Revealed: NSW’s worst scammers and how they ripped off innocent people

From a former animal welfare volunteer to a Star Casino gaming supervisor, these are the men and women who are among NSW’s worst fraudsters. Now, their sickening crimes and faces have been exposed.

Central Coast

Don't miss out on the headlines from Central Coast. Followed categories will be added to My News.

- Revealed: Sydney teachers whose crimes rocked school communities

- Central Coast restaurants: 30 of the best dining options revealed

They’re the people who have seemed genuine to the outside world, but have secretly been scheming in the background.

An investigation into the ten most shocking NSW fraudsters before the courts have revealed the devious ways scammers have preyed on the innocence and generosity of people.

From the woman who sold someone a blind, old dog she advertised as a puppy to the man who managed to scam Star Casino’s gambling system.

According to the latest research by Finder, scammers are capitalising on public fears around the COVID-19 pandemic.

A recent survey revealed that 47 per cent of Australians – equivalent to 9 million people – have received a fraudulent text or phone call since lockdown began in March.

“Cybercriminals are now using multiple tactics to steal money and information, mostly by impersonating the government,” Finder editor-in-chief Angus Kidman said.

The most commonly reported scams include government impersonation scams, superannuation scams and online shopping scams.

“This is devastating for victims once they realise what has happened, especially if they are already doing it tough during COVID,” Mr Kidman said.

“Keep a close eye on your transaction history. You may not know you’ve fallen victim to a scam until it’s too late, and funds have been deducted from your account.

Here are 10 of the worst scammers that have come before NSW courts.

Shocking Star Casino fraud

A man swiped more than $90,000 worth of gambling chips from Star Casino, telling a court that his scam was possible due to the casino’s poor security system.

Justin Ly, of Bonnyrigg, was sentenced to eight months home detention in September 2020 for repeatedly manipulating dealers to hand over thousands of dollars worth of chips. He pleaded guilty to 13 counts of fraud by deception.

The court heard the 23-year-old, who was a gaming supervisor at the casino, would lie to dealers about a ‘customer’ – his criminal accomplice – who had gone to the bathroom and left behind a number of gambling chips, typically valued about $7500.

When the ‘customer’ returned, Ly would order the dealer to pay out the ‘owed’ money in chips. This scam was executed more than a dozen times across a number of months in 2019.

Ly, who admitted that his gambling addiction made him do “bad things”, was convicted and also ordered to repay Star Casino $83,500.

Elderly women targeted in three month credit card scam

A Central Coast man went to great lengths to carry out a credit card scam which saw him steal more than $23,000 from 10 elderly women, aged between 78 and 92, across the Hunter, Southern Highlands, Illawarra and Canberra.

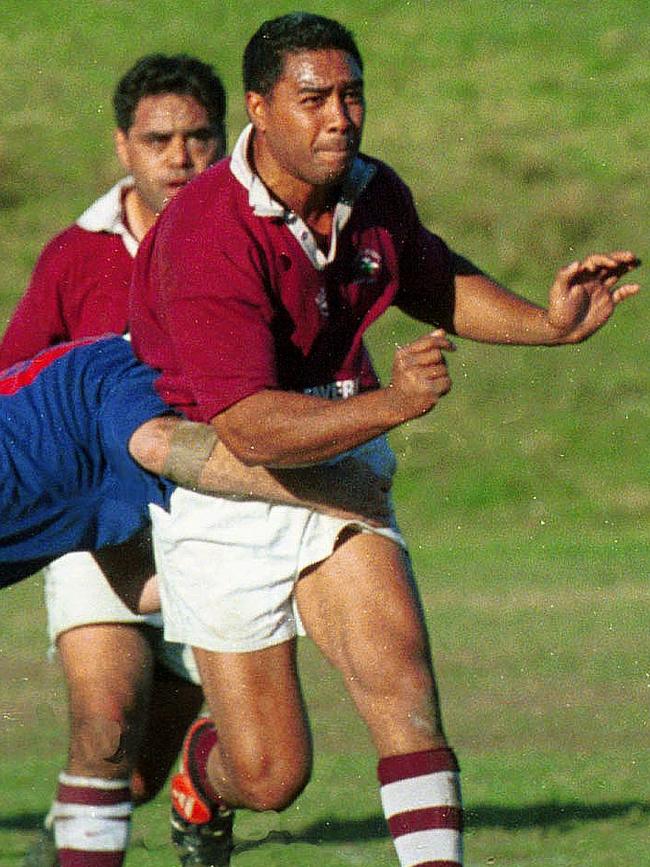

Tonga Harris was sentenced to five years in jail with a non parole period of three years in August 2020 for scamming elderly women over a three-month period between January 29 and April 26 2020.

