Ex-air hostess makes claim for son to Sydney stockbroker’s $180m fortune

A former air hostess who had a child with a Sydney stockbroker is planning to lodge a claim for a slice of his multimillion-dollar fortune on her son’s behalf.

Police & Courts

Don't miss out on the headlines from Police & Courts. Followed categories will be added to My News.

A former air hostess who had a child with a Sydney stockbroking baron has come forward wanting to lay a claim to a slice of his $180 million fortune on behalf of her son.

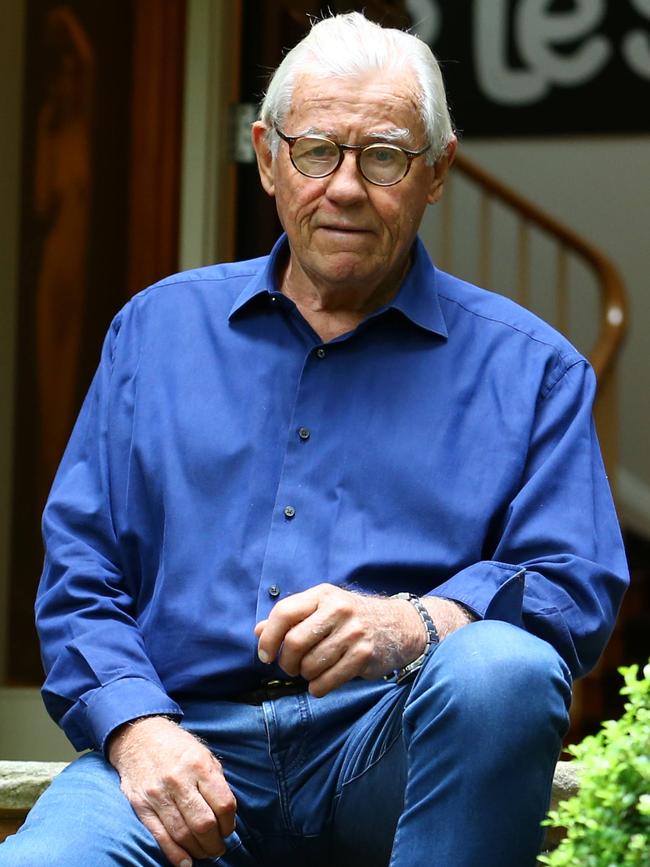

Bell Financial Group founder Colin Bell, 80, died in Sydney in March 2022 and left behind an “extremely large” estate that a court heard could be worth up to $180m and also include part ownership of a 40-metre superyacht, The Southern Cloud.

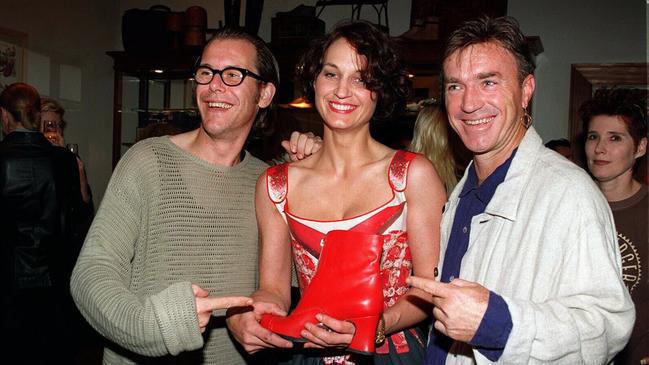

He had broken up with his current wife, international shoe designer Donna May Bolinger, in 2020 before his death.

The NSW Supreme Court recently heard a woman called Gina Agathopoulos, a former air hostess who had a relationship with Mr Bell between 2008 and 2010, launched proceedings for a family provision order on behalf of her son, who she had with Mr Bell when he was 69 in 2010.

The court was told that Mr Bell had been making fortnightly payments of about $3000 to support the boy along with paying his school fees before his death.

In a 2015 will Mr Bell, who married four times, left the vast majority of his estate to his two adult children, Ned Bell and Kate Perkins, who he had with former wives, and to his adult stepchild, Sophie Balderstone.

Ned Bell is now chief investment officer of Bell Asset Management.

Mr Bell also stated in the 2015 will he would put $2m in a trust that his youngest son could have when he turned 25 – meaning the money would not be accessible until 2035.

In court documents Ned Bell has stated the boy would be entitled to a share in the estate, as a child of Mr Bell, or that he would be the sole beneficiary of the $2 million trust.

The court heard Ms Bolinger also has an adult son, who does not work or receive any government support, who may also launch proceedings seeking a family provision order before the timeline for him being able to do so expires in March 2023.

Originally from Melbourne, Mr Bell was one of Australia’s highest-profile stockbrokers.

In 1970 he founded Bell Commodities, which transformed into the widely successful Bell Potter. It was the country’s biggest private client stockbroking firm in the early 2000s.

Bell Potter later changed to Bell Financial, an ASX-listed company.

Mr Bell suffered from ill health in his final years.

In March 2018 he suffered a stroke, the NSW Supreme Court was told.

The court heard Mr Bell then had a serious seizure in August 2019, from when he required regular assistance with daily living.

When he died Bell Potter’s chairman, Alastair Provan, said in an email that Mr Bell was a strong leader.

“As the founder of our company Colin’s enthusiasm, passion and vision has been, for the last 50 years, the driving force behind the growth and success of what started out as Option Investments, became C, A & L Bell Commodities Corporation Pty Ltd, and is now Bell Financial Group,” he wrote.

“The same passion, tenacity, and long-term belief has also been behind the success of Bell Asset Management.

“With Colin’s passing we lose a great friend, colleague and leader. His extraordinary presence, business acumen, friendship, and unique ability to blend unwavering drive, sense of fair play and fun will be very sorely missed.”