Brisbane woman and Sydney man lose fortunes to ‘sophisticated’ scam

A Sydney man has been left hiding a life-changing secret from his wife, after he invested $80,000 only to find out his dream was actually a nightmare.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A group of sophisticated scammers has ruined the lives of two more Australians after stealing $150,000 and $80,000 from their latest two victims.

Including those most recent losses, the fraudsters have stolen at least $2.73 million that news.com.au knows of from eight Australian victims. The highest individual loss totalled $750,000 and even an accountant in his 40s fell for the con.

The cyber criminals have been operating two different schemes in Australia since at least February and now victims are speaking out in an attempt to warn others.

The scammers used legitimate business numbers confirmed by ASIC, employed receptionists to man phone lines, created complex website portals and paid back dividends to maintain the charade.

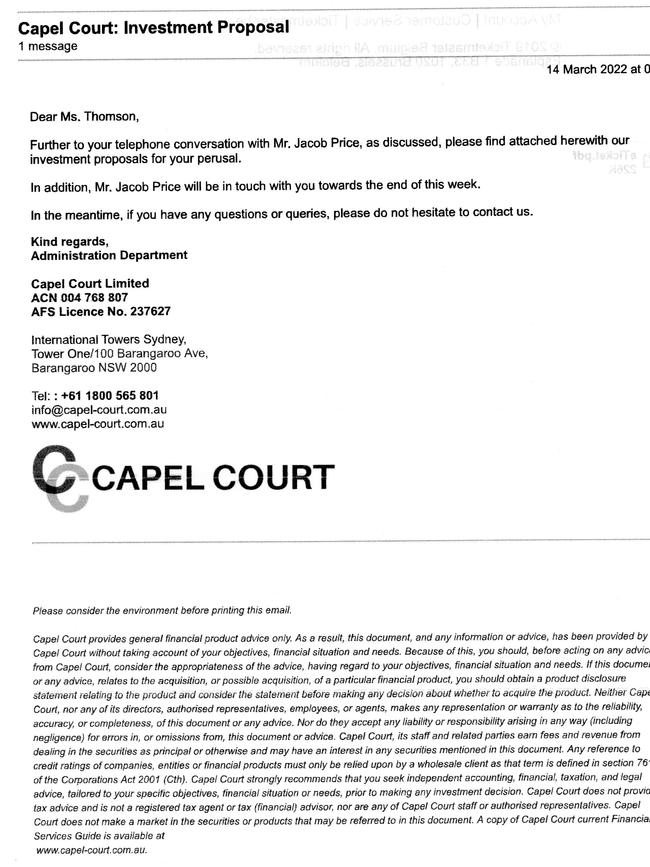

They impersonated two different companies – Capel Court and EQR Securities – which really are existing investment firms, although they have not operated for some time.

Janis Thomson, in her 60s, is now living in a sharehouse with her son and her son’s friend after she was tricked into handing over her $150,000 fortune.

Meanwhile, another man gave away $80,000, the sum total of his family’s life savings, and has yet to break the news to his wife that it all turned out to be a scam.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Ms Thomson, from Brisbane, said she was navigating a divorce from her partner and they sold their house, splitting the proceeds between them.

She found herself with $150,000 and wanted to invest it in a safe way.

“It was my half share of the house, I was looking for a better interest rate,” she told news.com.au.

“I came across Capel Court and I called them.”

Capel Court styled itself as an investment entity offering treasury bonds which had a 5.75 per cent return rate.

In March this year, Ms Thomson had a back-and-forth with a Capel Court representative who called himself Jacob Price.

This man is a recurring presence among all victims, using multiple aliases including David Jones, Stephen Jones, William Hughes, Ben Davis, Oliver James and Jacob Price.

“Every question I fired at him he had an answer,” she recalled.

She had no doubts: “None whatsoever. They were very professional, they took me in, usually I’m on the fence with a lot of things.”

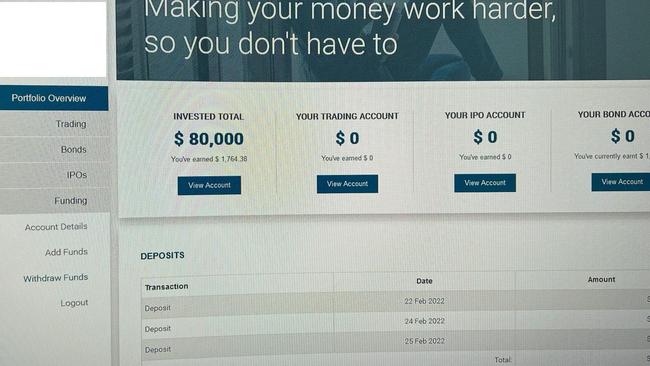

Unfortunately for her, the investment company was entirely fake. The scammers had created an elaborate website complete with a log in and internal portal.

