Hot property? Adelaide’s best and worst suburbs to invest in right now

Property investors have been served up a cheat sheet of where to put their money in Adelaide’s housing market – and better yet, where to avoid.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

South Aussies love property, but for many, figuring out where to invest is the hardest part.

Finder’s latest Property Investment Index has named Adelaide’s riskiest and most opportune suburbs for homebuyers at a time when significant price growth and a severely undersupplied rental market boost returns.

The data found Wayville, Bowden and Tusmore are among the safest markets to invest in for house price growth, while Woodforde, Rostrevor and Hectorville have the strongest investment credentials for unit returns.

On the flip side, Elizabeth Grove, Elizabeth and Athol Park were flagged as areas to avoid for house hunters, along with Aldinga Beach, Salisbury East and Salisbury for units.

The index modelled recent sales patterns, income changes, building approvals, buyer demand and more to reveal future growth stars, scoring each suburb out of 100.

Finder head of consumer research Graham Cooke said the data, which looked at close to 500 suburbs and towns across SA, found investors were beginning to take on more of the market from owner occupiers.

“In January 2021, investor loans made up 24 per cent of all home loans, but that figure has now grown to 37 per cent,” he said.

“So this whole project is designed to give investors an extra tool to help them with where to look in the market … a market that is constantly shifting and changing.”

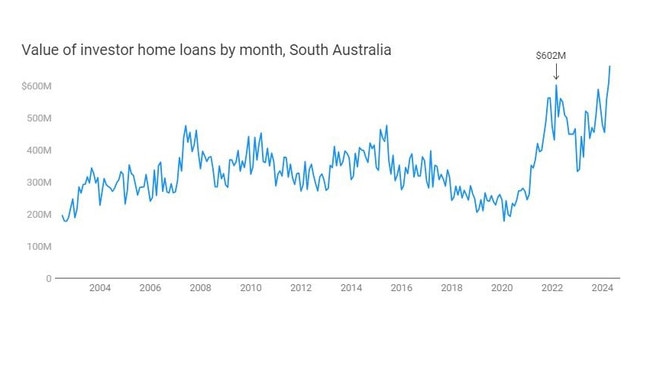

Mr Cooke said unlike other capitals, Adelaide’s investor market had gone from strength to strength since the onset of the pandemic in 2020.

“Prior to the pandemic, investor activity in South Australia had generally been falling but when Covid hit, investor home loans dropped initially but were relatively unaffected by the pandemic compared to Victoria and New South Wales,” he said.

However, in the second half of 2021, investor activity saw historical growth.

“In March 2022, investor home loans reached a record $602 million, a 71 per cent increase on the previous year,” Mr Cooke said.

“As of August 2023, the total value of investor loans in SA has been reported at $470m, an increase of 7.7 per cent month on month.”

Adelaide’s popularity with investors, along with limited housing supply, saw the state capital named as one of Australia’s top performing property markets in July.

Home prices are now tipped to eclipse those of Melbourne in the coming year, making it the country’s fourth most expensive city after Sydney, Brisbane, and Canberra.

PropTrack senior economist Paul Ryan said all eyes were on Adelaide where the average home now sold for around $780,000.

“Investors are clearly responding to high rents and low rental availability as we have seen investor lending grow over the past year,” he said.

“This is what we expect and it is one of the ways the market will recover from the really tough rental conditions we’ve seen.”

Daniel Seach of Ray White Black Forest said he was unsurprised to see suburbs within 10km of the CBD named as investor hotspots.

Mr Seach, who sold a number of homes in Wayville in recent months, said the inner-southern suburb had experienced exponential growth with demand fuelled by both first home buyers and foreign investors.

“I’m not surprised to see Wayville named as the top investor hotspot. The fact that it’s tightly held would be a contributing factor but also, it’s such a vibrant community and close to the southern parklands and you can walk to China town,” he said.

“We recently sold a home at 1/22 Davenport Tce and with that one, we had 17 offers after the first weekend of opening.

“We ended up selling it for $540,000 – $50,000 above the vendor’s price expectation.

“The majority of interest came from local buyers, there were a lot of first home buyers looking to get into the market, but also investors as the property came with great rental yields.”

Investor demand is also expected to ramp up in Adelaide’s west where West Lakes was named in the top 10 most opportune suburbs, according to Finder.

It’s hopeful news for Leon Zhao, who is helping his parents Nina and Xing sell the family home of 35 years at 2 Gretel Grove.

He said West Lakes was becoming increasingly popular with young buyers and investors.

“I’m not at all surprised that it’s so popular. Where the suburb is located, it’s not too far from the city and the water, so it really offers a great lifestyle,” Mr Zhao said.

“Growing up there, I often used to go out in my boat, go fishing, walk by the lake or go to the playground and play sports … and I know for my parents, they would love for another family to now have this lifestyle.

“Over the last five years, I’ve noticed more younger families moving here to enjoy the beach lifestyle, so there’s definitely a shift happening as more retirees are selling up and leaving … and investors are coming in.”

Originally published as Hot property? Adelaide’s best and worst suburbs to invest in right now