Central Coast Council financial crisis: Business recovery plan phased out

As Central Coast Council’s business recovery plan is set to be phased out, it has been revealed what actions saved the organisation from “immediate liquidity”.

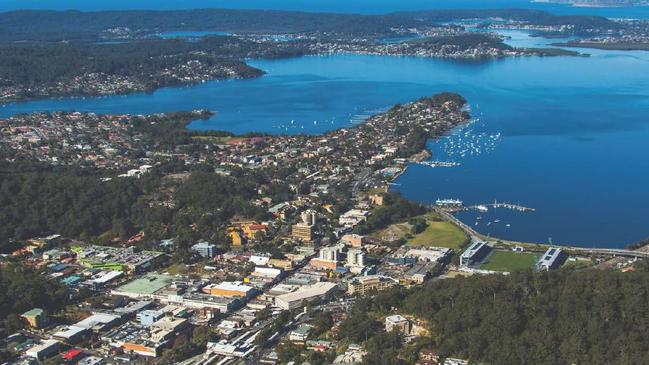

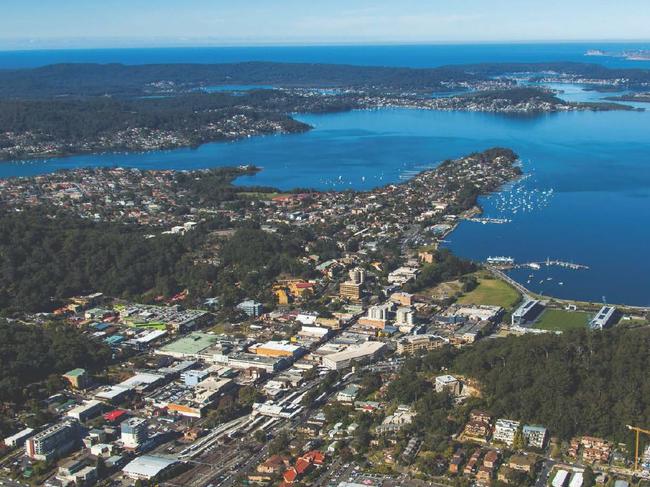

Central Coast

Don't miss out on the headlines from Central Coast. Followed categories will be added to My News.

It has been just over four months since the bombshell of Central Coast Council’s financial crisis was announced.

The past few months have uncovered shocking revelations as the council combats a $565m debt accumulated over the past four years.

When news of the “liquidity issues” hit on October 6, 2020, a financial tactical team was established to undertake a 100 day plan.

The plan, since renamed the business recovery plan, is set to be phased out at Tuesday’s council meeting to be held in Gosford.

The council will table its final business recovery report, which reveals that 72 per cent of the plan has been completed with the remaining 28 per cent to be absorbed into business as usual.

The financial tactical team will also discontinue.

“Council is continuing to closely monitor, track and reconcile its cash position daily,” the council report states.

“Council’s immediate liquidity situation has been resolved following the securing of the $150m loans and a Long Term Financial Plan has been developed to forward plan the repayment of the restricted funds over the next 10 financial years.”

Interim Administrator Dick Persson was brought in following the suspension of councillors and revealed the extent of the financial situation, with council looking at $565m worth of debt accumulated over the past four years which includes $200m worth of restricted funds unlawfully used by council.

Cash preservation was a major theme of the business recovery plan.

Here are some of the highlights of what’s been achieved to date:

■ $54.8m reduction in capital expenditure for the 2020/21 financial year

■ $11.9m reduction in materials and contracts

■ Securing of $150m in commercial loan

■ 40 per cent reduction in overtime

■ Review of IT equipment, licences and contracts

■ Identification of $50m worth of underperforming property assets to commence

the first tranche of asset sales

■ Workforce review finalised and total employee budget target identified

■ Commencement of workforce cost reduction initiatives

The plan involved all staff at council, with the financial team giving them the opportunity to come up with ideas to help.

An “opportunity log” was created and received 138 ideas with 90 considered feasible and under further investigation.

Council also indicated that a forensic audit into council’s financial situation will come to the council meeting set down for March 9.

