Coogee residents protest closure of Commonwealth Bank slated for March 1

A group of disgruntled residents in the city’s east are rallying to stop the closure of their last bank. See why Commonwealth Bank wants to close the shopfront.

Southern Courier

Don't miss out on the headlines from Southern Courier. Followed categories will be added to My News.

A group of disgruntled residents in the eastern suburbs have come together in opposing the closure of the last bank in the suburb after the Commonwealth Bank shifts “towards digital and phone-based banking”.

The decision, which is due to come into effect after March 1, will see the closure of the Commonwealth Bank’s Coogee Branch, forcing locals to travel to nearby Randwick to conduct in-person banking.

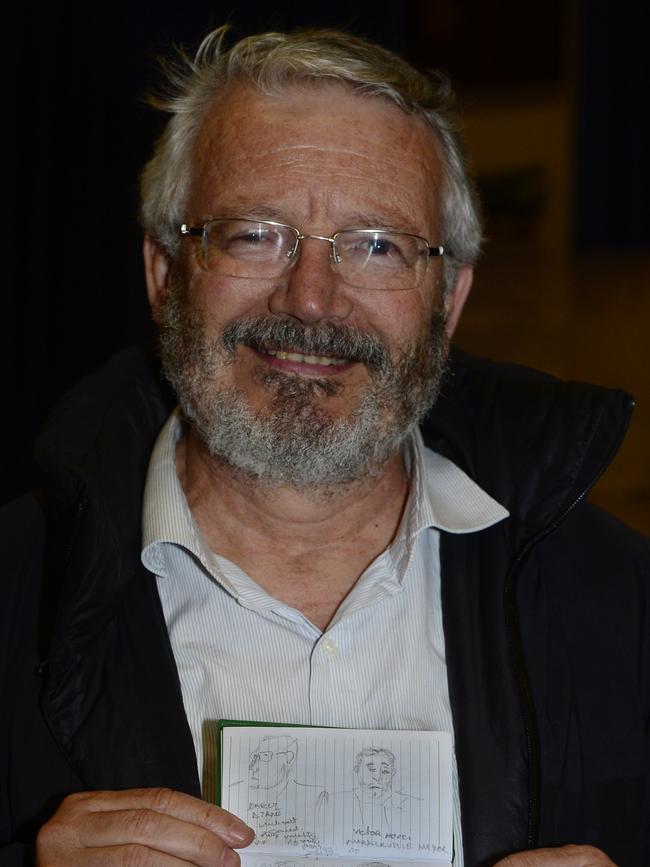

Coogee Precinct chair Mark England said many were blindsided by the news.

“The building was sold very quickly and no one was notified,” he told the Southern Courier.

“I brought this concern to the members of [Coogee] Precinct at our meeting, and they were very concerned because so many of us rely on the Commonwealth Bank.”

With more than 30 residents protesting against the decision on Thursday, Mr England said it was the last remaining bank in the suburb and many rely on speaking to “someone face-to-face”.

He said Coogee MP Marjorie O’Neill sent a letter to the Bank, outlining a number of community concerns, primarily the “age and physical limitations” of many residents.

“[Roughly] 24 per cent of the people residing in Coogee are over 50 years of age … that’s an accurate figure” he said.

With its closure, Mr England said ATM options in the centre of the suburb were limited and some would be forced to go into the Coogee Bay Hotel and incur a fee.

When questioned about the decision, Commonwealth Bank regional general manager Irene Rowlands said it “regularly” reviewed its services across the country “to help inform decisions on where to open, renovate or upgrade branches, or in some instances where to close branches”.

“Customer demand at our Coogee branch has progressively declined, with a 52 per cent drop in transactions over the last five years,” she said.

“After a recent review, we made the difficult decision to permanently close our Coogee branch.

“With more banking touchpoints than ever before, there has been a clear preferential shift towards digital and phone-based banking.”

Ms Rowlands said while the bank recognises “some customers prefer over-the-counter banking” it was proud to maintain the largest branch network in Australia.

“We’ve recently expanded our Randwick branch, with 37 per cent of Coogee customers already visiting this location, Bondi Junction, Maroubra and Westfield Eastgardens,” she said.

“ Customers who prefer over-the-counter service can continue accessing these branches, which are all within 5km.”

Randwick mayor Philipa Veitch didn’t share a similar view, saying pensioners and others needing cash will now pay an “extra cost” and be forced to carry large amounts of money as “they will withdraw less frequently”.

“With the hot weather and bus services often running late we need to ensure that everyone in our community can easily access their local branch,” she said.

“The ‘peoples bank’ has become just another financial megalith and despite recording record profits, is cutting much needed face-to-face services.”

Ms Veitch said she was planning to write to Commonwealth Bank CEO Matt Comyn.