The scam started when an elderly woman’s purse would disappear while they were out shopping, busy in the garden or visiting a neighbour.

Hours later they would receive a call from a man saying he was a “bank representative”, telling them their purse had been handed into the local branch. The man told them he needed their PIN number to cancel the card, and they all obliged.

Before the women knew it, thousands of dollars was missing from their accounts.

Tonga, a 46-year-old father of two, pleaded guilty to 19 counts of dishonestly obtaining financial advantage by deception.

His targeted areas included East Maitland, Wallsend, Bowral, Bargo, Dapto, Eleebana, Gerringong, Mittagong and Thirlmere.

Tonga told the court he ran the scam to feed his drug habit.

Bodybuilder developer swindled more than $1.18m

Sydney businessman James Vertzayias has pleaded guilty to swindling more than $1.18 million in payments from a construction company for ongoing work on a ghost project that was never approved.

In June 2020, a court heard Mr Vertzayias will be sentenced for dishonestly obtaining $1,185,355.74 from CBC Group after scamming them with fake invoices and phony government documents between November 2014 and December 2015.

Court documents revealed how Vertzayias was enlisted to make a rezoning application to Hurstville City Council for an industrial site in The Crescent Kingsgrove.

Vertzayias, a competitive bodybuilder, was solely responsible for managing the planning proposal and organising payment for contractors on behalf of CBC Group.

According to court documents, that allowed him free reign to claim payments for work that never existed by forging invoices from companies engaged in the early planning stages.

They revealed how the proposal was twice rejected however Vertzayias kept this secret from CBC Group and would later provide fake council minutes and letters.

Vertzayias was eventually caught out after a CBC executive asked for minutes of the council meetings. His sentence hearing will be held on October 30 at the Sydney Downing Centre.

Woman defrauds $371K from welfare group

A Central Coast woman’s “horrendous” gambling habit saw her defraud $371K from an Aboriginal health service in Nowra.

Carly Myranda Regan, 30, was sentenced to two years jail, with a non parole period of one year in July 2020 after pleading guilty to one charge of obtaining financial advantage by deception.

The court heard that between March and September 2018 Regan used her IT position at Waminda to purchase 163 mobile phones, 158 of which were sent to her home address and the other five to a Travel Lodge in Sydney where she was staying for work training courses.

She then on-sold the phones through Facebook and various other online marketplaces.

She resigned from Waminda after people started asking why the Telstra bill was rising to $8000-$9000 a month and a whopping $18,000 in August 2018.

The total loss to Waminda was $371,798.97.

The court heard Regan carried out the scam to fund her gambling habit.

Southern Highlands socialite jailed for fraud

Annabel Walker, from Bowral, was jailed in September 2020 for stealing tens of thousands of dollars from a string of unsuspecting victims before splashing out on swanky restaurants and luxury hotel stays.

Walker pleaded guilty to a raft of charges including multiple counts of dishonestly obtaining financial advantage by deception relating to when she was an administrative assistant for Aust. Leisure Group.

The court heard while working at the company and living in Sydney’s eastern suburbs she scammed $17,198.62 between February and May 2019 using her boss’s credit card.

She also stole money from her landlord and other businesses including painting consultancy Steady Hand Studio and Fire Fly Lighting.

In court Walker read out a letter saying she was constantly in an “irrational” state of mind and acted on “pure adrenaline” describing it as an “out of body experience.”

Walker was sentenced to a total of 18 months in jail with a 12-month non parole period.

Sophisticated interstate luxury car fraud syndicate busted

Two men were convicted at Campbelltown Local Court in 2019 over their roles in a fraud syndicate which sourced luxury cars from across NSW and Queensland.

Macquarie Fields panelbeater Hilal Merhi and Sans Souci man Mohamad Alameddine were arrested in 2018 and both were charged with driving, storing and even crashing the luxury cars.

