Sydney home prices rise for third straight month signalling ‘recovery stage’ says PropTrack’s monthly Home Price Index

Signs of a real estate recovery are getting stronger as Sydney records its third straight rise in home prices ahead of the RBA’s seismic decision on interest rates.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

House prices across Sydney have lifted for the third month running, pointing to strong signs of a recovery in the market.

PropTrack’s monthly Home Price Index has revealed a reverse in the string of house price declines from 2022 due to the limited supply of houses on the market and strong demand.

It comes ahead of the Reserve Bank of Australia’s (RBA) decision on interest rates expected next week, with economists pointing to another rise.

Sydney’s house prices rose by 0.27 per cent in March, following a jump of 0.36 per cent in February and 0.26 per cent in January.

MORE:

Why homeowners need a ‘Plan B’ right now

Airbnb savaged over ‘role’ in housing crisis

‘Fairytale’ castle by the coast shocks buyers

“Sydney has seen the greatest lift in values of the capital city markets, rising 1.01 per cent as limited supply underpins prices,” PropTrack senior economist and report author Eleanor Creagh said.

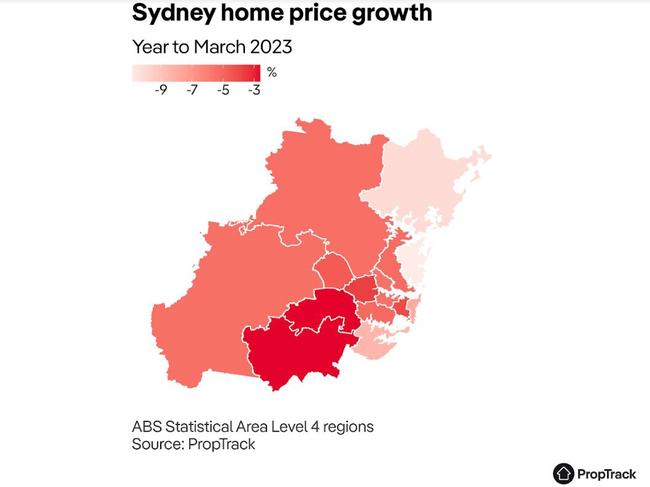

Over 2022, Sydney recorded the largest drop in house prices with the median price falling by 7.19 per cent.

Ms Creagh pointed to a likely interest rate rise next week, with inflation remaining above the Reserve Bank’s target range and the rise in employment rates.

“This is giving the RBA headroom to further raise the cash rate next week,” she said.

“But it’s a close call and the end of interest rate rises is in sight, whether the Reserve Bank pause this month or next.

“If the RBA does lift the cash rate next week by 25bp, it will be the 11th consecutive hike, bringing the cash rate to 3.85 per cent, its highest level since April 2012.”

Ray White chief economist Nerida Conisbee said the rise in house prices indicated the Sydney market was “well and truly at the start of a recovery”.

“In January and February we were a little bit uncertain whether it was just a one off,” she said.

“It has become a lot more expensive to borrow, cost of finance has increased and it’s really hard to get loans.

“But at the same time, we’ve seen this incredible level of population growth and there’s not many properties for sale. All of those things have led to a balancing out of the market.”

Ms Conisbee said once interest rates peak, the market would respond with further house price growths.

MORE:

Wham! George Michael’s Aussie getaway smashes records

F45 founder’s big sell off to fund dream home

‘James Packer effect’ reaps $1bn+ in Barangaroo sales

“There’s a lot going on which suggests now is the time to buy,” she said.

“It’s always best to buy at the lowest point in the market … it does seem to be the case that it is about now.

“The problem is there’s not much for sale so hopefully now that the market is turning we will start to see more properties come to market.”

My Housing Market chief economist Dr Andrew Wilson also pointed to the “recovery stage”.

“Looks like the Sydney market has turned the corner, we can say February wasn’t a blip,” he said.

Mr Wilson said there were no surprises Sydney was leading the capital cities due to its strong economy, housing demand, record low unemployment and surge in migration.

“One of the drivers of the market will be that perception that it is a good time to buy,” he said.

“With prices starting to grow it might start to encourage that little bit of fear of missing out energy.”

Mr Wilson said the price rise wasn’t surprising with confidence from the auction market.

“The Sydney weekend auction market been up and running this year, we’ve seen clearance rates continuing to hover a little bit above the 70 per cent mark which is the highest again in a year,” he said.

Ms Creagh said the “tightening” from interest rate rises over a short period was weighing on households.

“It takes time for higher interest rates to fully impact household cash flows,” she said.

“As such, it is expected that consumer spending will slow sharply over the coming months as the lagged impact of rate rises already delivered takes effect.

“This is leading some to speculate that an earlier pause is on the cards in April, giving the RBA more time to assess the full impact of rate rises already delivered on households, businesses, and economic conditions.”