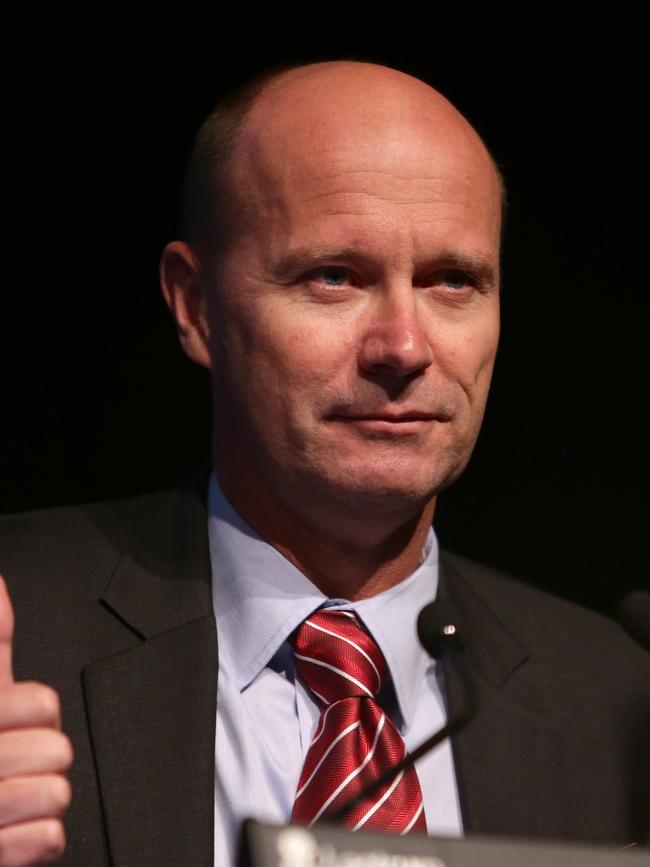

ASIC chair Joe Longo readies regulator for fight over big super

The corporate regulator is gearing for a fresh fight with the poorly governed and complacent superannuation industry.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s corporate watchdog has warned the nation’s $4 trillion superannuation industry faces a crackdown in 2025, accusing management and directors of complacency in outsourcing work amid concern over the poor handling of customer claims.

Industry giant Cbus was plunged into crisis last year after the Australian Securities & Investments Commission alleged it had mishandled up to $20m in death and disability payments.

Cbus chief executive Kristian Fok blamed a payment delay on the Japanese-owned company the industry superannuation fund had outsourced to administer claims.

But ASIC has issued a fresh alert to the booming sector, with chairman Joe Longo warning big super had become complacent in the face of guaranteed inflows of cash.

“You can’t delegate away your fundamental responsibilities,” Mr Longo told The Weekend Australian.

The ASIC chair noted super funds had been “extremely successful at accumulation of assets and in fairness there has been some good returns”, but Mr Longo cautioned there had been too much focus on one side of the ledger to the detriment of paying claims and providing services to members.

“There have been pockets of progress, but as a generalisation it just hasn’t been good enough,” he said.

“There has been a complacency and there has been an under investment.

“You can expect us to be active on directors’ duties and governance issues.”

ASIC will also turn its focus to burgeoning private markets and unlisted assets, which have grown to capture large parts of superannuation holdings.

The regulator is preparing to release a landmark report into the sector in late February.

“All Australians should be interested in what’s going on there and our private-public markets,” Mr Longo said. “Our private, public markets paper will go some way to shining a light on it.”

The issue of valuations in private markets has piqued the interest of regulators, given limited transparency from some investment firms.

ANZ is also in the regulator’s sights, with The Australian revealing ASIC is probing the banking major’s charging of fees to dead customers, as well as potential issues with the accrual of interest on savings accounts and hardship application handling.

Mr Longo also warns ASIC “will continue to be very active” in both banking and insurance, with investigations and court cases aplenty.

Already ASIC has taken aim at insurance giants IAG and QBE over failures to actually apply discounts they had spruiked to customers.