The court heard fraudulent documents were used by the elaborate criminal enterprise to secure $4.5m in loans for a collection of luxury vehicles, including Mercedes Benz AMG, Holden Commodore GTS and Holden HSV Club Sport, before onselling them for profit.

Major players in the syndicate included Monstr Clothing founder and accused bikie Shane Ross who died a week after being convicted in Queensland. His business manager Scott Stoneman was also convicted.

The court heard Merhi would operate for Mr Ross and registered a number of vehicles for the fraud syndicate. Merhi and Alameddine’s defence team told the court the pair never made any money from the scheme.

They were both convicted of dealing with the property proceeds of crime and placed on an 18-month and 15-month Intensive Correction Order.

Former accountant defrauded business of $200K

A Lake Macquarie woman escaped jail in August 2020 for fraud offences totalling more than $200,000.

Accountant fraudster Kylee Pryor pleaded guilty to dishonestly obtaining financial advantage by deception when she defrauded Farrell Transport while working at Valley Accounting and Taxation Services in Cardiff.

The court heard that between 2011 and 2016, Pryor conducted 178 electronic transactions unlawfully — totalling $201,105 — from Farrell Transport to Metal Steel Haulage (MTH), before transferring the money into several personal accounts.

Pryor was previously convicted in November 2018 for similar offences again involving Farrell Transport.

In Toronto Local Court, Magistrate Andrew Eckhold said full time imprisonment would not help to get any money back for the victim. Pryor was given a compensation order and sentenced an 18 month ICO, along with 300 hours of community service.

Blind toy poodle sold as part of scam operation

It appeared to be the perfect pet until its new owner discovered Shiny the toy poodle was blind and double the age advertised.

Ingleburn beauty Jenna Heaslip, a former animal welfare volunteer, used Shiny as part of an elaborate fraud operation which saw her roll in thousands of dollars.

Heaslip was convicted in 2019 for dishonestly obtain financial advantage by deception and placed on a two-year Community Corrections Order.

Court documents reveal a woman viewed Shiny at Heaslip’s home in December 2018 and purchased the toy poodle for close to $1500.

Following the sale, the owner quickly noticed something just was not quite right. Two visits to a vet revealed all and when confronted by police, Heaslip said Shiny was not even her dog.

Heaslip was also convicted earlier in July 2019 after lying about the age, breed and medical history of dogs and fleeced close to $5000 from nine victims sprawled across eastern Australia, including Newcastle, Orange, Canberra and Melbourne.

Woman guilty of defrauding bushfire grants scheme

A Hunter woman will be sentenced for defrauding a NSW Government agency out of $60,000.

Tiffany-Anne Brislane-Brown pleaded guilty to six counts of dishonestly obtaining financial advantage by deception at Belmont Local Court in September 2020.

The court heard Brislane-Brown used different bank accounts, emails and phone numbers to scam Service NSW out of $60,000, claiming she was a business that had been affected by the bushfires.

She made 24 applications during April and May for the small business bushfire/COVID-19 $10,000 grant scheme, with each application using a distinct ABN. She was eventually caught by Lake Macquarie Police who were investigating fraud offences against Service NSW.

Brislane-Brown attracted media attention in January when she had a crack at Newcastle Police for posting an unflattering photo of her when she was wanted for other offences.

“It’s not everyday I look like trailer trash. Let’s just say it wasn’t a good angle, shall we,” she posted.

Serial fraudster guilty of online pets scam

A Harrington Park man was exposed as a serial fraudster after scamming thousands of dollars through dodgy sales of dogs, kittens and furniture.

In July 2020, Joel Blayden Craig Ferguson pleaded guilty to a string of fraud offences in which he tugged on the heartstrings of wishful pet owners.

Court documents state Ferguson would monitor Gumtree for ‘wanted pet’ advertisements, in which he would then prey on the target and pose as a breeder.

In April, Ferguson sent photos he had ripped off the internet of a French Bulldog and received $2000 for a sale which never took place.

The court heard he also contacted a woman after a ragdoll kitten and provided a series of photos of kittens, his driver’s licence and Kittens NSW registration. When the victim said she wanted to back out of the sale, he threatened her with legal action which saw him receive the $700 sale fee shortly after.

Ferguson also posted a Facebook Marketplace advertisement selling furniture in which he negotiated a sale price of $750 but never delivered the goods.

The court heard Ferguson was a problem gambler.