Public Defender: insurance companies $150m better off after ripping off loyal customers

HUNDREDS of thousands of insurance customers face paying up to $150 million more a year because their loyalty discounts have been slashed by as much as half.

Public Defender

Don't miss out on the headlines from Public Defender. Followed categories will be added to My News.

HUNDREDS of thousands of insurance customers face paying up to $150 million more a year because their loyalty discounts have been slashed by as much as half.

Customers of NRMA, SGIC or SGIO who have held comprehensive car insurance policies for 15 years, earning 20 per cent off, will have that saving cut to 10 per cent.

Those who have taken out four policies will no longer receive a 12.5 per cent discount. Instead it’s just 7.5 per cent.

LIVE BLOG: Got a legal question? Our experts at Brydens Lawyers can help

The three brands’ $14 billion parent company, Insurance Australia Group, said the changes make its loyalty program “simpler and easier to understand”. IAG denies reducing discounts and claims there will be “no material impact” on revenue.

But experts say most customers will be worse off.

After learning of the revamp, leading insurance industry analyst Andrew Adams of global investment bank Credit Suisse said the level of discount has reduced in almost all cases.

Mr Adams said IAG did not want to compete on price.

By reducing rewards for loyalty, IAG could increase its nearly $10 billion of annual premium revenue by as much as 1.5 per cent, said senior industry analyst Stephen Gargano of international business research firm IbisWorld. His low estimate was 0.5 per cent.

After noting IAG had signalled price rises of 3-6 per cent this financial year, Mr Gargano said the (loyalty discounts) reductions could be a means to achieve the forecasts without raising prem-iums substantially.

Customers such as Kerry Northwood and Rita Moore are ropeable. They have been with NRMA Insurance for 19 years and hold three policies. Under the old system they had a total discount of $256. Now the saving is just $96.

“We are $160 worse off,” Mr Northwood, of Ocean Shores on the NSW north coast, said.

“Add all that together (across all customers) and you’re talking tens of millions of dollars. It’s like putting the price up by stealth. I will be changing companies next time our insurance is due.”

A spokeswoman for IAG said it was not true to say NRMA Insurance had reduced the discount paid.

“We have changed the structure of our discounting (and the) new structure is not directly comparable to the old structure,” she said.

“(It) rewards more of our customers by increasing the range of eligible insurance policies that contribute (to the loyalty discount).”

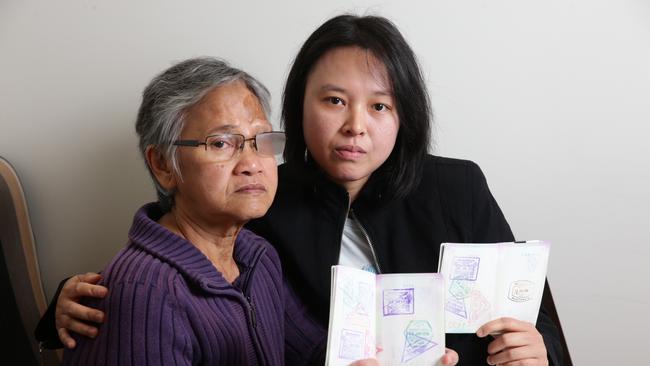

VIRGIN has increased its offer after wrongly stopping Betty and her mother Lam-In from flying to Fiji. The airline has decided to also refund the other two members of their group who did in fact go to Fiji, acknowledging the trip was effectively ruined for all by its visa misinterpretation.

Alex Fraser has prevailed in his fight with Vero Insurance after it denied a travel insurance claim following the death of his younger sister Jean, 81. Vero had argued his sister was not his relative because, by its definition, “relative means an immediate family member … under the age of 75”. Vero has made a “goodwill gesture” to Mr Fraser.

And there’s been an interesting response to the poll attached to last week’s story on whether John Laws should renew an offer to cover part of a debt. But I need more votes before I report your verdict.

Vote at http://bit.ly/1raVC0m.