Melbourne homeowners selling back yards to survive rate hikes, others losing home dream

Melbourne homeowners are selling their back yards in a bid to beat soaring interest rates and save their home, but the blocks are going up against another big hurdle.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Melbourne homeowners are looking to sell their back yard in a bid to keep their home as interest rate hikes push monthly mortgage payments into untested territory.

Developers meanwhile are having more than 100 blocks of land a month returned to their sales lists as home buying hopefuls have their dreams crushed or delayed in the fight against inflation.

The Reserve Bank has increased the nation’s cash rate 13 times since May last year, with more pain expected after three of the nation’s biggest banks, including the CBA, NAB and Westpac, predicted a further 0.25 basis point rate hike on August 1.

RELATED: REIV: Melbourne million dollar house club growing again as prices rise

Melbourne rent crisis: Where your suburb ranks on the pain scale

Sell Your Backyard’s Jodi Maree said half of the inquiries to the firm were from people wanting help to sell their back yard, despite it only being a side business to their main business Action Drafting.

“It’s been increasing, particularly in the past six months,” Ms Maree said.

“50 per cent of the calls to us now are young families with younger kids, and they are just feeling the rate hikes and the cost of living.

“Before the start of the year it would have been 20 per cent of our calls.”

Heightened demand means it is now taking them at least a year to make arrangements for suitable back yards to be subdivided and sold off, a timeline that had “risen because of the demand”.

Cash For Your Backyard owner Mary Mizzi said she was also encountering people who believed selling off their back yard had saved them from losing their house.

“I work with a lot of retirees and people who are struggling to pay their mortgage,” Ms Mizzi said.

“This is one option where they might not lose their home.”

Most of her projects are around Mill Park, Croydon and Ringwood and generally “places where there are big houses on a big block of land”.

One of her blocks is currently for sale in Hurstbridge, with a $580,000-$620,000 asking price.

Jill & Brian Boswell sold their back yard to Ms Mizzi and said they would probably have lost their house by now if they hadn’t.

“We were quite a few years from finishing our mortgage off entirely,” Ms Boswell said.

“We now don’t have a mortgage and we would never have survived the way the rates are going up and up.”

The pair had tried to sell their home prior to the pandemic, but weren’t getting offers at the level they needed for their retirement.

So they approached Cash For Your Backyard owner Mary Mizzi, figuring their back yard was becoming more than they were willing to manage.

Working through the process during the pandemic, their half-acre block was effectively cut in half — but still left them with about a quarter acre, which has proven more manageable, and their re-fenced backyard perimeter has also had updated stormwater services installed.

“And that’s more than enough for us,” Mr Boswell said.

Their old back yard, measuring 1345sq m, is currently for sale for $580,000-$620,000 via Jellis Craig’s Lorraine Grimshaw.

COULD YOU SELL YOUR BACK YARD?

– It shouldn’t be in, or near, a new housing estate;

– Ideally it will be within 20km of the Melbourne CBD;

– Council requirements will vary but a sellable back yard could be from 200sq m, though is on average about 300sq m;

– If there have been second houses built behind existing homes in your street, that is a positive sign;

– A sloping block could add extra costs and challenges, but can still be workable — especially in inner-suburban areas;

– Sheds, gazebos and other backyard fixtures can often be easily removed at low cost and typically won’t impact a sale;

– Backing onto a train line might make it less viable, but can still be done in inner suburbs;

– Easements can often be designed around;

– The back yard you have left will usually need to satisfy your council’s open-space requirements, so cutting right to your back door is unlikely;

Source: Mary Mizzi cashforyourbackyard.com.au

But it’s not alone. Land is also coming back onto Melbourne’s new estates as buyers who thought they had locked in their dream home 18 months ago reach settlement on their land after having had their borrowing capacity slashed by hundreds of thousands of dollars.

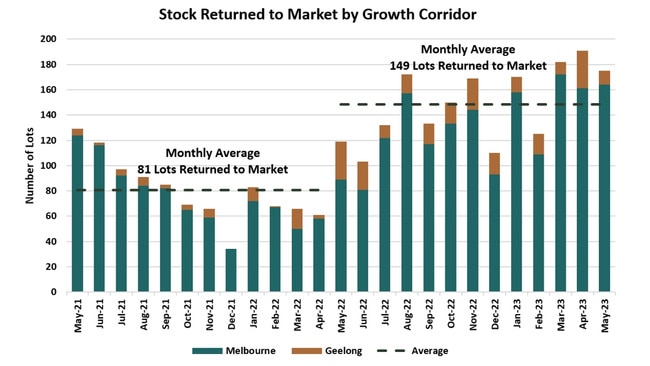

RPM Real Estate Group director Luke Kelly said there had been an “immediate” impact to the number of lots being returned to market in both Geelong and Melbourne after the first rate hike — and the numbers hadn’t dropped since.

“In May 2022, when the cash rate increased for the first time, the number of returned lots doubled compared to the previous month,” Mr Kelly said.

“From the 13-month period leading to May 2023, the market has experienced an average of 149 lot returns per month, which is an 84 per cent increase compared to the previous 12-month period.”

While this was lower than the land market’s last correction, he said the vast majority of people caught up in it this time around were homebuyers — as opposed to a significant number of speculative investors in the last downturn.

Up to 30 per cent of the blocks returning for sale, particularly those where a deposit was paid more than six months ago, are believed to have cost the buyer their deposit.

“If the purchaser can’t fund it, then there’s a clause in there for the vendor and the 10 per cent (deposit) is retained by the developer,” Mr Kelly said.

Others will be pushed to later stages of a development or onto smaller blocks as their borrowing capacity plunges and they can no longer afford to build a house they started planning before the hikes started.

“There’s no question every time interest rates go up, the amount you can borrow lessens and the amount you can spend building a house lessens,” Mr Kelly said.

“That makes it more challenging for the purchaser to work out what they are going to do. What you can afford today is not necessarily what you can afford next month.”

“And the people who bought 18 months ago couldn’t see that coming.”

He added that there were growing numbers of land buyers who were settling their purchase then immediately listing them for sale on realestate.com.au or even Gum Tree as they sought to recoup as much of their deposit as possible.

However, with speculative investors having compounded the last downturn many developers have added contract clauses barring resales until a house is built — though with the difficulty of selling land at the moment, he said this was usually a last resort.

Mr Kelly said he was expecting the number of lots being returned for sale to remain elevated for the rest of the year.

“But if there’s another rate rise, could they go up? They could,” he said.

“And we’d be foolish not to think there could be a future rise (in the numbers) if there are more interest rate hikes.”

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Carlton North: Ex-Essendon player Devon Smith lists his first home

Fitzroy: ARIA-award winner Matt Walker and friend selling house with retro caravan

Melbourne home prices forecast to surge 10 per cent in 18 months: NAB

Originally published as Melbourne homeowners selling back yards to survive rate hikes, others losing home dream