Queensland to bear brunt of bank closures with Heritage Bank to axe 11 branches

Queensland has been the hardest hit in the latest round of bank branch closures announced by People’s First Bank, with 100 positions affected.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

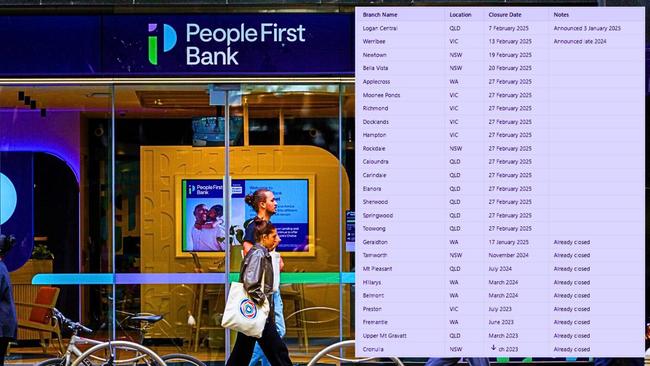

Queensland will bear the brunt of the latest round of bank branch closures with nearly 100 jobs expected to be affected when People First Bank shuts 18 branches across the nation before April.

Finance Sector Union national assistant secretary Jason Hall said Queensland would be the hardest hit with 11 Heritage Bank branches and seven People’s Choice branches to close.

Heritage Bank is now part of People First Bank after it merged with People’s Choice Credit Union in March 2023, creating a new national mutual bank.

The 11 Heritage branch closures will be at Beenleigh, Brookside, Capalaba, Indooroopilly, Mermaid Waters, Nambour, Nerang, Noosa Civic, Strathpine, The Pines Elanora, and Victoria Point.

The closures follow People First Bank’s decision in January to reduce operating hours at four Toowoomba-region branches.

The move also extends beyond Queensland, with the loss of branches in regional towns including Gawler and Victor Harbor in South Australia, Warrnambool and Maryvale in Victoria and Darwin in the Northern Territory.

Mr Hall said the People First Bank closures, all due by April 4, were a devastating blow to banking staff and customers and accused the bank of prioritising profits over people.

“These aren’t the first branch cuts of 2025, but they are the largest,” he said.

“It also really plumbs the depths of irony for a bank calling itself People First to start their new brand by slashing branches and staff, putting last the people they claim to put first.

“This is an attack on regional communities that depend on local bank branches.

“These closures come as families focus on getting their kids back to school, and yet here we have a bank sneaking out savage cuts that will leave thousands of customers in the lurch.”

Heritage Bank chief customer officer Maria-Ann Camilleri defended the decision and argued that declining in-person banking transactions made maintaining branches unsustainable.

She said the Beenleigh branch was an example of declining in-person patronage with the bank claiming it only had 59 regular monthly customers.

“We know the important role branches play in local communities, so these decisions are only made after much careful consideration,” she said.

“There has been a sharp decline in physical banking, and branch transactions now account for less than 1 per cent of all customer interactions.

“Increasingly, our customers are choosing card payments, ATMs, internet Banking, and our App for their day-to-day banking.

“While these decisions are challenging, we need to prioritise the services our customers use most.

“This means reallocating people and resources to higher-demand areas, such as our 24/7 contact centre, and investing in technology to meet customers’ need for simple, convenient digital banking.”

Ms Camilleri said all impacted staff would be offered alternative roles within the bank, and that customers would be provided with guidance on alternative banking methods, including fee-free deposits and withdrawals at Australia Post outlets via the Bank@Post service.

The closure of Beenleigh’s Heritage Bank branch marks another financial services blow to residents in Logan’s federal seat of Rankin held by ALP Treasurer Jim Chalmers, following branch shutdowns by the Bank of Queensland in Springwood and Logan Central last month.

Mr Hall called on Mr Chalmers and Assistant Treasurer Stephen Jones to implement recommendations from last year’s Senate Inquiry into rural banking.

He asked for minimum standards to be introduced to ensure all Australians retain access to face-to-face banking services.

“It’s been nine months since the Senate Inquiry handed down its report, and we’ve heard nothing from Stephen Jones,” Mr Hall said.

“How much longer do Australians have to wait before this government takes action to protect banking access?

“The removal of branches and ATMs is designed to boost profits while reducing services. Banks are cutting services on a whim with no regard to local needs or preferences.”

The 18 People First Bank branches will close permanently at 4pm on Friday, April 4.

More Coverage

Originally published as Queensland to bear brunt of bank closures with Heritage Bank to axe 11 branches