The home wreckers fleecing Aussies of millions — signing them up for houses that are never finished

A FORMER prominent SA footballer is a key figure behind a national cold-calling property investment scam fleecing millions of dollars from victims by signing them up for houses that are never finished.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

READ BELOW: Frustrated investors hit a brick wall

A FORMER prominent South Australian footballer is a key figure behind a national cold-calling property investment scam fleecing millions of dollars from victims by signing them up for houses that are never finished.

Colin MacVicar – who played 186 games for Woodville alongside the likes of Malcolm Blight and Ralph Sewer, and 78 games for Glenelg alongside Peter Carey and Graham Cornes – is one of three directors of Members Alliance.

A six-month investigation by News Corp Australia reveals one of the biggest names in the unregulated investment property sector is suspected of duping lenders into handing over money for work that hasn’t been done by resubmitting old progress payment forms without even changing the dates.

The investigation into the Members Alliance group has also found an investor released funds after receiving photos said to show construction at the site only for it to emerge the pictures were not of the investor’s house.

Owners have little idea there is a problem until they are deep in debt and with no prospect of getting a finished home because the properties they are sold are typically thousands of kilometres and multiple plane flights from where they live.

In dozens of cases, houses meant to be finished as far back as 2014 are still incomplete, devastating buyers who have been left with large loans, no rental income and, in some instances, without access to insurance to finish jobs.

“You try to get ahead and this is what happens. I should have bought a V8 and a jet-ski like everyone else,” said one victim, Pippa De Beaux.

Some face bankruptcy, while others are working extraordinary hours to avoid foreclosure. Some have had to delay starting a family.

One investor threatened to kill himself in a Members Alliance office after he went from having a small amount of debt on his home to two mortgages on it and two on an investment property plus $50,000 owing on a credit card he said it arranged.

Members Alliance — which pushes house-and-land packages mainly in rural Queensland and country NSW to investors across Australia — has been under investigation by fraud detectives and building authorities for several months.

“The Queensland Police Service is investigating a number of fraud complaints referred by the Queensland Building and Construction Commission,” a QPS spokeswoman said. The probe is ongoing.

Queensland’s Housing Minister Mick de Brenni said: “Fraud and predatory behaviour, like what has been alleged in this case, is reprehensible. I’ve asked the QBCC to provide me with advice on how it might deal with cases of suspected fraud.”

What the QBCC has found has also been referred to the national Phoenix Taskforce after 18 Members Alliance group companies went into voluntary liquidation late last month. The Phoenix Taskforce — which includes the Australian Taxation Office, Australian Securities and Investments Commission and NSW Police Force — pursues companies that deliberately liquidate to avoid paying debts then transfer assets to a new entity and keep operating. The failed Members Alliance group companies owe $29 million to the ATO, the liquidator said.

News Corp Australia has seen several sets of progress payments forms that are suspected of being fraudulent. In one set:

* the date on the house frame claim is earlier than for the base and the same as for the deposit;

* on the frame claim there are ticks in both the “frame” and “deposit” boxes; and

* on the subsequent claim for being “enclosed”, most of the deposit box has disappeared.

Yet the bank, ANZ, released the funds. It is investigating about 20 Members Alliance group loan files on suspicion of “misconduct” such as funds being drawn down without work being completed. The bank is also “looking at our processes” and assisting Queensland Police.

After being quizzed about its lending to MA clients, a spokesperson for ANZ said the bank has been treating this matter very seriously and they have been assisting both the Queensland Building and Construction Commission and the Queensland Police with their inquiries.

“We’re actively identifying customers who might have been impacted and we will be working with these customers on an individual basis to provide the necessary assistance,” the spokesperson said.

“Our starting position is that we will do the right thing by customers that have lost out through no fault of their own.

“We are also looking at our own processes to identify what further measures we can take to protect customers against misconduct by third parties.”

News Corp Australia has seen photographs sent to an investor as proof her kitchen had been completed in an email urging her to call her bank to release more funds. She did so. But the photographs were of another house. This emerged last week when a new builder appointed to complete the Monto, Queensland job sent images showing what was actually there — including a totally different kitchen.

A law firm representing the three Members Alliance group directors — Richard Marlborough, David Domingo and Colin Macvicar — as well as former CEO Andrew Marco, said the Monto photos did not “reflect a sample sufficient to more accurately reflect the volume of building works that were undertaken”.

In relation to other payments being obtained prematurely, the firm said this “would at best represented as an isolated incident” that its clients were not aware of to the best of their knowledge.

