Bank of mum and dad making huge sacrifices to get kids on the property ladder

Rising house prices means the bank of mum and dad is hitting record highs, but it is still not enough to cover the 20 per cent deposit, new research shows.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Younger Australians are increasingly turning to the bank of mum and dad to take their first steps onto the property ladder, but even with a leg up many are struggling to raise enough money to buy in Australia’s capital cities.

Survey data released by comparison site Mozo shows more than one in three first home buyers needed parental assistance.

“Despite these large contributions, Mozo modelling shows a $74k gift is often still not enough to cover a 20 per cent deposit on median homes in Sydney or Melbourne, especially with stamp duty and other upfront costs factored in,” the Mozo report said.

“Dual incomes remain essential and many first home buyers still fall short of lending thresholds even with family support.”

According to Mozo, that was $4,113 more than in 2021.

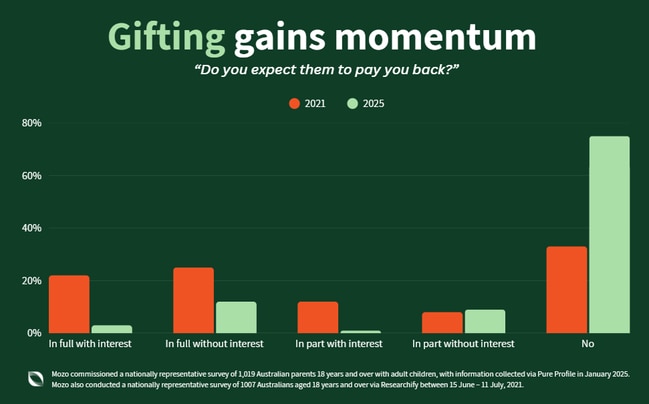

And 75 per cent of parents who had backed a deposit did not expect to be repaid, up from 33 per cent over the same period.

PropTrack data confirms this, showing Australia’s median house price is already at a record high in April, rising 0.2 per cent to $805,000, although prices in Australian cities are more expensive.

An average house price in Sydney now costs buyers $1.18m, while Australia’s second most expensive city Brisbane costs $882,000 and the ACT will cost buyers on average $852,000.

Since March 2020 during the depth of the Covid lows, house prices nationally have recovered by 48.6 per cent, putting more pressure on those looking to get into the market.

REA Group senior economist and report author Anne Flaherty said one positive for those looking to get into the market was house price growth was slowing.

“While national home prices rose in April, the rate of growth has slowed compared to the first three months of the year,” she said.

“Should interest rates fall in May, we may see the rate of growth pick up again as borrowing capacities increase and mortgage repayments decline.”

More than half of the parents who did help their children had to dip into their savings, while 14 per cent are putting off their own retirement or accessed their superannuation to help the children.

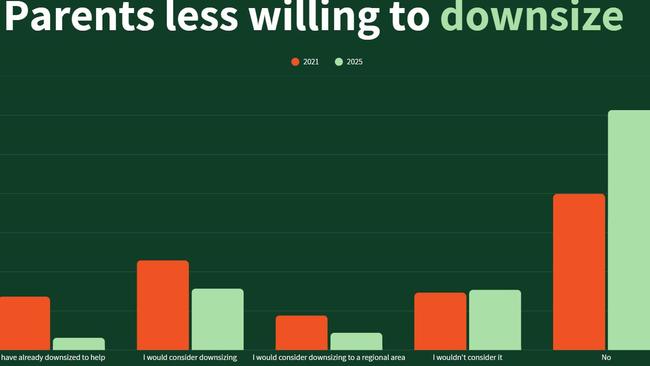

Even though parents are willing to sacrifice to help their own children, when asked if they were willing to sell the family home, the majority answered no.

“Interestingly, while financial support from parents has increased, fewer parents are willing to make extreme sacrifices to fund their children’s homeownership goals,” Mozo’s report said.

Despite the large sums of money given from parent to child, Mozo’s data warns there is a lack of any formal agreement or protection.

“That leaves both parties exposed if circumstances change. As house prices continue to outpace wage growth, the role of the ‘Bank of Mum and Dad’ is becoming both more vital and more financially perilous,” the report said.