink, with personal insolvency claims soaring.

And more Australians are expected to declare bankruptcy in the run-up to Christmas as the cost-of-living crisis continues to bite and business failures trigger a ripple effect through the economy.

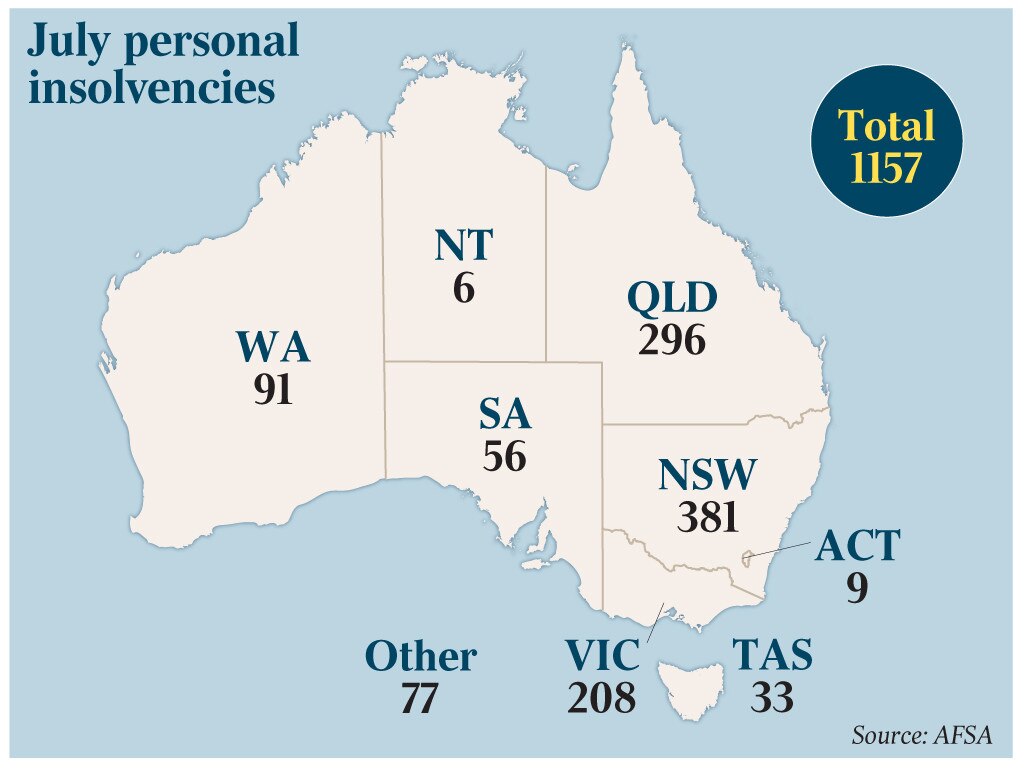

Data from the Australian Financial Security Authority (AFSA) show there were 1157 personal insolvencies in July, up 8.9 per cent from June and 25 per cent from the same period a year ago.

Throughout the period, 315 of those who entered a formal personal insolvency were also involved in a business, with that cohort making up 43.4 per cent of all bankruptcies in the month and more than half of all personal insolvency agreements.

Jirsch Sutherland partner Stewart Free said financial pressures including tax debt, the inability to raise further funds for businesses and strata debt had caused a spike in personal insolvencies, and the situation was likely to worsen in the period before and after Christmas.

He added that there had been an increase in small business restructuring filings as director penalty notices (DPNs) increased.

The Australian Taxation Office has been chasing unpaid tax, and issued 26,702 DPNs worth $4.4bn in the past financial year – a 50 per cent rise.

“DPNs aren’t just causing an increase in corporate insolvency and restructuring matters, it’s also leading to an increase in personal insolvencies – and there doesn’t appear to be any respite on the horizon,” Mr Free said. “When you couple increased DPN activity with the cost-of-living crisis and expenses like mortgage and strata payments, rent, grocery bills, school fees and motor vehicle running costs, it’s little wonder that Australian households are suffering significant financial pressure.”

The rise in personal insolvencies comes as Australia faces a business insolvency crisis, with the number of failures soaring this financial year as a growing number of hospitality businesses shut their doors, the victims of stretched household budgets.

Figures from the Australian Securities & Investments Commissions show that there have been 1864 insolvencies in the six weeks to August 18 – 45 per cent of the total number of insolvencies that occurred during the pandemic-stricken 2021 fiscal year. July saw 45 per cent more insolvencies than in July 2023 at 1238.

The rapid increase was driven by the hospitality sector, which surged 140 per cent in July to 249. A further 106 businesses have collapsed in the first two weeks of August.

Construction continued to make up the lion’s share of insolvencies with 328 appointments in July, but the rate of increase slowed to 11 per cent from a year ago, compared to 48 per cent between 2022 and 2023.

Ahead of the Turnaround Management Association national conference, Alvarez & Marshal partner Neil Hayward told The Weekend Australian that the hospitality sector was in strife as small operators faced fewer customers and a barrage of price rises from suppliers.

“Hospitality is impacted straight away from that reduction in consumer discretionary spending. That leads to personal insolvencies because hospitality is a hotbed of entrepreneurship and many use their mortgage or house as collateral to fund their business,” he said.

“When you’re not getting the footfall like what we are seeing and your costs are going up, you are in trouble. You put more of your household money into it until eventually there’s nothing left. And then the business goes into insolvency, but the personal insolvency follows.”

Credit reporting bureau CreditorWatch reports that thousands of private Australian businesses have failed in the past six months after defaulting on massive tax debts. Some 34 per cent of private businesses with debt to the tax office of more than $100,000 and more than 90 days in arrears – 7003 in total – have become insolvent or voluntarily closed in the six months.

CreditorWatch chief executive Patrick Coghlan said it was appropriate that the ATO ramped up its debt enforcement program with such a huge amount outstanding.

“The ATO is simply trying to collect the tax that all companies are obliged to pay,” he said.

“I truly sympathise with the situation that these businesses are in, with such a huge amount of tax owing, particularly in the current economic climate. A tax debt of $100,000 or more is a huge drag on a business, particularly SMEs.”

AFSA data show that personal insolvencies in the construction sector increased 17.4 per cent to 135, while healthcare and social assistance had a 47.2 per cent uplift to 131 and retail trade firmed 29.1 per cent to 102.

More Coverage

Originally published as Business failures push more Australians into insolvency as cost of living and inflation hit