Geelong suburbs where ex-rental home sales are soaring

There’s been an almost 30 per cent jump in homes once for lease being listed for sale in Geelong this year. See the suburbs where most have hit the market.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A wave of landlords selling up their investment properties has cut nearly 20 per cent from the pool of homes normally available for renters in Geelong this year.

New analysis shows the number of ex-rentals listed for sale in January and February jumped almost 30 per cent when compared to the same period in 2023.

The Suburbtrends analysis show 356 homes were put up for sale in the Geelong region in the first two months of 2024, 82 more than in 2023.

RELATED: Luxury Newtown home sells for huge price after one inspection

No mortgage, no worries. See the Geelong suburbs where more buyers are paying cash

Crazy way 8yo earned $170k on property market

The figures were more stark when compared to the amount of stock available for rent over the same periods, Suburbtrends founder Kent Lardner said.

The number of properties available for rent remained steady over the corresponding periods, rising from 1877 in 2023, to 1890 in 2024.

Ex-rentals for sale represented 15 per cent and 19 per cent of rental stock respectively, he said.

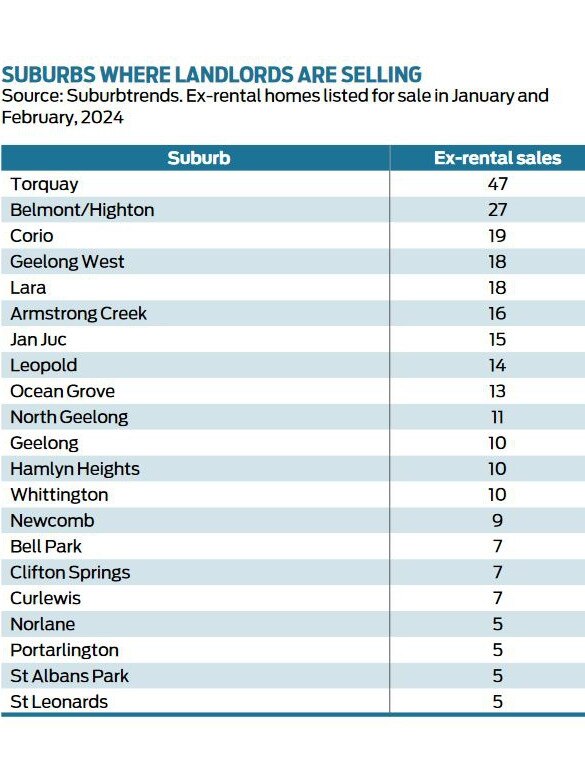

A breakdown by suburb shows Torquay had the biggest share with 47, with 27 selling in Belmont and Highton, 19 in Corio and 18 in Geelong West and Lara.

“These properties would have otherwise ideally been re-entering the rental market,” Mr Lardner said

“We’re not wanting to lose any properties in the rental market because the argument that a lot of people hold is that when a property exits the rental market, it creates an opportunity for a renter to buy a property.

“But that argument misses the point that so many renters cannot afford to buy today.”

Maxwell Collins director Nick Lord said the figures were of no surprise to the industry, where some large rent rolls have lost up to 20 per cent of homes available to lease over the past 12 months.

Higher land tax was the number one reason investors were choosing to sell in Victoria, he said.

Changes to minimum standards and compliance laws had a minor impact on the amount of rental homes in the market, while some long-term investors weathered rising interest rates, but land tax bills provided a direct hit on cash flows, he said.

“Land tax has been a very large reason and a daily conversation that we have with our residential and commercial investors who are looking to bring their property to the market,” Mr Lord said.

“They are mainly long-term investors that maybe has one or more properties. And what we saw was they’re asset rich with a property but cashflow is a challenge and now with land tax it’s time for them to maybe look to invest their funds otherwise.”

Mr Lord said first-home buyers have been the most active group buying up ex-rental homes.

Many investment-grade properties were in a sub-$700,000 price bracket that were a “perfect fit” for a first-time buyer or another investor entering the market, Mr Lord said.

Hayeswinckle director Michelle Winckle said some investors and people with self-managed superannuation funds were buying but there was plenty of stock available.

“Now is a good time for investors because there are few around so they won’t be buying with as much competition, which means they’re going to get it at a better price than what they would have a year ago.”

Mr Lardner said addressing supply was the only way to address the housing crisis for the bottom 20 per cent of the market that couldn’t afford to buy.

The focus on build-to-rent schemes and government building targets won’t address the shortfall in homes now, particularly for people on lower incomes, Mr Lardner said.

“Building a $700,000 property is not going to do it cheaply,” he said.

“That doesn’t translate to a cost-effective rental for somebody.”

Mr Lardner’s left-field solution is leveraging government land to create caravan park or mobile home villages-style living, which could be done in short time.

“You could roll out anything from a caravan to a prefabricated beautiful house in one of those parks. It means you could leverage government land and pull a lot of levers to create a roof over somebody’s head at the right speed.”

Originally published as Geelong suburbs where ex-rental home sales are soaring