IPART approve rate rise in Central Coast, Hunters Hill, Cumberland, Kyogle and Snowy Valleys councils

Five local government areas across NSW are set to experience a significant rate rise. See which communities will be hit here.

Central Coast

Don't miss out on the headlines from Central Coast. Followed categories will be added to My News.

Residents in five local government areas across the state are set to receive a hit to their hip-pocket after council applications for rate rises were approved by the Independent Pricing and Regulatory Tribunal.

Residents on the Central Coast, Cumberland City, Hunters Hill, Kyogle and Snowy Valleys will see changes to rates following IPART’s approval of applications.

Central Coast residents will be slugged with an extension of the temporary 15 per cent increase until 2031 in an effort to repay $150 million in emergency loans and secure the council’s ongoing financial sustainability.

Cumberland Council was successful in its approval of a minimum rate rise to $715 in 2022-23, $785 in 2023-24 and $860 in 2024‑2025 in an effort to harmonise rates.

Independent Cumberland councillor Joseph Rahme deemed the rate rise unnecessary following the council’s forecast $3.5 million surplus.

“I think it’s a kick in the guts to all residents because despite the message that Labor’s trying to push, this isn’t a compulsory rate rise and the magnitude of the rise was never forced,’’ he said.

Labor councillors who backed the rise said it was because the state government forced councils into a difficult fiscal position.

Cumberland ratepayer Roydon Ng residents were entitled to sound financial management.

“It is imperative that the entire Cumberland LGA benefits holistically from the increased rates given hardships in the area and forced council amalgamations,” he said.

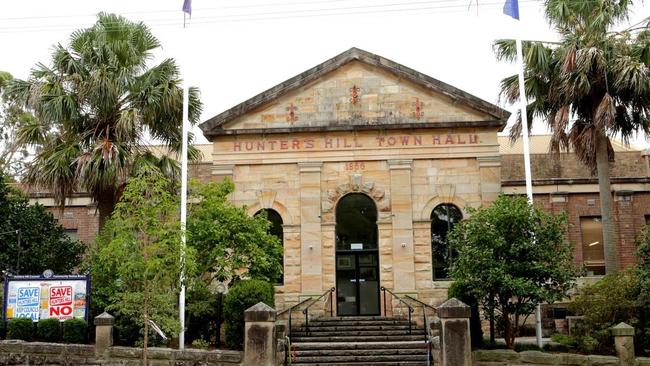

In Hunters Hill a special variation will result in a permanent increase of 16.9 per cent in 2022-23 and a further 7.8 per cent in 2023-24 for residential and business ratepayers.

Kyogle residents will see a permanent 2.5 per cent increase in 2022-23, applied across residential, business and farmland ratepayers.

While residents in the Snowy Valleys will see an increase of 15.7 per cent in 2022-23 and 17.5 per cent in 2023-24.

IPART chair Carmel Donnelly said the submissions of ratepayers were considered.

“We considered community concerns along with the councils’ demonstrated need for additional revenue to ensure financial sustainability and service provision,” she said.

“The councils were required to consult with the community, establish that the impact on ratepayers is affordable, and make productivity and cost savings.

“The conditions for Central Coast and Hunters Hill councils’ special variation approvals require them to spend the additional income on the specific purposes outlined in each of their applications.”

Central Coast, Hunters Hill and Snowy Valleys councils are also required to report to the community about how their additional revenues are spent.

‘We’ll have to cop it!’ Residents react to council’s 26% rate hike

Ratepayers in Sydney’s north will soon have their rates increase by 26 per cent in a move set to hit households with a new set of cost of living pressures.

The Independent Pricing and Regulatory Tribunal (IPART) has given the green light for a special rate variation application lodged by Hunters Hill Council to address its growing deficits and infrastructure backlog.

The increase means residential and business ratepayers will see a permanent increase of 16.9 per cent in 2022-23, and 7.8 per cent in 2023-24, leading to a cumulative rise of 26.02 per cent over the next two years.

The council – which at 6 sqkm measures as the state’s smallest local government area – is predicting the increase to cost average households about $3.50 extra per week, or $180 per year.

The council’s application to the IPART stated the increase would help it fund $212 million of assets and complete infrastructure works such as footpaths, kerbs, gutters and seawalls.

“Overtime, the condition of our key infrastructure will deteriorate to a level that will result in operational inefficiencies and increased maintenance expenditure if sufficient funds are not provided to effectively maintain and renew,” the council said.

The decision has drawn a mixed response from locals at a time when many are already feeling the pinch of rising grocery, fuel and power prices.

Gladesville local Mario Moniarci believed the council should look at other ways of plugging its revenue black hole.

“It’s a terrible time for people – we’re all coming out of a pandemic and what more of a curveball can you throw at people?” he said.

“People will have to pay it because what choice do you have? If you don’t pay it on time you end up getting charged nine per cent if it’s late so it only ends up costing you more.”

Georgina Youssef, who owns 2 Doors Down Cafe in Gladesville, said there could be a flow on effect to local business.

“Everything is going up in life at the moment with the food and petrol and rates going up as will make more people struggle,” she said.

“If people have less money, they’ll be spending less and that will hurt the local businesses.”

