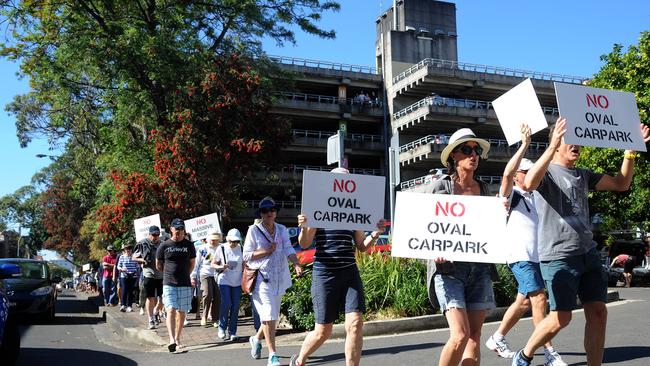

Reports find big risk with scrapped Manly Oval carpark plan

THE cost of building a carpark under Manly Oval was “significantly underestimated” and proposed profits over-inflated by out-of-date figures, two independent audits have found.

Manly

Don't miss out on the headlines from Manly. Followed categories will be added to My News.

THE cost of building a carpark under Manly Oval was “significantly underestimated” and proposed profits over-inflated by out-of-date figures, two independent audits have found.

And developers for the major linchpin proposed to fund the controversial plan – the Whistler St carpark redevelopment – could have walked away due to “changing commercial or economic conditions”.

The long-awaited release of assessments by Value Network and Ernst and Young, which led the merged council’s administrator Dick Persson to scrap the plans, came on Wesnesday.

Value Network said the council had “significantly underestimated” the total cost of the oval carpark.

The final cost the independent assessment came to was redacted but it is believed to have been an increase from the proposed $29 million to almost $36 million.

Significant contractual risks were highlighted in the deed signed with Abergeldie, which transferred all project risks to the council, possibly leading to even more cost blowouts.

The council would have been required to remove acid sulfate soils and any other contamination of soil – which would require costly remediation.

Ernst and Young highlighted significant, uncosted, risks due to the height of the water table in Manly. It cited the Coles carpark near Manly Oval which is “required to pump out a large amount of groundwater at significant cost”.

The redacted reports said expected revenues and funding models were based on plans from 2013, when an 800-space carpark was being mooted, rather than the 500 signed for in development deeds.

Other risks included the carpark’s “investment horizon” of 50 years, as opposed to the usual 10 to 20 for a public sector debt. Ernst and Young pointed out – citing the Whistler St carpark’s decaying state – that maintenance and wear and tear were not considered as costs, nor was the “risk of obsolescence”.

Meanwhile, the price Manly Council received for the Whistler St triangle from Built Development Group and Athas Holdings was “three times greater than council’s valuation”.

Value Network said the council should have conducted a review to ensure the deal would not collapse after carpark construction had started – leaving ratepayers with no way to pay.

The two developers would have paid Manly council $37.5 million in cash and another $10 million in-kind to lease the Whistler St triangle site for 99 years. But the signed development deeds presented no agreed timetable for payments.

The auditors said the height of the proposed Whistler St carpark was 7m above what was permitted, and would require approval from the Planning Minster.

Value Network said the majority of funds would not come until the Whistler St development was completed – which was more likely to be five or six years, rather than the council’s assumed two-year payment.

“There is a risk the current offer for the Whistler St site might ‘fall over’ because of changing commercial or economic conditions”, the report said.

Value Network assessed the deal was part of a public-private partnership, which had been split into two to avoid stringent regulations. Where a project is deemed to be high risk ($50 million) it needs to meet the requirements of the Office of Local Government.

Value Network indicated the two projects should be treated as one, because the Whistler St lease was intended to fund the carpark construction.

“There was no information sighted indicating whether council has confirmed with the OLG that Whistler St development or the total projects considered one project under the OLG guidelines irrespective of two separate contracts,” the report said.