Battlelines drawn over first homebuyer grants

A battle is emerging between Australia’s states and territories over controversial first homebuyer grants.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

ANALYSIS

There is an emerging battle among competing state governments to encourage first home buyers into new homes in their respective states.

The battle lines shifted last weekend when the Palaszczuk government in Queensland doubled its first home grant to $30,000.

It is open to all Australian citizens who are intent on taking up occupancy following construction of their new first house or apartment.

It is for the buying or building of a new home valued at less than $750,000, including land and any contract variations.

The grant is not available to buy investment properties.

Premier Annastacia Palaszczuk and Treasurer Cameron Dick expect 12,000 buyers to use the scheme, which expires in June 2025. With the grant only focused on “new supply, not bidding up the price of existing supply” Dick claims it will take the pressure off existing stock prices.

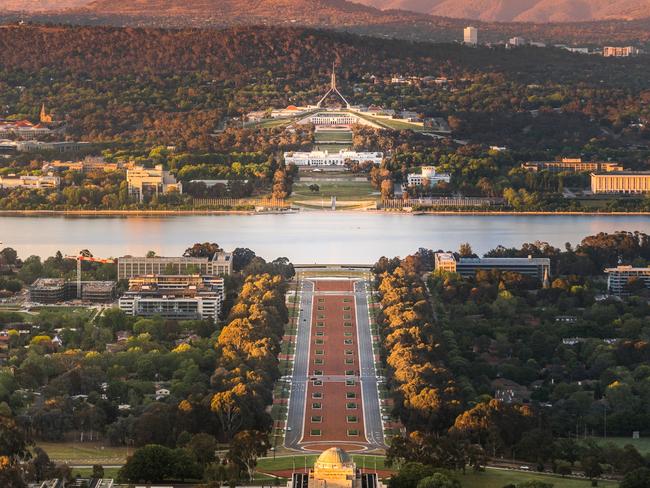

First homeowners grants are offered by all state and territory governments except in the ACT. There are cash grants on offer plus stamp duty discounts or exemptions, which on the surface can save a lot of money.

Meanwhile, economists like Saul Eslake criticise the policy, saying there is incontrovertible evidence over the past six decades that giving cash to home buyers resulted in more expensive housing, not in more people owning their own home.

Queenslanders were quickly advised last weekend that the increase in the grant makes it as generous as Tasmania’s scheme, but triple what is offered in NSW, Victoria and Western Australia.

The locals were told coal royalties had bankrolled the boost.

There will be prospective first home buyers in NSW who will considering moving north.

Of course job prospects will play a big determinant role, along with family considerations, but a fluidity of location is in the first homebuyer DNA.

The details of what is permitted under the various competing schemes is important to navigate. For instance the Queensland first home stamp duty concession only applies to a home valued under $550,000, potentially saving $15,925. A $750,001 purchase would cost $19,600 in transfer duty.

In NSW a full $30,000 exemption from transfer duty is available when buying a new (or existing) home valued up to $800,000, while homes valued less than $1m qualify for a concessional rate.

NSW duty exemptions in October were the highest in two years.

Buying or building a new home valued up to $750,000 in Victoria allows eligibility for its grant of $10,000. There is a $31,000 first homebuyer duty exemption for purchases valued up to $600,000, or a concession up to $750,000.

Obviously the overall price of house and land amid increased unaffordability will have a major contributing influence on the location of buying decisions.