Property finance: fixed home loans are probably a bad deal right now

Rushing to rearrange your mortgage as fixed rates start falling can be dangerous to your future wealth. Here’s why.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Hundreds of mortgage fixed rates have been cut by lenders in recent weeks as forecasts firm for a Reserve Bank of Australia interest rate cut within six months.

Some fixed rates are now under 5.6 per cent across one, two, three, four and five-year terms, and it may seem tempting for borrowers to lock in now – particularly as many pay between 6.5 and 7.5 per cent on their variable-rate loans.

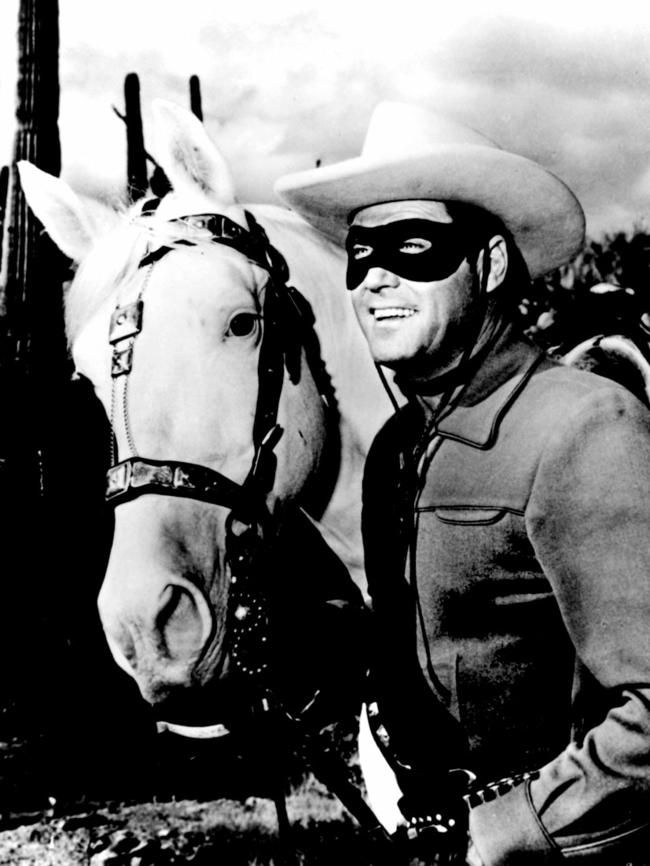

However, to borrow words from classic TV series the Lone Ranger (not to be confused with the loan arranger): “whoa there Kemosabe!”.

Anyone considering galloping into these lower fixed rates right now risks a pile of regret down the track.

That’s because many lenders are offering these lower interest rates because there’s a chance they’ll make some good money out of borrowers who lock in now, just before a likely string of rate cuts for variable loans.

Interest rates already have started falling overseas as central banks aim to ease pressure on indebted households and businesses. Australia’s RBA is likely to be among the last to reduce rates, because it was one of the last to lift them back in 2022 and has not gone as high as other countries have.

If you lock in a multi-year fixed-rate home loan now at a nice rate below 6 per cent, you may be ahead financially for several months while basic variable rates hover around 6.5 per cent. But when the RBA eventually follows other countries on a rate-cutting cycle, it only needs to cut two or three times before variable rates become better value for money than fixed rates.

The RBA’s cash rate has climbed 4.2 percentage points since May 2022, and while most forecasters don’t expect it to drop to anywhere near the 0.1 per cent level it was during the pandemic, there’s every chance that we will see more than three rate cuts over the coming year.

Our economy is weak – it’s been going backwards on a per-person basis – and the 13 RBA rate rises in the past couple of years are pushing up insolvencies, mortgage arrears and piling extreme pressure onto household budgets.

I personally got caught by the fixed-rate trap a couple of decades ago, when I locked into a three-year fixed-rate mortgage right before RBA rate cuts began. I was unnecessarily paying more than I needed to for those three years, and couldn’t get out of the fixed loans because break fees made the cost prohibitive.

While the Lone Ranger’s famous stallion, Silver, was described as “a fiery horse with the speed of light”, there’s no reason for most of us to rush into fixing right now.

And while on the topic of Western heroes, do yourself a favour and listen to the Lone Ranger theme song online today. The catchy tune was actually the William Tell Overture, and I guarantee if you hear it you’ll want to pick up a broom or mop and gallop around the house. Or is that just me?

More Coverage

Originally published as Property finance: fixed home loans are probably a bad deal right now