‘Reckless’ Federal Government spending ‘to increase mortgage payments by $3,088 per year’

All Aussie households with a mortgage are set to get hit with more than $3k per year more of costs as a result of the Federal Budget according to a shock new study.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Mortgage payments could be driven up another $3000 per year due to government spending, according to the Institute of Public Affairs (IPA).

The IPA claim that Federal Government spending will drive up mortgage payments via inflation, and has called on the Treasurer to cut spending ahead of this week’s Budget to be handed down on Tuesday.

“Forecast increases in Federal Government spending will drive inflation higher, causing average mortgage repayments to increase by over $3,000 per annum, for the next three years,” IPA’s deputy executive director Daniel Wild said.

MORE

‘Labour of love’: epic home reno spans four generations

NRL fans chance buy hotel near team’s HQ

Values doubled in 3 years: Sydney’s luckiest homebuyers

IPA has released economic research, titled Australia’s Spending Crisis, revealing that Federal Government spending from last year’s October Budget will cause average household mortgage repayments to rise by $257 per month, or $3088 per annum, for the next three years.

“Australia is in the midst of a cost-of-living crisis with basic household goods and energy bills rising beyond the means of too many Australians,” Mr Wild said.

“The Treasurer must cut spending in this week’s federal budget if we have any hope of fixing runaway inflation and household costs.”

He said federal spending, estimated to rise by at least 4.6 per cent per annum, could push Australia’s inflation rate up a further 1.6 percentage points over the next three years.

“Reckless levels of government spending are the root cause of Australia’s current high inflation rate, and it is households and businesses that get left with the bill,” Mr Wild said.

“Governments at all levels must exercise responsible economic leadership through fiscal discipline.

“The Federal Government has the opportunity this week to take the lead in tackling inflation and the cost-of-living crisis before it’s too late.”

Often referred to as a ‘secret’ or ‘silent’ tax, inflation has pushed households costs up since the pandemic. According to the Australian Bureau of Statistics, Australia’s annual CPI inflation was 7 per cent in the March quarter. That was down from a 30-year high of 7.8 per cent in the December quarter. However the actual prices rises of household staples and consumer necessities might be considerably higher.

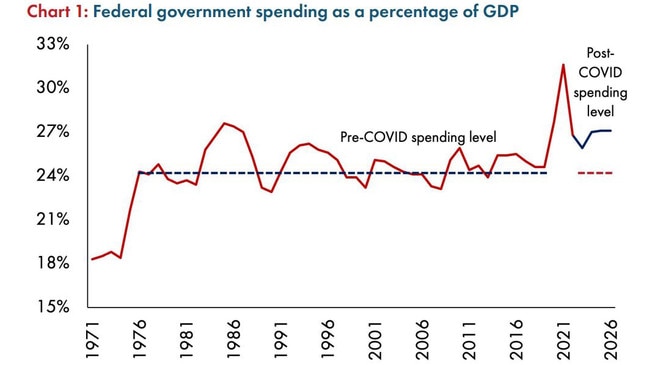

The IPA stated that the 28.9 per cent rise in spending between 2020 and 2022 has had a devastating impact on families.

MORE:

‘Labour of love’: epic home reno spans four generations

Sydney’s ‘Succession home’ could smash price records

Why villa costs $10m more than three years ago

“Spending on the Covid pandemic response from governments has caused the typical monthly mortgage repayment to rise by $554, or over $6,600 per annum, which is the spark that lit Australia’s current inflation and cost of living crisis,” Mr Wild said.

“Australian families and businesses are facing acute and immediate cost of living pressures, caused by rapidly rising inflation, energy costs, and rising mortgage repayment rates.”

“Governments need to cut spending now or we face an economic era of high inflation, in which higher and rising interest rates become the norm.”

As of December 2022, Consumer Price Index (CPI) inflation reached 7.8 per cent.

Research by the IPA revealed the cost of housing has “undergone the highest increase among all the categories of goods and services included in the CPI consumption basket”.