The firm said “a mere suspicion of fraud should be taken to be unsubstantiated until it is supported by real evidence” and that its clients were “not aware of any … investigations that are presently ongoing, and in particular of any proper investigation with the Queensland Police”.

The firm said there were “only 31 incomplete houses ... which could be subject to a claim under the home warranty insurance scheme”.

The cost to complete these was about $2.9 million but the “at-risk balance of incomplete works ... which we say is insured is approximately $800,000”.

It’s understood the QBCC and NSW building authorities have received at least 100 complaints from investors.

THE MEN BEHIND THE LUXURY GATES

Which luxury car do I follow? The Ferrari? The Rolls? The Bentley? Or the Jaguar with massage seats?

I’m trying to heed the advice of the man pictured — the former CEO of Members Alliance, Andrew Marco (real name Andrew Markovitch).

And that advice is find the directors and ask them what went wrong.

It’s not as if I haven’t been trying. That morning, shortly after dawn, I had driven into one of the Gold Coast’s most exclusive golf estates, home to two of the group’s three directors.

Director Richard Marlborough’s mansion is perhaps the finest property at Hope Island Resort. Its features include a private putting green. Fellow director David Domingo lives around the corner, behind a different gate.

Within 15 minutes of entering the resort I was escorted away by security guards who threaten to call the police and pursue trespassing charges if I don’t provide my driver’s licence details.

The next day I attempt to find Mr Marlborough at the Sanctuary Cove International Boat Show, without success.

The problem is working out which car to track from Hope Island resort. I could try following the Ferrari Mr Marlborough is said to have owned. But there’s every chance he might come out in his Rolls Royce Ghost or Bentley or one of his Mercedes.

And I’ve got to keep one eye on the other gate in case Mr Domingo exits in his Jag — the one with massage seats.

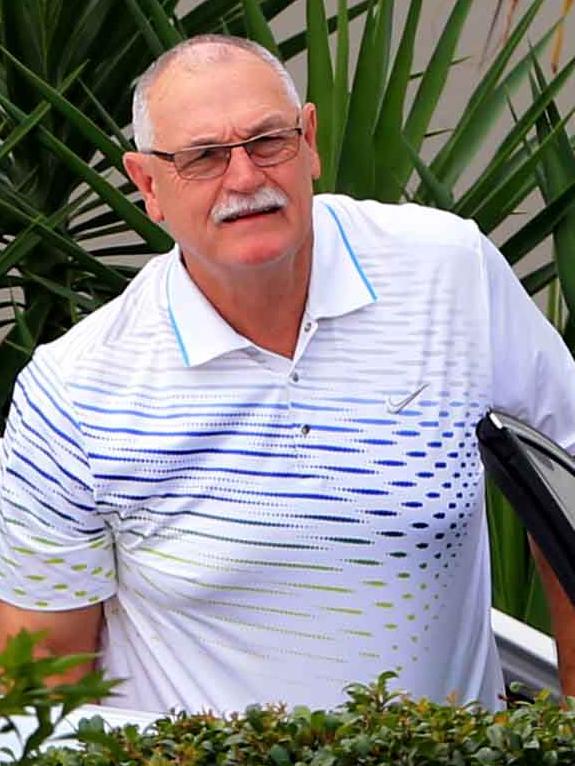

The other former Members Alliance director, Colin Macvicar, lives in a different gated estate. Shortly after I make it inside that cloistered community he pulls up in his Mercedes-Benz coupe after a round of golf.

The former South Australian Aussie Rules star also denies knowledge of loans being drawn down before building work had been done, or use of false photos. He said he had no involvement with Members Alliance’s construction subsidiary, Image Building.

But you were a director, I point out.

That was only to sell an asset, he said.

His involvement in Members Alliance was limited to “lead generation”, he said.

Records show he was a director and secretary of several Members Alliance group companies.

The man with the title of CEO, Mr Marco, claims he doesn’t know of any wrongdoing and wasn’t responsible anyway.

I caught up with Mr Marco after he had returned from a family jaunt in his $120,000 Mercedes Benz SUV. Standing outside his Gold Coast waterfront property he told me: “I was just a staff member.”

It was more of a “sales manager role”.

He stresses that he was never a director of any Members Alliance company.

“I’m the wrong person to be asking” about what went wrong.

Mr Marco told me he was “not aware” of a practice said to be known within the group as “pre-claiming”, where investor loans are unlawfully drawn down before building work is done.

