Grocon doubles subsidiaries in administration to preserve cash for court battle with NSW government

Things have gone from bad to worse for collapsed construction group Grocon, with it placing dozens of its subsidiaries into administration.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Collapsed construction giant Grocon has placed dozens more of its subsidiaries into administration, saying it needed to take the dramatic step to preserve cash for its bitter court battle with the NSW government.

In late November, 39 Grocon companies were placed in the hands of KordaMentha and a further three were added the following month.

An additional 45 specific-purpose subsidiaries – many of which appear to have been dormant for some time – joined the list on Monday, leaving the administrators combing through the accounts of twice as many companies as when it started.

The latest appointments include Grocon Group Holdings Pty Ltd, which is one of the three companies embroiled in litigation with the NSW government over the Central Barangaroo project in Sydney, dominated by Crown Resorts’ new casino.

Grocon blames its collapse on that development, alleging rival Lendlease and Crown Resorts reached a secret deal with Infrastructure NSW on building heights in 2019, protecting the rights of Crown tower – Sydney’s tallest building – to unobstructed views of the harbour.

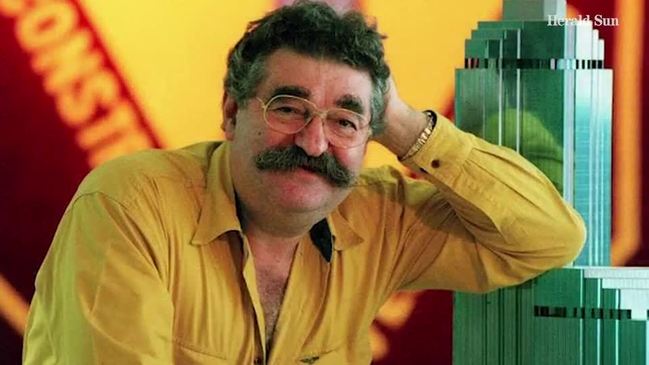

Grocon chief executive Daniel Grollo alleges that scuppered his group’s plans to build much smaller commercial and residential towers nearby, and he is seeking compensation in the NSW Supreme Court.

KordaMentha Restructuring’s Andrew Knight said in a brief statement the future of all 87 Grocon companies in administration would be decided at the second meeting of creditors to be held before the end of next month.

“We are advised that no further entities are expected to enter administration and that a deed of company arrangement will be proposed to include all 87 Grocon companies,” Mr Knight said.

Administrators will recommend to investors whether they should back a restructuring attempt to keep the group afloat, liquidate it or – and this is far less likely – return it to the directors’ control.

Mr Grollo described himself as “disappointed but determined” in a statement, saying it was necessary to place the additional subsidiaries in administration to prepare for a protracted court battle with the NSW government.

“Sadly, there is a human toll to this action with 20 staff no longer employed,” he said.

“I didn’t want it to come to this, but I have had to accept the fact that iNSW would rather put Grocon out of business than take responsibility for its actions.

“We need to focus on winning the court proceedings so we can compensate the group and its creditors.

“But to achieve this, we have to close down most parts of the legacy Grocon construction business to avoid financial resources being allocated away from this fight.”

Some Grocon subsidiaries are not in administration, but the 87 subsidiaries that are – tangled in interlocking relationships and related-party loans – comprise the vast majority of the group.

Media reports emerged last month outlining the complaints of a particularly disgruntled investor, Impact Investment Group, which says it was forced to terminate Grocon as developer and builder of the stalled Northumberland office tower in Melbourne’s Collingwood late last year.

Impact said it had been asked to foot the bill for cost overruns, and some frustrated subcontractors refused to return to site.

Mr Grollo’s grandfather Luigi founded Grocon in 1954.

It has built major CBD office and residential towers and was pushing into the burgeoning build-to-rent sector.

Originally published as Grocon doubles subsidiaries in administration to preserve cash for court battle with NSW government