NSW construction industry: Four builders fall into liquidation a day as new liquidations data released

Four construction businesses across NSW have fallen into liquidation every day in the last financial year. See why industry leaders and surviving business owners say they need help.

Local

Don't miss out on the headlines from Local. Followed categories will be added to My News.

Four construction businesses across the state have fallen into liquidation every day in the last financial year – as NSW tradies make up more than half of all trade-based insolvencies across the country.

A total of 1684 NSW-based construction businesses were forced to throw in the towel in the 2023-24 financial year, with haemorrhage cashflow, rising costs, declining consumer confidence and mounds of red tape to blame for dire circumstances.

NSW rental housing market: 418,000 households relying on Federal Government rental assistance

NSW Housing Growth: How many homes will be built in every NSW electorate, western Sydney tops list

Australian Securities and Investment insolvency statistics confirmed a business bloodbath of 3,533 companies having liquidators or restructuring specialists appointed in the 12 months to June.

It can also be revealed the number of builders and tradies falling onto hard times has almost doubled since June 2022.

A shocking 215 NSW construction companies saw external administrators appointed in April this year.

Business NSW boss Daniel Hunter revealed exclusively to The Saturday Telegraph his agency’s confidence index reported a significant nosedive in support from consumers according to new data released this month.

“There is no doubt that businesses in NSW are drowning in two decades red tape,” he said.

“65 per cent of business in the construction industry have reported increased time commitment in regulation.”

The Business NSW boss said the sector had also been hit hard by sharp increases in building material costs.

“Business confidence has remained deep in negative territory for more than three and a half years since September 2021,” he said. “Business conditions will deteriorate if the state and federal governments do not take a co-ordinated approach to easing tax and regulatory burdens on business.”

Mr Hunter said businesses in NSW were slugged with higher insurance premiums, with the issue identified as the “number one cost concern for business in 11 of the past 13 Business Conditions Surveys since December 2019”.

“Uninsured businesses are vulnerable and their closure may result in bankruptcy, lay-offs, legal problems and disrupted services - impacting both business owners and their customers,” he said.

“Many builders are suffering because two-year-old contracts they were locked into have increased dramatically in price.

“This is not to mention new industrial relations changes at a federal level and owners trying to find skilled labour when the housing crisis forces many people to abandon new job and business opportunities.”

The industry leader said a survey of construction businesses last month confirmed builders were bearing the brunt of more than “40 hours a month of compliance and regulation”.

The business conditions survey data confirmed more than 70 per cent of businesses were tasked with more than 11 hours of compliance paperwork a month.

The growing list of insolvencies come as state and federal governments promise mass building projects to beat the housing crisis.

Last month, NSW Premier Chris Minns revealed where 377,000 new homes would be built across the state to meet the demands of the Federal Government’s housing accord, with communities across the inner west, eastern suburbs, north shore and northern beaches expected to build 107,000 new homes by 2029.

Meanwhile, an additional 59,000 homes would be required across Sydney’s west.

In March, The Daily Telegraph revealed the Minns Government would work to cut red tape with “approved best-in-class low- and medium-density housing designs” that would allow for development to be fast-tracked through the planning system.

Master Builders Australia chief executive Denita Wawn said the cost of building a home has increased by 40 per cent since 2019.

“Despite high demand for housing, people are not going ahead with new builds because the numbers just don’t stack up,” she told The Saturday Telegraph. “The delivery of new homes and related infrastructure has been obstructed by ongoing and concurrent challenges.

“Tradie shortages, planning and licensing delays, draconian industrial relations changes, material cost inflation, inefficient regulation, unfeasible lending practices and risk allocation are compounded to make projects unsustainable.

“Unfortunately, builders have borne the largest risk, so it’s essential to focus on preventing issues before they arise rather than dealing with the consequences when it’s too late.”

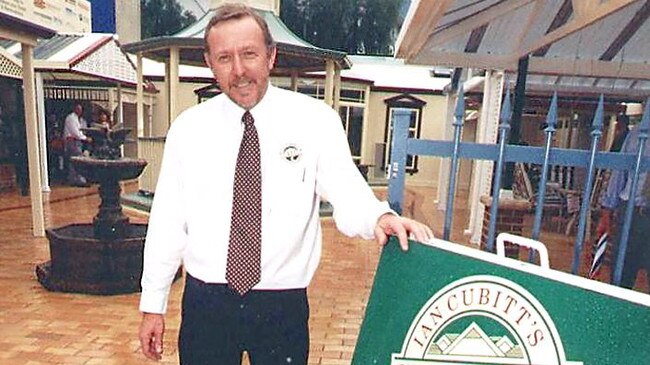

Data confirming harrowing business conditions across the sector comes just days after “iconic” western Sydney builder, Cubitt’s Granny Flats and Home Extensions, formerly entered into voluntary administration.

Representative of the decades-old business blamed bank lending conditions, supply prices, taxation changes, insurance prices, Covid recovery and lengthy weather events, for the move.

“Cubitt’s company has suffered more than it can shoulder,” the statement read.

Western Sydney solar boss James Hill said the entire construction industry is on “tenterhooks”.

“Everyone in the building industry is constantly nervous,” He said. “All it takes is one big contractor to go under and the ripple effect across the industry is immense.

“I have been in the industry for 40 years and very rarely have I seen this much strain on big and small business.”

The construction industry veteran said the number of businesses in the sector going under was “concerning but not surprising”.

“We have a tightening economy with little to no government support, rising wages, and increasing cost of materials – these are the factors that are leaving business owners exposed and under threat.”