‘Burnout economy’: Real consequences of RBA rate hike on ordinary Australians

With the RBA stinging mortgage holders again, there are widespread consequences for the economy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ANALYSIS

Australia is in per capita recession. This means that the average individual’s share of economic output is shrinking.

It is not a headline recession only because of rampant population growth, lifting aggregate output enough to prevent it.

But this comes with costs to the environment, public service provision and, most pressingly, access to housing.

Inflation to recession

The Albanese government has deliberately used tearaway mass immigration to suppress wages and lift house prices.

However, it has overcooked the strategy. The housing economy is experiencing a tremendous demand shock that is driving rents crazy.

House prices are following and have already begun to lift consumption via the wealth effect.

This was happening before the Reserve Bank of Australia finished squashing inflation.

Hence, the government is directly to blame for a resumption in interest rate rises.

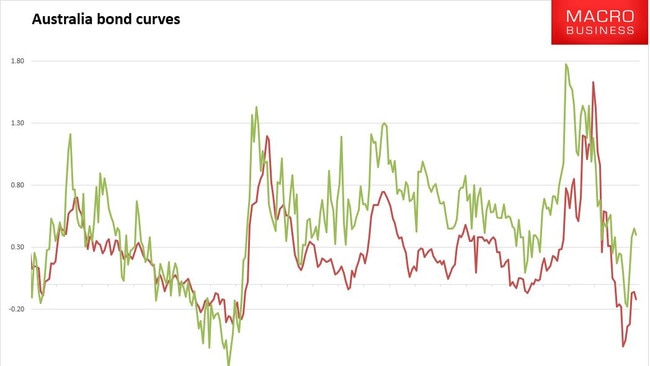

The bond market reaction speaks volumes. Near-term yields are higher than yields over five years.

This is called an inverted yield curve and is a classic signal of recession.

In Australia, inverted 1-year to 5-year yields usually accompany per capita recession.

The inversion of 2-year to 10-year yields is more predictive of outright recession. That curve did invert a few months ago but has steepened since.

What sort of recession?

Even after Tuesday’s interest rate hike, the bond market is not decisively forecasting a headline recession – more a continuation of the trend of worsening individual output.

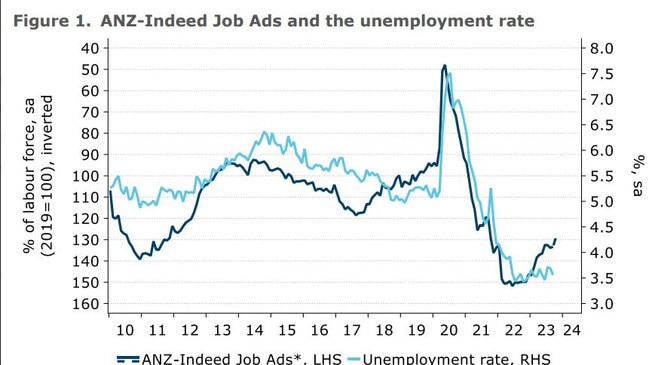

But, along with that intensifying per capita downtrend, the rate hike will trigger deeper falls in the number of jobs and force unemployment higher. It is already happening.

This will help slow house prices for a time as well. Weak Christmas consumption is guaranteed.

Unfortunately, it will also hurt dwelling construction, and more builders will go bust.

This will prevent a supply-side response from helping ease inflation.

Thus, we can’t rule out more rate hikes to address further rent and price rises, which is the madness of this government’s policy.

It is a ‘burnout economy’ in which the economic engine roars, but the brakes are on, and most Australians go nowhere while breathing toxic smoke.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as ‘Burnout economy’: Real consequences of RBA rate hike on ordinary Australians