All you need to know about the Build-To-Rent sector in Qld

Developers big and small are dipping their toes into Queensland’s burgeoning build-to-rent (BTR) sector. Here are the projects in the pipeline.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

DEVELOPERS big and small are dipping their toes into Queensland’s burgeoning build-to-rent (BTR) sector as rents skyrocket amid a shortage of stock and the state government earmarks billions of dollars for affordable housing projects.

Big names and some local players have sensed an opportunity, with international giants like Brookfield and local groups including Mirvac, Lend Lease, and Frasers Property Australia, among those announcing substantial BTR projects in Brisbane and the Gold Coast.

Don’t miss the new Developing Queensland section, every Saturday in The Courier-Mail.

Build-to-rent is the term used when entire apartment blocks are built for renters rather than the more traditional build-to-sell to owner-occupiers or investors.

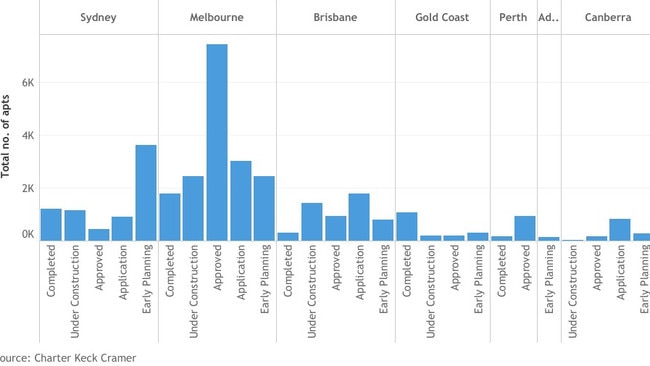

The sector is now a $17 billion asset class in Australia, with close to 24,000 apartments operating, under construction or in planning. Only about 5100 of those are in Queensland, but that number is growing.

MORE DEVELOPMENT NEWS:

Terrace homes sell out in first stage of new marina precinct

First look: $500m quarry revamp to create close to 500 homes

Revealed: 23 Qld developments to watch in 2023

Analysis from property services firm Charter Keck Cramer has found Australia is undergoing a structural change in living preferences, with more people living in apartments and renting for longer — both drivers of BTR.

Charter Keck Cramer director of research Richard Temlett said rising rents, population growth, and the infrastructure being built in the lead-up to the Olympic Games, made Brisbane and Queensland’s southeast corner an attractive option for BTR.

“Suddenly, BTR has become financially feasible in Brisbane,” Mr Temlett said. “There’s a significant amount of interest in BTR and a lot of the developers...have all picked up sites because they see the fundamentals there, which is the take-up of apartment living and renting for longer.

“It’s important, especially now with supply slowing as badly as it is, to get some more good quality rental stock delivered to the market.”

Mr Temlett said BTR was also part of the solution to mobilising the supply of dwellings to meet the increasing population and add a diverse form of housing that had not existed before.

But he admitted not everyone was convinced, due to concerns about financial returns and the viability of the sector.

“Some developers are saying; ‘When you look at the finances, is it worth the risk we’re going to take in an asset class that doesn’t yet exist?” he said.

“Some of them also just don’t believe it’s going to emerge in Australia.”

The federal Labor government recently announced a big tax break for foreign investors into BTR, lowering the managed investment trust withholding tax rate from 30 to 15 per cent for BTR housing projects.

Queensland is also offering a 50 per cent land tax discount for new BTR projects, with the state government being forced to act as Brisbane faces the challenge of ultra-low vacancy rates of less than 1 per cent, fuelling annual rental growth of more than 20 per cent.

The Palaszczuk government is backing three developments via its Build-to-Rent Pilot Project in the Brisbane area, which will deliver more than 1200 homes. Up to 490 of those will be provided at subsidised rent.

One of those developments is Brisbane’s largest BTR project, Brunswick & Co, in Brunswick St, Fortitude Valley.

Fraser Property Australia has made its foray into the sector with construction starting on the 25-storey tower, in conjunction with the state government.

The 366-apartment project will dedicate 40 per cent or 144 of its units to subsidised rentals.

Frasers Property executive general manager of development Cameron Leggatt said the project would “redefine renting”, with the subsidised rentals “targeted at key workers that live in and around this area and are finding it tough to find suitable and affordable accommodation”.

Mr Leggatt said BTRs were part of the solution to the housing crisis.

“It is still very challenging because of the state of the construction market… We’ve got a lot of people coming into the country, we need more houses, but the builders are under pressure.”

One of the newest developers to jump on the bandwagon in Queensland is Sunguard Property Group, which has this month launched plans for a build-to-rent project of nearly 400 apartments in Fortitude Valley.

The plans for a dual-tower, mixed-use complex of 20 and 25 storeys, featuring rooftop gardens, wellness areas, and a co-working space, have been filed with the Brisbane City Council.

US property giant Brookfield Residential Properties has also chosen Brisbane to make its first Australian foray into BTR with a dual-tower project in Hamilton.

‘The Hamilton’ project is for 560 studio, one, two and three-bedroom apartments over two towers at the $1.3b Portside Wharf precinct, 6km from the Brisbane CBD.

Renters will have access to an onsite concierge, a health and wellness spa, a co-working space and a dog wash.

In Bowen Hills, construction has begun on Lendlease’s first Australian BTR tower at its Brisbane Showgrounds precinct.

Partnering with QuadReal Property Group, 443 units will be delivered in a mix of studio, one, two and three-bedroom apartments over 37 levels, housing 600-800 residents.

The project is being positioned as a premium offering to appeal to a younger demographic of renters.

Mirvac’s project, LIV Anura, in Newstead will have about 390 high quality rental apartments that will be offered at discounted rates by 2025.

Construction started on the building last year and is due to be completed in the 2024 financial year.

In Brisbane’s inner west, a new mixed-use community has been proposed to offer 478 residential apartments over four towers, most of which will be subsidised rentals.

The Keylin Group has lodged a development application for the Indooroopilly site, which would include 388 apartments, of which 39 will be specifically for affordable housing — offering lower rent options with the support of the Housing Investment Fund.

An additional 44 units will be for short-term accommodation and there will be 46 premium apartments for private ownership.

On the Gold Coast, Virtical has acquired a prime development site on Nerang Street site in Southport, with plans approved for a $1.2 billion residential precinct.

The 1.1ha site is the largest available land holding in the region, with construction of the four tower luxury residential development expected to commence in 2024.

It will feature 1,019 apartments and 137 BTR dwellings.

Private developer Pellicano is also accelerating its pipeline of BTR projects, with plans for a $225m project at Robina on the Gold Coast.

The Robina plan comprises 418 residences across four buildings of nine to 10 levels.

The project, to be called Paloma House, involves close to 8000 square metres of amenities including a wellness centre, gym, steam room, sauna, cinema, residents’ lounge and work-from-home space.

Another 410 BTR apartments under construction will be completed over the next 15 months in Woolloongabba, Fortitude Valley and Kangaroo Point.

Originally published as All you need to know about the Build-To-Rent sector in Qld