However a letter signed by Mr Marco sent to an investor acknowledges “amounts were drawn down prior to the required dates”. The letter blames this on the previous management of wholly-owned subsidiary Image Building.

Why not just ring Messrs Marlborough and Domingo, you might ask. I tried that — and texting — too. Mr Marlborough never answers or responds.

As for Mr Domingo, he’s put the telecommunications equivalent of a golf-estate security gate between himself and my messages. “He’s blocked your number,” the company PR man says.

HOW IT WORKS

THE SOLUTION

Politicians need to tell the bureaucrats who run home warranty insurance to take a more lenient approach to assessing claims from Members Alliance victims.

That is the first thing that needs to happen to fix this mess.

In many cases it has been impossible for owners to claim against home warranty insurance because payments made for work not done aren’t covered.

Others voided their protection when they moved from one Members Alliance building subsidiary to another, or to a different builder.

Then there are those who have been unable to make a claim because they have been receiving damages payments from the subsidiary builders — of as little as $1 a week.

Questions must be asked of the banks that doled out money after receiving forms that were clearly forged.

It’s all well and good for ANZ to run advertisements promoting its “Falcon” anti-fraud protection system. But what’s the use of that if the bank isn’t even checking the date on progress payment forms?

Evidently its verification procedures are deficient, which should be of concern to their millions of customers — and shareholders.

It is also arguable these lenders should be sending someone to sites to ensure work has been done in circumstances where the borrower lives thousands of kilometres away.

Yes, there will be costs to the borrower. But in retrospect many Members Alliance clients would now be only too willing to have paid.

And thought needs to be given to whether investment property needs greater regulation. At the moment, it’s open slather.

DO YOU KNOW MORE? EMAIL JOHN.ROLFE@NEWS.COM.AU

LIKE THIS REPORTER’S WORK ON FACEBOOK: WWW.FACEBOOK.COM/PUBLICDEFENDERCOLUMN

Frustrated investors hit a brick wall

By John Rolfe and Steve Rice

THEY are ordinary people whose hopes were nothing more than to have enough to live reasonably in retirement. But Members Alliance has put paid to those dreams.

Among them is Paradise couple Paul and Ligliwa Otta, who were cold-called by Members Alliance in late 2014.

For the past year they have been paying interest on a $300,000 loan for an unfinished property in Monto, Queensland

“I just put my head in the sand. I don’t even know what the situation is,” Mr Otta said.

“I haven’t even seen the building since they sent through a photograph. Hopefully we will be able to do something with it.”

Mr Otta, 58, estimates he has paid about $7000 of the loan but has put off following up on where he currently stands.

“The bank knows about (Members Alliance) so they are now in a position where they won’t release any further money,” he said.

The Sunday Mail took some investors to a cul-de-sac in the central NSW town of Parkes to see their nightmare.

Where lawn should be growing there was a dead rabbit and tumbleweeds.

Pippa De Beaux, a mining engineer from Darwin, looked around and through her half-finished house.

“The stress has been unbelievable. It’s affecting how I can do my job. I’m taking on a lot more hours to cover what I have to pay,” she said. It was two hours and 150km before she was able to talk again.

The shell of a home to the north of hers is owned by Satomi and Bronson Hetet from the Gold Coast. Little, if any, building has gone on here since 2014.

“We were planning to start a family about a year ago but that’s not been possible with these kinds of problems,” Mrs Hetet said.

To the south of Ms De Beaux’s property is that of the Montebello family of Perth.

Peter and Leanne Montebello’s daughter Paige wants to go on The Voice because she thinks it will help her make enough money to get her parents out of their investment property nightmare.

Their son Jack recently gave up an overseas school trip because he knew his mum and dad were cash-strapped.

“I really need to sell this house because we’re going bankrupt fast,” Mr Montebello said.

The most decrepit Members Alliance property belongs to the Valenti family of Melbourne. It is at Pimpama, between the Gold Coast and Brisbane. Rubbish is piled high outside. Parts of the frame are warped from exposure.

Rita Valenti can’t understand how much money has been chewed up, considering the state of the property.

They were told by Members Alliance they had no future if they didn’t get into investment property.

“Without this, we’d be debt-free,” Mrs Valenti, who’s had to return to study to get a higher-paying job, said.

Building authorities rejected her insurance claim last week because the family transferred its construction contract to a second Members Alliance building subsidiary not realising that would void the home warranty cover.

Originally published as The home wreckers fleecing Aussies of millions — signing them up for houses that are never finished