Mr Longo said ASIC was acutely concerned with the insurance sector’s claims handling as well the need for transparency after massive policy cost increases over recent years.

“Consumers want to understand it. They want to know, why are they paying increased premiums?” he said.

At 65, the ASIC chair is nearing the end of his five-year term at the top, but the activity out of the watchdog shows no sign of slowing its frenetic pace, after a rush of activity in the last months of 2024.

Mr Longo heads up Australia’s business enforcement agency, which is charged with policing financial crime, among a wealth of other responsibilities.

The veteran lawyer with more than 38 years experience in corporate law, is showing no signs of slowing down as he nears the end of his term, having taken ASIC’s top job in June 2021.

Many ASIC watchers note Mr Longo looks like a man gunning for a second term at the top of the corporate regulator, but the Perth-born son of a green grocer, now ensconced in Melbourne’s eastern suburbs, declines to be drawn on if he wants to steer the commission for another five years.

When asked, Mr Longo notes the journey at the regulator over the past four years, with a major restructure of its functions wrapped up and efforts underway to modernise the internal system of the agency.

“As far as my future is concerned, I’m totally focused on the job as it is,” he said.

A transformation of ASIC, Mr Longo says, is far from finished, with the regulator cautioning the investment in the agency’s “digital transformation” through both its data and systems would affect its enforcement output.

“The ASIC that I inherited is very different to the ASIC of today,” Mr Longo said.

“The ASIC of June ’21 had a number of internal issues that the agency was grappling with that had an impact on all levels.”

Mr Longo says he won’t “go into it, in any detailed sort of on the record way”, but the ASIC boss is clearly conscious of the chaos surrounding the corporate regulator in the early days of his tenure at the top.

Having emerged from an internecine war between its past chair James Shipton and former deputy Karen Chester, ASIC was a regulator still marred by the chaos of those years.

Mr Longo says ASIC is now “renewed”, with a suite of fresh commissioners and a new chief executive, poached from a rival regulator, set to start in March.

ASIC announced Australian Competition and Consumer Commission CEO Scott Gregson had been appointed to the top job, replacing interim chief Greg Yanco, who stepped into the role after the departure of Warren Day last year.

‘Any fair-minded observer can see that our enforcement record continues to go from strength to strength’

Joe Longo, ASIC chair

Mr Longo said he was focused on bedding down and consolidating ASIC as an “ambitious regulator”.

He points to the regulator’s record, noting the agency was “in court literally every day of the year”.

However, the regulator has faced criticism over its record, with observers pointing to a failure to take on many of the matters referred to ASIC by liquidators or other agencies.

“Any fair-minded observer can see that our enforcement record continues to go from strength to strength,” Mr Longo said.

But he nods to the critique of the regulator’s record, citing a 20 per cent rise in the agency’s investigations and court cases.

He also notes ASIC’s regulatory work outside the courtroom, pointing to its recent work on hardship that saw Australia’s banks scrutinised over their handling of cries for help from borrowers.

Some of this work has gone on to inform ASIC’s enforcement efforts, with both NAB and Westpac in the firing line over their handling of hardships.

Australia’s cyber resilience is also a focus for ASIC, with Mr Longo noting the regulator was looking at several companies over their handling of breaches and protection of data.

Mr Longo, who sits on the board of financial regulators peak body IOSCO, said ASIC was looking to step up its international engagement in response to the Trump ascendancy in the United States.

Pointing to the crypto sector, after ASIC recently caused a stir late last year in an intervention calling for a largely licenced landscape, Mr Longo said Australia could present an attractive market to companies keen for a standardised approach as opposed to the United States’ highly fragmented regulatory landscape.

Mr Longo is also faced with the potential politicisation of ASIC, after a highly critical report into the regulatory agency was published by Liberal Senator Andrew Bragg last year.

Senator Bragg recommended ASIC be split into two agencies, amid criticism of the regulator’s enforcement record

Mr Longo said he didn’t “think there’s any appetite at all to run with” much of the recommendations from Senator Bragg’s report.

Originally published as ASIC chair Joe Longo readies regulator for fight over big super