Barefoot Investor warns couple who ‘made $11,400 profit’ that they’ve been scammed

An Aussie couple think they’ve made ‘$11,400 profit’ trading online but Barefoot has bad news - they’ve been hooked by scammers chasing their prized superannuation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

I was in at the ABC the other day when a young Gen Z bloke who worked there (whose hairdo made him look like one of my alpacas) nailed me with a killer question:

“If the economy is so screwed … why is the share market at all-time highs?”

Great question!

He’s dead right, of course. For most people the economy is ‘stuffed’. And it’s not just a feeling. Over the last year household incomes in Australia have dropped by more than in almost any other country in the world.

Yet, while our politicians are busy flogging the supermarkets with their own $20-a-kilo lettuce leaves, it’s not making much of a difference. Prices keep going up.

It’s shocking, and depressing … and yet it does beg the question:

Does the share market know something about the future that we don’t?

Nehhhy … spits Pedro the alpaca.

In fact, the share market has predicted nine out of the last two recessions!

Seriously, though, the question of why the share market is at record highs right now has a long answer.

(Interest rates coming down? Donald Trump going up? Artificial intelligence replacing us all? Who the heck knows? Not this alpaca farmer.)

Yet the short answer is actually pretty darn simple:

Shares mostly go up.

That’s right. Most years shares go up. That’s because the share market is really just a collection of businesses that make a lot of money and compound it over time.

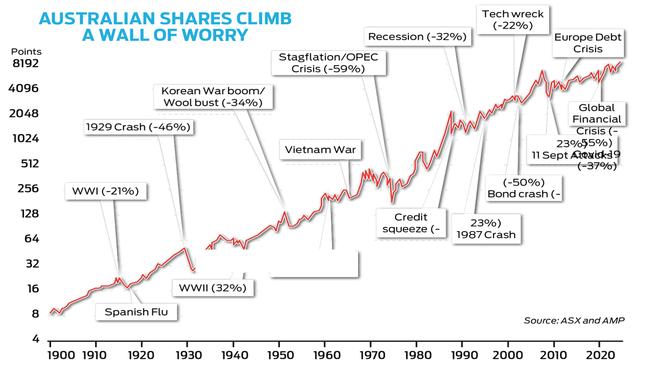

The chart below tells the story.

The other thing you should know is that the term ‘record highs’ is a newspaper headline writer’s best friend: each day the share market goes up by even a point, it’s a new record high! The next day it may dribble up another couple of points. Another record high!

Now it is true that the share market occasionally crashes (though no-one can accurately predict when it will happen). Yet, as the chart shows, shares always recover.

That’s why I told the ABC kid the same thing I tell everyone:

Follow the Barefoot Steps, and become an investor.

Just don’t wait for the alpaca-lypse!

Tread Your Own Path!

The future Olympian

Hi Scott,

I’m a 19-year-old athlete training for a qualification spot in the LA 2028 Olympics. Since finishing school, I’ve been working a full-time job to pay for all the training, competitions, overseas travel and extra expenses that come with being an athlete. Recently, I’ve been getting frustrated with the numbers. I can always just pay for all the expenses, but I never seem to get anywhere financially. The tough call is that any extra time I choose to work means less time for training, and vice versa. I’d love to eventually start saving for a house or maybe uni. Any advice?

Kayla

Hi Kayla

Do you know how rare it is to have a single, driving goal that gets you out of bed each morning?

That’s gold (or silver, bronze or, heck, just the absolute honour of competing for your country)!

What I like about where you’re currently at is that it’s finite: you either get there in 2028 or you don’t, and you move on with your life.

Look, life isn’t about accumulating as much money as possible, it’s about creating memories. And you’re currently working on something that, when you’re sitting in an aged care facility in sixty years’ time, will be one of your most cherished memories.

The main thing to focus on is not going backward financially. As long as you can keep your head above water, you should go all in for the next four years. Then, if you apply the same steely dedication to your post-athletic career, education and financial situation, you’ll have nothing to worry about.

Follow your dream.

We’ve all made $11,400 profit in four months

Hi Scott,

My husband and I recently started trading CFDs (Contracts for Difference) online with a company. We started with $500 thinking that “if it’s a scam, we’ll only lose $500”. We talk to one of their brokers (who is in Switzerland) a few times a week and it’s going very well (we’ve ‘made’ $A11,400 profit in four months). We have done a withdrawal of $100 to see if we have ready access to the money, and it came through with no problems at all.

The broker is now asking us to invest more money – up to $US100,000 ($A152,360). We don’t have that kind of money, so he has suggested we set up an SMSF and invest some of our super. We always seem to miss the boat on financial opportunities, so I wanted to get your view on whether we should do it.

Rick

Hi Rick,

Somewhere – probably in a compound in Laos – your name is written on a whiteboard.

These scammers have got you on the hook … and now they’re attempting to reel you in.

The big barramundi for them is your superannuation. They plan on stealing every last cent of it and leaving you with absolutely nothing.

This happens to a trusting, unsuspecting Aussie every single day.

My advice?

Contact IDCare (idcare.org, 1800 595 160) and tell them you’ve been scammed.

Why would you do this?

Because here’s the thing that most crooks have worked out: the best people to scam are those who have already been scammed.

That’s you!

So don’t let it keep happening. IDCare will help you safeguard your identity online, and hopefully ensure your name doesn’t appear on any more whiteboards.

The Barefoot confession

Hi Scott,

I used to be a sucker for personal development. I was always taken by the idea of the freedom that would come with the ‘laptop lifestyle’. Over seven years I spent over $100,000 in course fees and coaching programs and amassed $50,000 in personal loans. Bye-bye house deposit! I ended up working on the side as well, holding down three jobs to feed my course junkie addiction.

It wasn’t until I met my partner that I realised that I was the product, and that it was just another variant of an MLM scheme. So, over the past three years I’ve followed your steps and paid off my debt, and now I have $50,000 in my savings – slowly on the way to a 20 per cent house deposit! I am so proud of getting back on track, and I feel I am finally free of those who preyed on my insecurities and desires to make themselves wealthy. I’ll be forever grateful for your level-headed path to true freedom, and better relationships too.

Thanks for the confessional, and thanks for your work.

Lisa

Hey Lisa

As Dr. Phil says, thank you for sharing.

Your story reminded me of one of the oldest and most famous tales from self-development, called Acres of Diamonds. It was written in the late 1880s, and it tells the story of a farmer who sells his land and goes searching for diamonds. The new owner discovers a diamond mine on that same land. The moral of the story is that wealth and success is in our own backyard. You’ve proven that.

Shine on you crazy diamond.

You Got This!

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as Barefoot Investor warns couple who ‘made $11,400 profit’ that they’ve been scammed