Opposition accuses Labor of broken promise over changes to superannuation concessional tax

The Coalition has slammed the government for a major superannuation change they claim is a breach of trust, after Labor’s plan to overhaul a tax concession kicked into a new gear.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Anthony Albanese has been accused of breaking an election promise after announcing that Australians with more than $3million in superannuation would lose tax concessions.

The prime minister promised during the election campaign that he would not make any changes to super if Labor was elected.

“We’ve said we have no intention of making any super changes,” he said at the time.

But Australians with more than $3 million in their superannuation accounts will now have their concessional tax rate doubled from July 1 2025, in a move predicted to save the budget $2 billion a year.

The move is forecast to impact less than 0.5 per cent of all Australians with a super account – or about 80,000 people.

The opposition have accused Labor of being “tricky”, given the change to concessional tax rates – from 15 per cent to 30 per cent – won’t come into effect until 2025-26, after the next election.

Shadow treasurer Angus Taylor said the government had totally disregarded Australians.

“It’s clear this has been rushed out, but what is also clear, is that when the Labor Party runs out of money, it comes after yours,” he said.

“We’re going to see, I’m confident, a lot more of this from the Labor Party.

“This is a Labor Party that wants to spend your money, and is going to have to tax all Australians in order to be able to do that.”

Mr Taylor said the opposition would not be party to Labor “breaking an election promise”.

But Treasurer Jim Chalmers said the 99.5 per cent of Australians not affected by the proposed new cap would continue to receive the “same generous tax breaks” as before, and questioned whether the opposition was prepared to mount a fight on behalf of the wealthiest Australians.

“In 2016, they jacked up taxes on superannuation to the tune of $5 billion. At the time, Angus Taylor said it’s inappropriate that someone who contributed millions and millions of dollars continues to get the 15 per cent concessions. That’s what Angus Taylor said in 2016 when they increased taxes on super,” Dr Chalmers said.

“If (the Coalition) want to vote against this change and try and prevent this change, they can explain to people why they’re not prepared to back energy bill relief for pensioners, they’re not prepared to back people fleeing domestic violence with more affordable homes, and a broader and deeper industrial base in this country, manufacturing jobs, but they’re prepared to go to war for the one half of 1 per cent of people with more than $3 million of superannuation in their accounts.

“They can explain that to the Australian people. We take our responsibilities seriously. This is about responsible economic management. We think we have struck the right balance here and we’re confident we have.”

Opposition finance spokeswoman Jane Hume called the doubling of tax a “breach of trust”.

“This is very much a broken promise … You can only ask what’s next,” she said.

The “modest adjustment” is not retrospective, and will not impose a limit on the size of superannuation account balances in the accumulation phase.

Prime Minister Anthony Albanese said it was an “important reform” that did not change the fundamentals of the superannuation system, but made it more sustainable for the future.

“With 17 people having over $100 million in their superannuation accounts, one individual with over $400 million in his or her account, most Australians would agree that this is not what superannuation is for. It’s for people’s retirement incomes,” Mr Albanese said.

“Confronted with this information, it would be irresponsible to not take any action whatsoever. This reform will strengthen the system by making it more sustainable.”

The average superannuation balance is about $150,000. And of the 80,000 people with more than $3 million in their accounts, the average is about $6 million.

Earlier on Tuesday, the 2022-23 tax expenditures and insights statement was released, which showed the revenue foregone from superannuation tax concessions amounted to about $50 billion a year, and is on track to cost more than the age pension by 2050.

The statement also estimated that of the 10 biggest tax expenditures, worth more than $150bn annually, around a third is made up of tax discounts.

“The majority of these super tax breaks go to high income earners,” Dr Chalmers said in a statement.

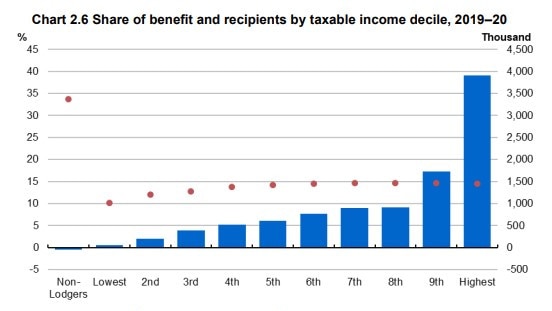

“For instance, over 55 per cent of the benefit of superannuation tax breaks on earnings flow to the top 20 per cent of income earners, with 39 per cent going to the top 10 per cent of income earners.”

The Treasury statement, however, said that assessment is unsurprising.

“There are fewer recipients in lower income brackets because government payments, for which compulsory superannuation contributions are not required, are the main source of income for a large proportion of individuals in these deciles,” the statement read.

“People in higher taxable income deciles receive a larger share of the benefit due to making larger contributions and paying higher marginal rates of tax, which makes the flat 15 per cent rate of tax on superannuation contributions more concessional.”

Currently, a person earning under $250,000 can make a contribution to their super before tax at a rate of 15 per cent.

For individuals whose combined income and concessional contributions exceed $250,000, the effective rate on contributions above the threshold is 30 per cent.

A 15 per cent tax on the earnings within super funds is also applied which is much lower than the 45 per cent marginal rate taxed on high-income earners.

Dr Chalmers said the statement was an “honest reporting of the facts”.

“We inherited $1 trillion of debt, and it is getting more and more expensive to service as interest rates go up. We have persistent and growing spending pressures,” he said.

“Budget pressures are intensifying, rather than easing. This is the mess that we were left and this is the mess we’re trying to clean up.

“This announcement is part of the effort.

“Every dollar spent on a tax break with tens of millions of dollars in super, is a borrowed dollar that makes the deficit bigger.”

He said high earners would still get their tax concessions, just “not quite as generous as they were before”.

“It will improve the budget position by $900 million over the forwards, $2 billion in its first full year, and $3.2 billion over five years,” he said.

“I’m confident that Australians will see this change as modest, and reasonable, and fair. But one which makes a difference to the sustainability and affordability of the superannuation system that we cherish.”

Mr Albanese said the announcement did not foreshadow changes to concessional tax for the other 99.5 per cent of Australians.

“People can see what we’re doing here. Which is why we’re proposing a change that will have an impact on 0.5 per cent of the population,” he said.

“There will be no changes this term (to super). Even this change.

“We can’t be clearer.”

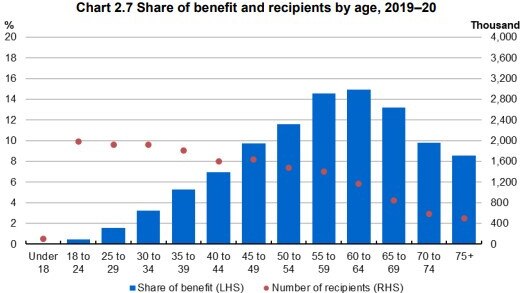

On average, men received a higher concessional tax benefit on their superannuation ($1100) when compared to women ($750), the tax expenditures and insights statement revealed.

Treasury noted this “reflects men, on average, having larger superannuation balances” and said they are on average taxed higher personal income tax rates.

Likewise, the older the person with the superannuation account, the greater the benefit. Forty six per cent of the tax concessions benefit goes to those aged 60 or older.

“The average benefit for those aged over 60 who have superannuation is also higher because of the zero per cent tax rate applied to earnings in the retirement phase,” the statement said.

Originally published as Opposition accuses Labor of broken promise over changes to superannuation concessional tax

Read related topics:Anthony Albanese