Hunters Hill resident Caylene Hansen, who lives on Alexander St, said she did not mind paying the increase.

“I’m one of those people who feel incredibly fortunate and privileged to live in Hunters Hill. Everything’s going up at the moment so why shouldn’t rates go up too? We’ll just have to cop it,” she said.

“The potholes on the roads need to be fixed so if the money can be used for things like that then I support it.”

Hunters Hill Council’s recently elected mayor Zac Miles – who originally opposed the rate hike – said the rate increase would address a maintenance backlog he said had been overlooked by previous terms of the council.

“I originally thought the rate rise was premature – that being said IPART has made a determination so hopefully it will see the council get back into the black and into a more positive financial position,” he said.

“We have to get on top of the deficit budgets because otherwise the local infrastructure will continue to fall behind and deteriorate.

“I recognise it is a big increase and we’re conscious everyone’s doing it tough at the moment and that’s not going to change in the foreseeable future with cost of living pressures increasing.

“At the end of the day, the council needs to have a positive operating position and that’s our job – to make sure the council is financially stable.”

Mr Miles said the demographics of Hunters Hill meant ratepayers in more affluent suburbs including Woolwich would incur the biggest increase on the rate notices, dropping in suburban parts of the local government area such as sections of Boronia Park and Gladesville.

The council said it had a financial hardship policy in place providing assistance to ratepayers experiencing genuine hardship. There are also pensioner concessions in place.

SEVEN YEAR RATE HIKE LOCKED IN

Central Coast residents will be paying the 15 per cent rate rise until 2031 thanks to Central Coast Council’s 2020 financial crisis.

The Independent Pricing and Regulatory Tribunal (IPART) announced it had approved the council’s application to extend the current increased tax rate, which came into effect in 2021.

The variation, lodged by the council in February, will see the extension of the temporary 15 per cent rate increase for a further seven-year period, from 2024-25 to 2030-31.

The rise, brought about due to the financial crisis which saw the council plunge $565 million into debt, was approved by IPART in May 2021 for three years and equates to an additional $26 million in income per year.

The council lobbied for the extension to help repay $150 million in emergency loans and secure its ongoing financial sustainability. The message to residents was if the extension was not approved, the council would make further cuts.

Central Coast Council has issued a statement in support of the decision which Administrator Rik Hart described as “sensible” in order to ensure the completion of the council’s Business Recovery Plan.

“This outcome allows council to continue to maintain current service levels, comply with current banking requirements and most importantly, allows us to continue without interruption our 10-year long-term financial plan that provides long-term financial stability for the organisation,” he said.

“It’s a decision that factors in the unique situation this council. We’ve achieved one of the most significant financial turnarounds of any organisation in under 12 months, with the current and forecasted surpluses repaying the emergency loans over the next 10 years.”

Mr Hart reiterated that for the community, there is no increase in rates, describing it as a “continuation of the current rates you pay with the exception of the rate peg as determined by IPART every year”.

Council’s chief executive officer David Farmer said this major milestone would draw a line under the council’s financial crisis.

“We are currently performing better than budget, with a high level of staff vacancies, but we know this is causing difficulty in our delivery of services to our customers in a number of areas,” Mr Farmer said.

“I recognise this has been a difficult time for the community, and I thank you for your patience, understanding, and for your comments and contributions about what needs to be done to improve Council and services.”

Bensville’s Kevin Brooks, who has been publicly against the extension, said IPART was supposed to protect customers from “monopoly pricing, but once again it has ignored community feedback”.

“Throwing extra money at poorly managed organisations rarely improves performance. It merely reduces the incentive to reform,” he said.

“Last year, IPART concluded council only needed Special Variations for three years. Now, rate hikes are to be extended out at least ten years. What has changed in just 12 months?

“Council certainly hasn’t changed its position that it only needs $110m from rates to repay the loans (the rest coming from asset sales) – so why is it now getting an extra $250m?

“Most of the extra money isn’t to repay loans at all, but to fund ongoing deficits that still haven’t been brought under control by an inefficient bureaucracy.”

Ourimbah resident Michelle Goddard said the coast would now be stuck with council’s financial crisis for the next nine years.

“This money is coming out of our pockets at a time when cost of living is a real issue,” she said. “It’s a really tough pill to swallow.”

Wyong state Labor MP David Harris said the decision was a concern to struggling local residents.

“The current financial situation for many ratepayers is dire given the increase in interest rates, higher inflation and the pressure on mortgage and rent payments,” he said.

“It is more important than ever, that Central Coast Council, has generous provisions in place to assist people in genuine need when it comes to rate payments. With rising costs of living, stagnant wages and now increasing interest rates these rate increases could not have happened at a worse time.”

Former Wyong Ratepayers Association spokesman and long-time local government commentator Kevin Armstrong said in the end IPART “didn’t have much choice” other than to lock in the rate rise.

He said to do otherwise would have risked another “massive restructuring process”, which would have caused further disruption to services and could have jeopardised the repayment terms of council’s emergency loans.

Mr Armstrong said the financial calamity had its origin in the forced council amalgamation.

“It was a comedy of errors from conception to the birth,” he said.