Federal Government under pressure to strip churches of tax benefits

Tens of thousands of Aussies have signed a petition calling on the federal government to overhaul the tax exemptions churches get.

Faith On Trial

Don't miss out on the headlines from Faith On Trial. Followed categories will be added to My News.

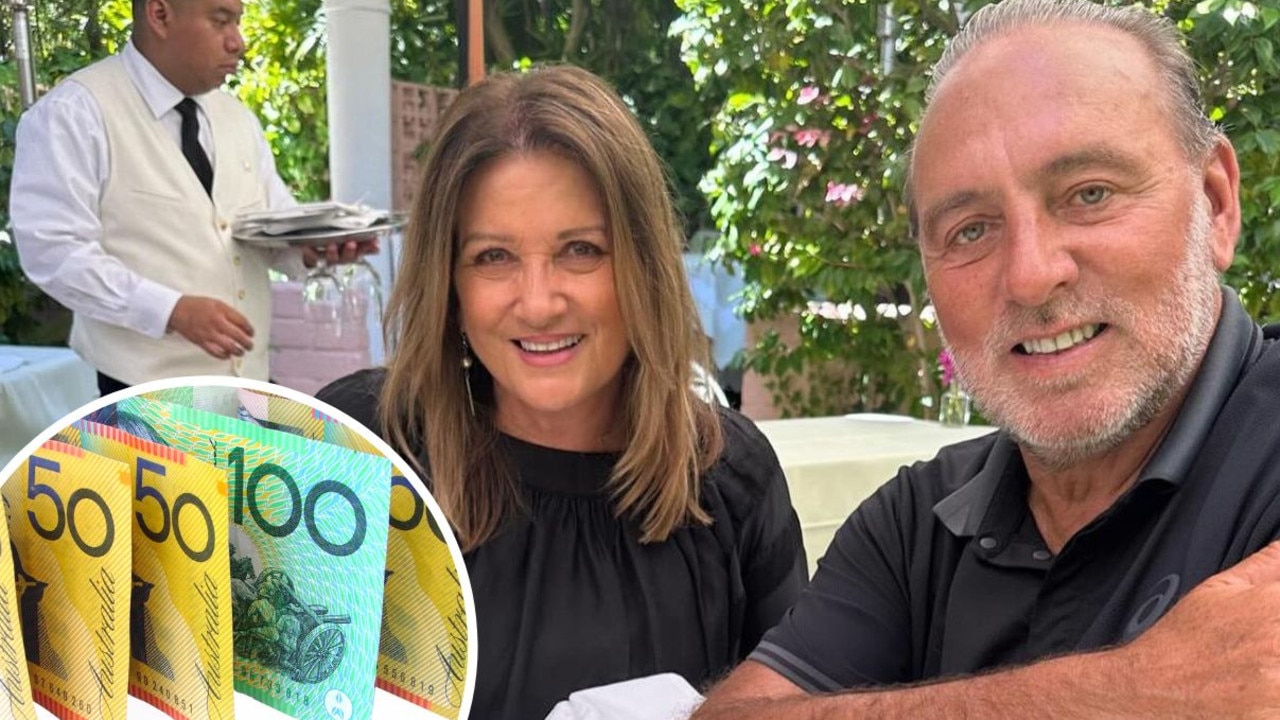

The federal government is under pressure to strip churches, including Hillsong, of their tax exemption status after the mega church allegedly engaged in money laundering.

More than 19,000 people have signed a change.org petition, which states “Tax-free financial rorting is rife in Australia’s churches: their TAX-FREE status must be revoked”.

“Combined churches make a truckload of cash every year – more than $30 billion. The Catholic Church owns half of that,” the petition blurb reads.

“These mega churches are handled more like investment banks, employing financial experts whose job is to make the churches even more money. And everything they make is tax free.”

The petition touches on the “trauma and pain” churches have contributed to, such as child sexual abuse.

“Why do these massive institutions continue to get tax privileges when they abuse our trust so shamefully? Tax privileges should be earned, and not be an automatic right,” the petition blurb reads.

It comes as News Corp’s Faith on Trial podcast looks at how Hillsong became so powerful – exposing disturbing claims of worker exploitation, complicated consensual sexual relationships and a culture where women are allegedly told to physically submit to their husbands.

LISTEN TO THE FAITH ON TRIAL PODCAST

Comments on the petition page give an indication as to how strongly people feel about the issue of tax where charities and churches are concerned.

“Charities run by churches are no long Charities (sic) they’re big businesses with … fat salaries. They should pay tax like the rest of us. No more tax evasion for everyone!,” one person commented.

“I believe all churches should be like any other business and pay their taxes,” wrote another.

“Churches need to be accountable to the greater good. The current system is too easy to exploit for wealth gain,” said another.

The Australian Charities and Not-for-profits Commission, which has the power to strip Hillsong of its tax-free status, has announced it was investigating the megachurch’s finances.

Hillsong College is also under investigation by education watchdog Australian Skills Quality Authority, which could result in a suspension of its registration to run courses.

A spokesperson for the Australian Charities and Not-for-Profits Commission said: “As the regulator, the ACNC administers laws and regulations. Any change to policy impacting charities is a matter for government.”

Assistant Minister for Competition, Charities and Treasury Andrew Leigh said: “Religion has long been accepted as a charitable purpose”.

“Comparable international jurisdictions, including the United Kingdom, the United States, and New Zealand also consider religion a charitable purpose, and provide tax concessions to religious bodies,” he said.

“I encourage anyone wishing to participate in a national conversation on charitable tax settings to engage with the Productivity Commission’s current inquiry into charitable giving in Australia.”