There was an 1800 number and an office number as well as Jacob Price’s mobile number that she used to communicate.

Whenever she called the office or 1800 number, the phone was answered by a receptionist who told her that Jacob Price was in a meeting.

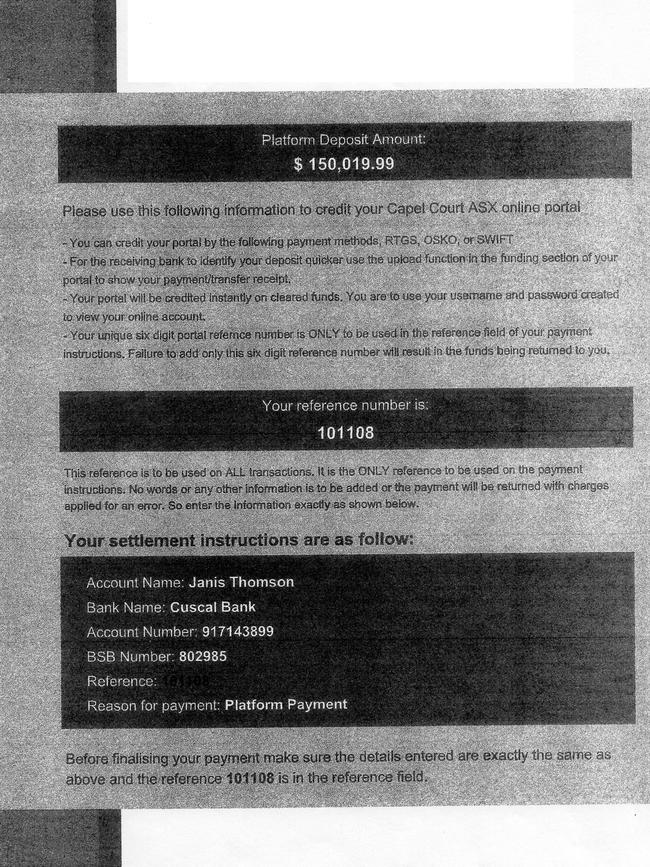

Ms Thomson finally transferred $150,000 to the scammers on March 25, in the belief she was buying Commonwealth Treasury Bonds.

She completed the transaction in “one lump sum payment” and went into her bank to do a teletransfer.

It was only months later, in July, when Ms Thomson realised something was not right.

Her dividend payment was due but nothing had come through, either in her bank account or via an email alert.

“I was overseas at the time it matured and I didn’t hear anything,” she said.

By then, news.com.au had already exposed the group and the website had been taken down. Her phone calls also went unanswered.

As she authorised the deposit, the money will not be compensated for by her bank.

“I’ve been retired for a while, I was going to use that as a deposit to buy a house for myself and my son,” she lamented.

In another blow, Ms Thomson is worried her identity will be stolen, because in order to set up her account, she had to verify her identity by providing her driver’s licence to the criminals.

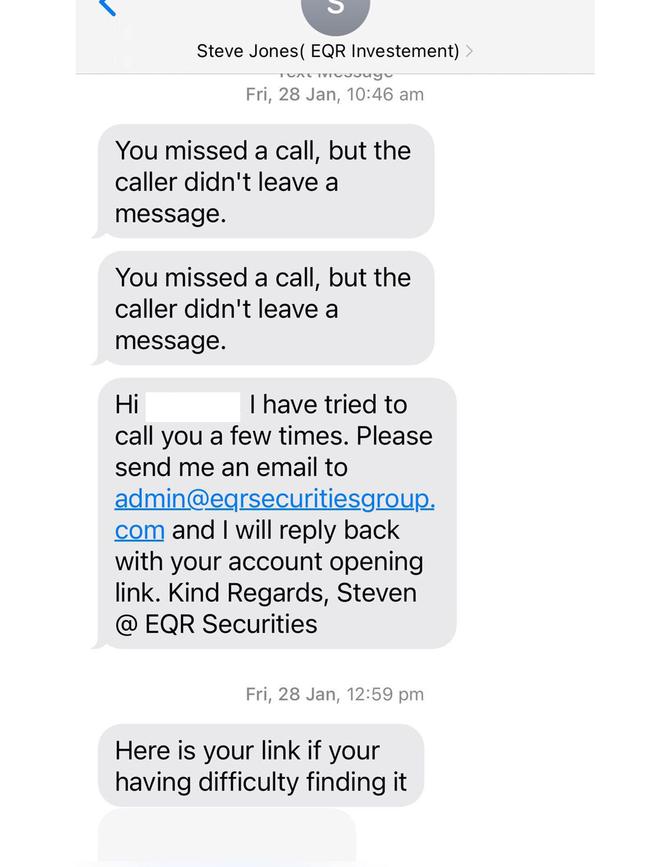

It wasn’t just her. Another person news.com.au spoke to, Jim*, was scammed out of $80,000 by the same group of people.