We’re still here for you. For trusted news that matters, and to support local journalism, go straight to the source:

>> Visit the Central Coast Express Advocate

>> Get local news direct to your inbox. Search and sign up for the Express Advocate here: https://www.newsletters.news.com.au/dailytelegraph

>> Find us on social: Twitter or Instagram

EARLIER:

Central Coast ratepayers’ dud deal revealed

By Fiona Killman,

February 8, 2021

A 15 per cent rate rise across the Central Coast would only be applied once but remain permanently in the rate base from the 2021/22 financial year.

At Monday night’s council meeting, interim administrator Dick Persson voted to apply to the Independent Pricing and Regulatory Tribunal (IPART) for the 15 per cent increase, which includes the annual 2 per cent rate peg.

Mr Persson reiterated to the community that a rate rise was vital for helping council out of its financial crisis, resulting in $26m per year in savings.

“I hate being involved in a rate increase. I believe there is no choice,” he said.

“I am convinced this is the best solution for this community.”

Mr Persson explained it simply, saying that if council was an orange then “we’ve squeezed the living daylights out of it” in terms of making cuts.

“It’s our view that you get to a point that if you make further cuts you risk irreparable damage to an organisation,” he said.

“To the people who say no rate rise, more cuts, be careful what you wish for.”

Acting chief executive officer Rik Hart said no rate rise would see remaining council assets deteriorate and services close.

However he said even with a rate rise, people will still see a slight reduction in service levels as well as no additional capital works projects due to the dire financial situation.

Council’s current measures to manage costs and increase income include staff reductions to the tune of $31m, $22m on spending restrictions and $49m in asset sales. Infrastructure spending has been reduced from $225m to $170m.

Mr Hart said these steps only achieved 70 per cent of the $76m annuals savings targets needed in the financial recovery. The remaining 30 per cent needs to come from a rate rise.

Mr Persson has copped backlash over the proposed rate rise, however has remained firm that there is no one else to pay. He said the alternative was further cuts to council’s services.

He has also stressed that when rates are harmonised between the former Gosford and Wyong councils, a 15 per cent rate rise would mean that average rates in the former Wyong area would go down by $3 a week and average rates in the former Gosford area would go up by $7 a week.

“It is also a fact that even with a 15 per cent rate rise Central Coast Council rates would still be below the neighbouring councils of Newcastle, Maitland and Lakes Entrance,” he stated in his three month progress report into the crisis.

“I have been supporting a rate rise because I can’t see any other way out of this mess we find ourselves in. I accept I will cop criticism from many, but in the end, I need to do what I feel is necessary.”

Council’s financial crisis became public in October 2020, with councillors suspended following the announcement that the council could not pay staff wages.

Mr Persson was appointed to get to the bottom of the issues and revealed in December that the council was looking at an accumulated debt over the past four years of $565m. This includes $200m to be paid back for the use of restricted funds.

He outlined many factors for the financial decline including costs to upgrade IT systems and infrastructure, an industrial dispute, the IPART pricing determination for water services, an increase in 250 staff since the merger and council embarking on a $242m capital works program that it could not afford. This resulted in the unlawful use of restricted funds.

Since then, many strategies have been put in place including securing loans, staff cuts, identifying assets to sell and the proposed rate rise.

Last week, local Labor MPs called for a public inquiry into what they describe as the “failed amalgamation of Central Coast Council” on the back of the proposed rate rise and job losses.

“We are calling on the State Government to establish a public inquiry into the collapse of Central Coast Council, the Terms of Reference of which must examine the financial position of the former Wyong and Gosford Councils before amalgamation as well as the structural weaknesses of the new council which the Liberals created in 2016,” Wyong state Labor MP David Harris said.

The Entrance state Labor MP David Mehan said it was not acceptable for the community to foot the bill when a significant proportion opposed the 2016 amalgamation.

Mr Persson has pointed out that the only significant cost to council directly related to the amalgamation was for upgrading IT systems and infrastructure. This amounted to $50m, with $8m ongoing, and council received a grant of $10m from the State Government towards these costs.