Public Defender: Leaving the grandkids a timeshare debt

When Phil and Jillian Cousins’ son died not only were they burdened with grief, they were also lumped with years of maintaining his timeshare investment. Their only way out was an $18,000 lump sum.

Public Defender

Don't miss out on the headlines from Public Defender. Followed categories will be added to My News.

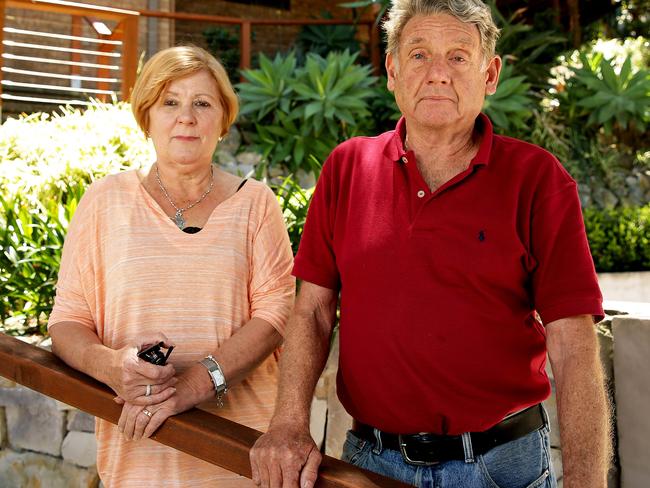

PHIL and Jillian Cousins felt their best option to avoid lumping their grandkids with their holiday timeshare debt was to fork out even more money.

Having already inherited a timeshare debt themselves, the couple recently agreed to pay a lump sum of nearly $20,000 to bring their scheme involvement to a speedier end.

They had bought into a holiday timeshare scheme in 1999, as did one of their sons, Tony, who died in 2002. As his next of kin, they had to take over responsibility for his investment in the 99-year scheme.

Get your legal drama sorted for free by the experts in our live Q&A from 1pm via this link

Mr Cousins, 69, and his wife, 68, say they are now too old to be able to sit in the car for the 4.5-hour drive north from their Belmont home to the Boambee Bay timeshare, for which they are paying $2800 a year in upkeep fees.

And they have been worrying about what will happen when they — and their children — are no longer around to pay.

“In 99 years my kids will be dead too so it will be in their kids’ names,” Mr Cousins said.

In a bid to slash the hefty annual payments, in August the couple agreed to pay a lump sum of $18,490.

After The Daily Telegraph’s intervention that agreement has been torn up and the timeshare’s board will soon consider whether to let the Cousins out of the scheme on medical grounds.

Follow the Public Defender’s work on Facebook via this link or on Twitter here

The Australian Securities and Investments Commission is understood to have raised a “concerning” number of complaints about holiday timeshares with the body representing scheme sellers.

Choice has written to ASIC asking the regulator to investigate the way schemes are being sold, particularly the “free holiday” lure being used by at least one major holiday timeshare business. The consumer group says it appear to be unconscionable, misleading or deceptive conduct.

Scheme sellers could soon come under more pressure if the Federal Government follows through on a Financial System Inquiry recommendation to give ASIC “product intervention power”.

Daniel Sinclair’s experience is an example of the dodgy spruiking that appears to be rife.

Mr Sinclair, from northern Melbourne, specifically recalls being told at a seminar that the timeshare would have strong resale value and be easy to sell.

That has proven untrue. He had been locked in a 65-year deal under which he has been paying $5200 a year in loan repayments plus $1500 in annual fees.

“I just want (my contract) abolished,” Mr Sinclair, who is on reduced earnings due to a work injury, said.

That will now happen. Mr Sinclair said it was due to The Telegraph’s involvement.

“Thank you very much,” he said.

About 170,000 Australian households have invested in holiday timeshare, outlaying about $270 million annually.