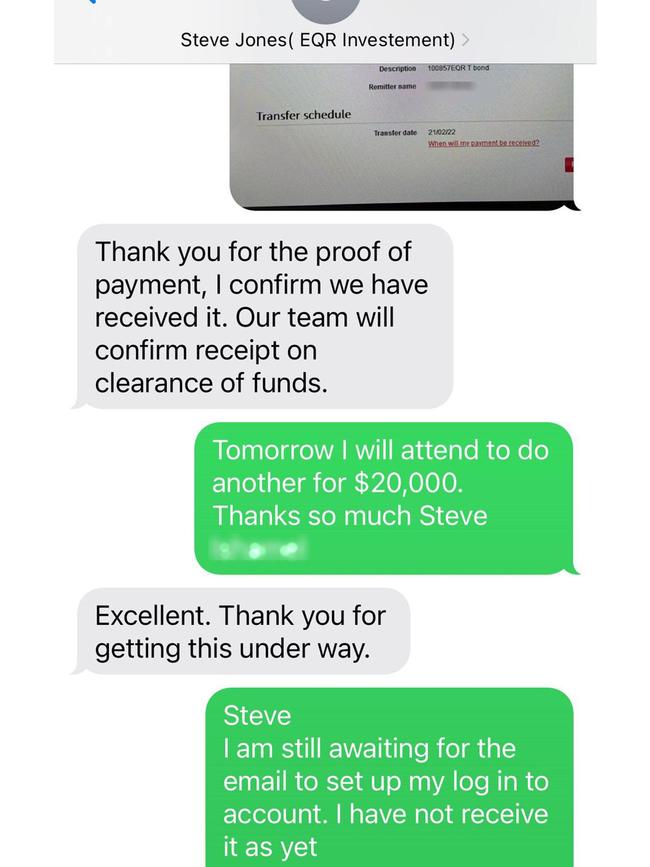

This time they posed as an investment platform called EQR Securities and his main point of contact was a man calling himself Stephen Jones, who had a “high class” English accent.

Jim, a 54-year-old from Sydney, set up his account with the company in February, transferring four instalments of $20,000.

Then in August, a friend suggested he buy some treasury bonds. When he told them he already had bonds and mentioned the name of the company, they warned him it was a scam.

“He said that I’ve been played, that’s when I got freaked out,” Jim told news.com.au.

He immediately tried to withdraw his money but to no avail.

And the worst part – he has yet to break the news to his wife that he has lost all of their money.

“I am shaking and I don’t even want to go home,” he said.

Since his initial conversation with news.com.au, he confirmed he had since broken the news to his wife.

Sadly, this is not the first time this scamming syndicate has duped Australians out of hundreds of thousands of dollars.

News.com.au has previously reported on this same group of scammers, who posed as Barclays and Macquarie Bank and EQR Securities.

They scammed one Melbourne man out of $700,000, a schoolteacher out of $500,000, a retired couple lost $200,000 and an accountant fell for it too, losing $160,000. A widow lost $250,000 while another widow $750,000.

In October last year, retired Queensland couple Antje and Bardhold Blecken had $200,000 stolen from them when they mistakenly believed they were investing in a Barclays Bank term deposit.

Then in March, Melbourne man Andy* thought he was investing $700,000 into bonds with Capel Court. It was fake and he lost his life savings.

Robert*, an accountant, also sank $160,000 into the fraudulent Capel Court group while NSW couple Jody and Corey Bridges lost $500,000 to the same scam.

Michelle Lowry transferred $750,000 to EQR Securities in December last year, which also turned out to be fake.

News.com.au can link these separate scam websites because the same aliases and mobile numbers were used by the fraudsters.

These particular scammers are fans of rapid payment platforms like Cuscal, Money Tech/Monoova and also cryptocurrency platforms including Binance, TechMarket AU/ED Australia and ElBaite. They have also used bank accounts through the Commonwealth Bank, ANZ, Citibank and NAB to channel money. It’s understood many of these accounts are under investigation.

A cyber security expert, Nick Savvides, told news.com.au these particular scams are “sophisticated” and “well-resourced”.

He believes it is likely they had a group of at least 20 people working together to steal large sums of money.

The money has probably ended up overseas and could be part of an organised crime gang.

alex.turner-cohen@news.com.au

Originally published as Brisbane woman and Sydney man lose fortunes to ‘sophisticated’ scam