Melbourne’s median home price falls below Adelaide and Perth, as experts blame Vic gov policies

The Victorian government has been blamed for driving Melbourne’s property market so far into the ground that the city has plunged to the nation’s sixth-most affluent capital in one key measure.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The Victorian government has driven the state’s once-thriving property market so far into the ground that Melbourne has plunged to the nation’s sixth-most affluent capital on one key measure.

While the city’s typical house price is still the fourth highest in the country, it has been ranked sixth when a capital’s full array of homes, including units, townhouses and apartments, are included.

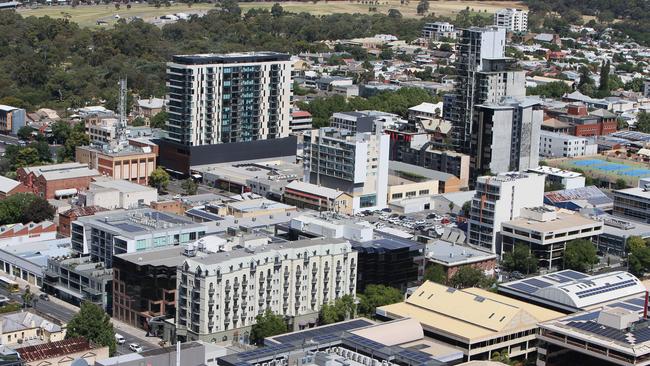

It is not yet clear if Melbourne’s median house price will be eclipsed by Adelaide and Perth, but with the Victorian capital home to a far higher share of units than either of the other two cities, the two have moved in front when all dwellings are considered, according to a new report from CoreLogic.

RELATED: Melbourne’s median house value falls nearly $10,000 in one year: PropTrack

PropTrack: Aus rental prices, national weekly rents jump more than 9 per cent in 12 months

Report reveals what’s in store for Adelaide house prices over the next financial year

During the pandemic the city was the nation’s second-priciest city on both fronts, with experts warning the fall from grace is “single-handedly” the work of Spring St, and arguably Victoria’s most famous property investor, Danny Wallis, bluntly stating: “they’re killing it”.

The new CoreLogic report released Monday shows Melbourne’s $776,044 median home price, for both houses and units combined, has just been surpassed by Adelaide, $790,789, and Perth, $785,250.

It’s also behind Sydney, $1,180,463, Brisbane, $875,040 and Canberra, $845,875.

That’s a stark contrast to April 2021 when Melbourne – with a then-$737,700 median value – was in second place behind Sydney’s on $958,700, with Adelaide languishing at $492,600.

CoreLogic’s head of research Eliza Owen described the reversal as “extraordinary”.

“It’s the first time Adelaide’s values have ever been higher than Melbourne’s, records show,” Ms Owen said.

This is also the first time since the mining boom in 2015 that Melbourne’s median dwelling price has been lower than Perth’s.

Melbourne traditionally having more housing supply than demand, plus “flat to falling” median prices across the past three months, has been blamed for the situation.

In contrast, Adelaide’s median value has steadily grown 60 per cent since Covid struck in March 2020, as the rise in working from home reshaped the city’s living arrangements.

CoreLogic’s Asia Pacific research director Tim Lawless said Melbourne’s median dwelling value was lowered by the 35.6 per cent of homes that were units across the city, while flats, townhouses and apartments make up about 16 per cent of Adelaide’s and Perth’s markets.

For now, Melbourne’s individual median house and unit prices still remain higher than Adelaide’s and Perth’s.

But even with this, the overall picture is a new low for Victoria.

Property Investment Professionals of Australia board member and prominent buyers’ advocate Cate Bakos warned the state government’s actions had “single-handedly influenced our position on the league ladder”.

Ms Bakos said a land tax increase introduced in January had added thousands to the cost of owning investment properties, which had “been devastating for rental stock, with agencies reporting their rental rolls are being decimated”.

She added that increased rental sector regulation was also causing many landlords to sell, suggesting the city’s rental crisis was poised to worsen.

Many investors are now looking elsewhere, with one of the nation’s most influential buyer’s advocacy groups, Propertyology, having boycotted the state since October last year in response to everything from its political policies around housing to ripping up the Commonwealth Games plans and flagging healthcare system.

Propertyology head of research Simon Pressley said the land tax increase was the “final straw” in a list of bad decisions the Victorian government had made, leading to his organisation’s boycott.

“We’ve got no confidence at all in the future of Victoria’s economy and therefore can’t have any confidence in the property market’s future, because the two are so linked,” Mr Pressley said.

One of the state’s most high profile property investors, rich lister Danny Wallis, said “they’re killing it” of the government’s actions around the housing market.

Mr Wallis said he had shifted his property investment plans to Queensland due to the “out of control” land tax.

“There’s a general lack of confidence in Victoria,” Mr Wallis said.

But there is some dispute over how far Melbourne has fallen, with separate PropTrack figures released yesterday showing Adelaide’s median dwelling value was still almost $29,000 below Melbourne’s, with the Victorian capital still the nation’s fourth priciest behind Sydney, Brisbane and Canberra.

AUSTRALIAN CAPITAL CITY MEDIAN DWELLING VALUES (COMBINED HOUSE AND UNIT MEDIAN PRICE), AUGUST 2024:

City: Sydney

Median dwelling value: $1,180,463

Percentage increase or decrease in value since August 2023: +5%

City: Brisbane

Median dwelling value: $875,040

Percentage increase or decrease in value since August 2023: +15%

City: Canberra

Median dwelling value: $845,875

Percentage increase or decrease in value since August 2023: +1.5%

City: Adelaide

Median dwelling value: $790,789

Percentage increase or decrease in value since August 2023: +14.9%

City: Perth

Median dwelling value: $785,250

Percentage increase or decrease in value since August 2023: +24.4%

City: Melbourne

Median dwelling value: $776,044

Percentage increase or decrease in value since August 2023: -1%

City: Hobart

Median dwelling value: $655,114

Percentage increase or decrease in value since August 2023: -1.2%

Median dwelling value: City: Darwin

$504,367

Percentage increase or decrease in value since August 2023: +1.6%

Source: CoreLogic Hedonic Home Value Index

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Vic home renovations: Owners paying near-record sums to overhaul their properties

Investor exodus: Melb has most homes for sale since 2018, after flood of new listings in Aug

Factor that increases your home’s value by 25 per cent

Originally published as Melbourne’s median home price falls below Adelaide and Perth, as experts blame Vic gov policies