Relying on the Laws of fair play: Lescuyer family’s desperate situation after flower business went into liquidation

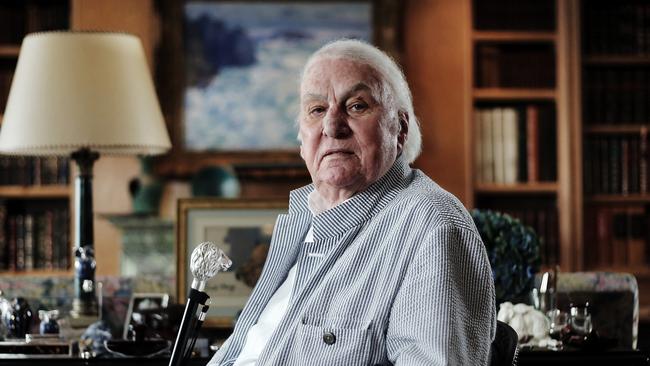

A WESTERN Sydney family business which is owed $70,000 has asked radio legend John Laws to renew his offer to cover part of the debt.

Public Defender

Don't miss out on the headlines from Public Defender. Followed categories will be added to My News.

A WESTERN Sydney family business which is owed $70,000 after a native flower farm went into liquidation has asked radio legend John Laws to renew his offer to cover part of the debt.

Wetherill Park’s Philippe and Moira Lescuyer, owners of Experience Flowers, provided services including overseas shipping for Australian Wildflowers Pty Ltd before it was liquidated in 2010.

Mr Laws was not a director of Australian Wildflowers or involved in the management of the Queensland properties on which it operated.

GOT A LEGAL QUESTION? JOIN BRYDENS LAWYERS LIVE BLOG @1PM TODAY

FOLLOW PUBLIC DEFENDER ON TWITTER

Its ultimate holding company was Smith Smyth & Jones Pty Ltd, whose directors are John Laws and his assistant Jodee Borgo.

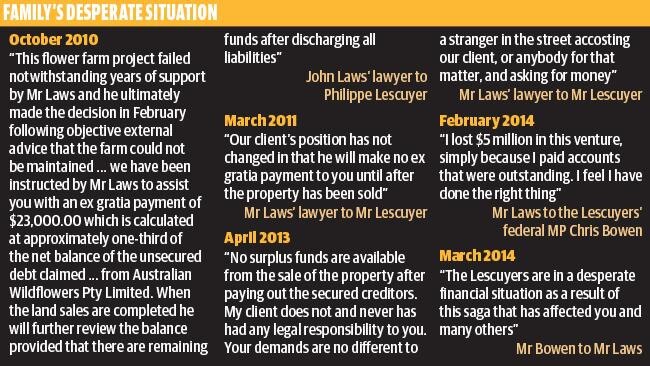

Smith Smyth & Jones Pty Ltd has two equal shareholders, Mr Laws and Carrajung Pty Ltd, which has two equal shareholders, one of which is Mr Laws. In an October 2010 letter to Mr Lescuyer, Mr Laws’ lawyer wrote his client had decided the farm could not be maintained.

An “ex gratia” (voluntary) payment of $23,000 was offered — a third of what the Lescuyers claimed to be owed. If land sales more than covered liabilities Mr Laws would “further review the balance”, his lawyer wrote.

The only condition stated in the letter was that the parties enter a “deed of release” agreeing to standard contractual terms that they “desist from communicating the terms of this arrangement”.

However, in March 2011, Mr Laws’ lawyer wrote “our client’s position has not changed in that he will make no ex gratia payment to you until after the property has been sold”.

In April last year Mr Laws’ lawyer wrote that, after the sale of land, there was no surplus. When the $23,000 offer was first proposed, the Lescuyers did not take it up immediately out of concern they would not receive all of what they were owed.

As it’s turned out they’ve received nothing from Mr Laws or from the liquidation — there was no dividend to unsecured creditors.

Earlier this year the Lescuyers turned to their federal MP, Chris Bowen, who twice wrote to Mr Laws.

In response to the first letter, Mr Laws told the former federal treasurer he had lost $5 million in the venture. Mr Bowen replied that the Lescuyers “are in a desperate financial situation’’.

Mrs Lescuyer told me they have had to pay tens of thousands of dollars to clear debts incurred in providing services to Australian Wildflowers. Had they not taken out an overdraft — at 18 per cent — they faced having to liquidate.

What do you think? Should Mr Laws renew his offer to Experience Flowers or should the Lescuyers move on?